Did you know?

Are you prepared for the financial impact of unforeseen events like critical illness?

Check how well protected you are and if you face a protection gap with the Life Insurance Protection Calculator.

Get covered with our critical illness plans.

Complete Critical Protect

- Get lump sum payouts for treatments

- Continuous protection from diagnosis to recovery

- Guaranteed option to buy another life insurance plan[3]

Complete Cancer Care

- Get lump sum payouts for treatments

- Comprehensive support from diagnosis to remission

- Guaranteed option to buy another life insurance plan[4]

Speak with an Income advisor

Speak with your preferred Income advisor or leave your contact details so we can assign an advisor and schedule a personalised needs analysis with you.

Learn more about getting adequate financial protection

Learn about the 37 types of critical illnesses covered by LIA, what critical illness insurance covers, and key updates in CI definitions for informed decisions.

We tend to think we’re invincible when we’re young, but the unfortunate can happen to anyone. Xin Yi, 29, shares her experience with unexpected illness and the importance…

Enjoy financial protection against critical illnesses with Income Insurance.

Let us help you

Important notes

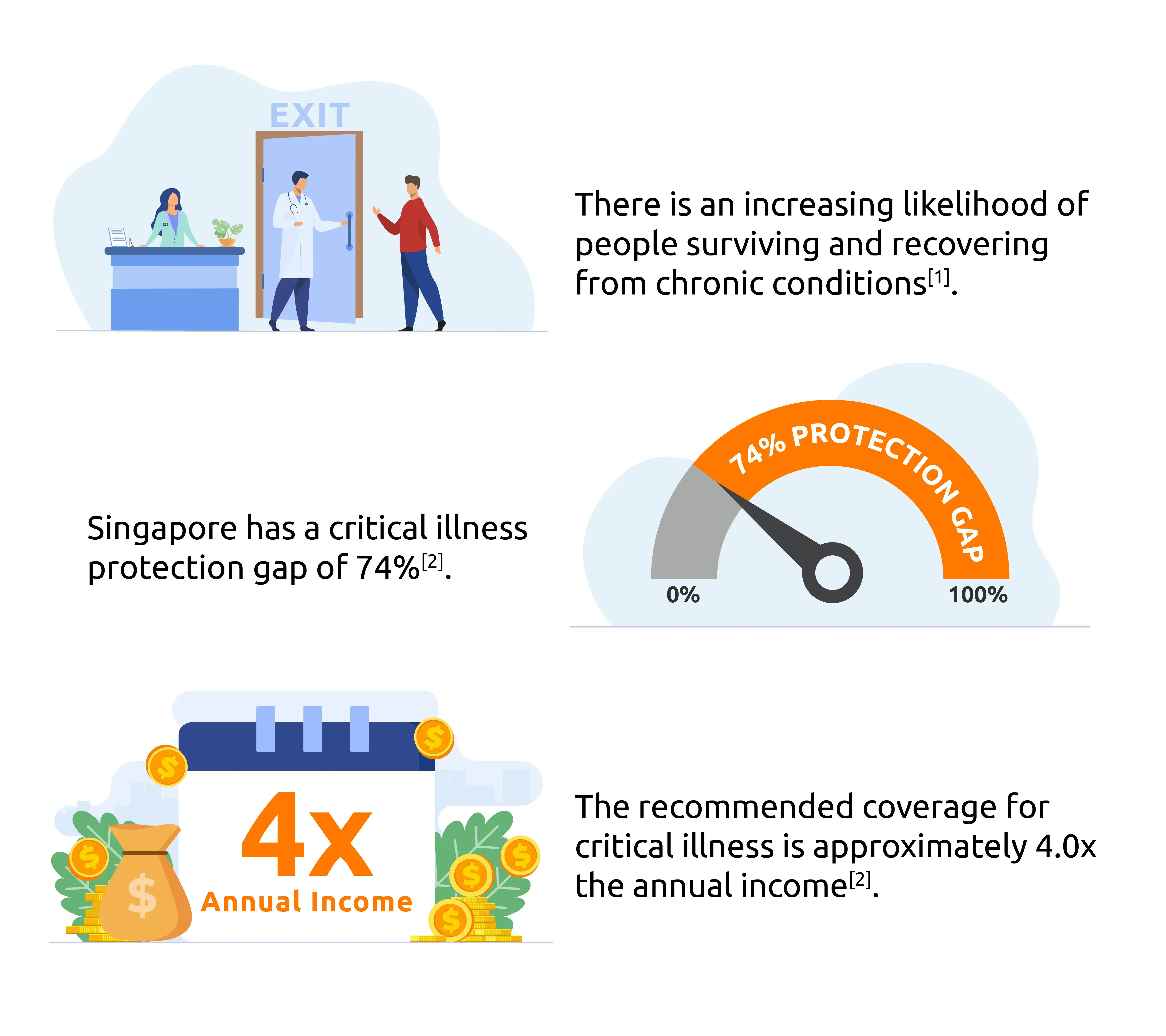

[1]The Straits Times, Working adults have inadequate cover if critical illness strikes, says study.

[2]Life Insurance Association Singapore, 2022 Protection Gap Study Key Findings – Singapore.

[3]Upon an impairment of a vital function or advanced stage dread disease diagnosis for Complete Critical Protect. Other policy terms and conditions apply.

[4]Upon an advanced major cancer diagnosis for Complete Cancer Care. Other policy terms and conditions apply.

Exclusions

There are certain conditions whereby the benefits under these plans will not be payable. You can refer to your policy contracts for the precise terms, conditions and exclusions of these plans. The policy contract will be issued when your application is accepted.

Important Notes

This is for general information only. You can find the usual terms, conditions and exclusions of these plans in their respective policy conditions. All our products are developed to benefit our customers but not all may be suitable for your specific needs. If you are unsure if these plans are suitable for you, we strongly encourage you to speak to a qualified insurance advisor. Otherwise, you may end up buying a plan that does not meet your expectations or needs. As a result, you may not be able to afford the premiums or get the insurance protection you want. These plans do not have any cash value.

These policies are protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact Income Insurance or visit the GIA/LIA or SDIC web-sites (gia.org.sg or lia.org.sg or sdic.org.sg).

This advertisement has not been reviewed by the Monetary Authority of Singapore.

Information is correct as at 22 December 2025