What's new at Income

Check out the newest updates Income has in store for you!

Happy Tails Pet Insurance

The hero your furry friend deserves

Gro Retire Flex Pro II

Retire freely. With the flexibility to adjust when your cash payouts may begin.

Travel Insurance

Don't worry, travel happy with Income's Travel Insurance. If it's happy travellers, it's Income Insurance!

Gro Cash Plus & Gro Cash Sure

Enjoy less financial stress and more assurance with capital guarantee. Policy Ts&Cs apply.

Sustainability Report FY2024

Find out more about our efforts and performance in our latest Sustainability Report 2024.

Complete Life Secure

Get extra protection for advanced stage critical illness with Early Critical Secure rider. Policy Ts&Cs apply.

eDrivo Car Insurance

If it’s an EV, get Income’s eDrivo Car Insurance!

Critical Illness Plans

Watch Arun Rosiah, a cancer survivor, fulfil his model dream, made possible with critical illness protection.

Complete Critical Protect

Receive continuous protection against dread disease with Complete Critical Protect. Policy Ts&Cs apply.

Star Secure Pro

Mental health issues can happen to anyone. Get the support you need with Star Secure Pro. Policy Ts&Cs apply.

Investment-Linked Plans

Our flexible investment plans adjust to your financial goals. Policy Ts&Cs apply.

PA Fitness Protect

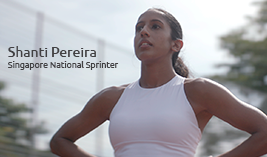

Your active lifestyle deserves more protection. Keep it less complicated with PA Fitness Protect.

Drivo™ Car Insurance

Get real care on the road. Enjoy exclusive accident assistance within 20 minutes from Orange Force.

Complete Cancer Care

Receive continuous care throughout the cancer journey, from diagnosis to recovery. Policy Ts&Cs apply.

WealthLink

Enjoy the flexibility to top-up or withdraw from your investment with WealthLink. Policy Ts&Cs apply.

PA Assurance

Safeguard your active lifestyle with our personal accident insurance plan, PA Assurance. Get covered with up to $20,000 medical expenses per accident.

Trust Bank

Income is collaborating with Trust Bank, Singapore's digital bank, to offer exclusive deals to Income policyholders.

Paynow - Policy Payouts

To support Singapore's vision to be chequeless by 2025, Income has integrated PayNow to provide customers with a fast and convenient way to receive policy proceeds.

BetterHealth App

Protect you and your loved

ones from the comfort of

your home with a 24/7 clinic in your pocket!