^Promotion terms and conditions apply.

1 This plan does not cover infectious disease diagnosed within 14 days from the policy start date as well as any infectious disease which has been announced as:

(a) an epidemic by the health authority in Singapore or the Government of the Republic of Singapore; or

(b) a pandemic by the World Health Organisation (WHO), in the affected countries,

from the date of such announcement until the epidemic or pandemic ends.

2 Under Basic, Classic and Superior Plan for children who are:

- under 18 years of age; or

- under 25 years of age, unmarried and not on full-time employment, and are primarily dependent on the insured person for maintenance and support. For example, full-time students or national servicemen.

3 The policy will be renewed as long as:

- the eligibility requirements are met;

- claims have not reached the lifetime limit allowed for the respective plans; and

- the full sum insured under the final expenses or permanent disability benefits have not been claimed.

4 The childcare and student care expenses optional benefit covers the insured child if he/she is unable to attend childcare or student care due to him/her:

- being required to stay as an inpatient in the hospital for 4 days or more due to an injury or an infectious disease; or

- being confined at home for 5 days or more underwritten medical advice by a medical practitioner due to an infectious disease.

5 The event and staycation expenses that we will reimburse is the non-refundable deposit or ticket fees incurred by the insured person. We will not pay for claims that are less than $50.

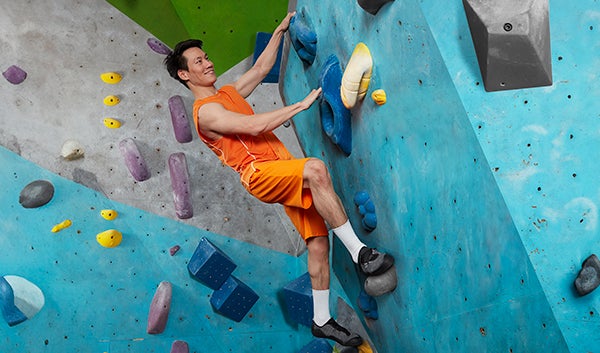

6 Adventurous activity means any recreational activity which:

- the insured person has undertaken while complying with all safety procedures, such as wearing safety equipment and following rules and regulations, whether specifically advised or generally expected of a reasonable person, and

- where guidance and supervision of licensed guides or instructors are available, the recreational activity must be carried out under the guidance and supervision of licensed guides or instructors of the tour operator or activity provider, and

- is not excluded under the general exclusions listed in part 2 of the general conditions of the policy.

Adventurous activity includes but is not limited to hiking, mountain climbing, scuba-diving, bungee jumping, parasailing, paragliding, parachuting, hang-gliding, skydiving, abseiling, skiing, snowboarding, canoeing, kayaking, white water rafting, dragon boating, paddleboarding, marathon, ultramarathon, biathlon, triathlon, surfing, and snorkeling.

7 This is up to a maximum of 25% for 5 consecutive claim-free years. If there is a claim made under section 1, 2 or 3 under this policy, we will apply the renewal bonus for the claim and after which no renewal bonus will be given under the policy for any subsequent claims made under section 1, 2 or 3 or renewals.

This page is for general information only and does not constitute an offer, recommendation, solicitation or advice to buy or sell any product(s). You can find the usual terms, conditions and exclusions of the plans in the policy conditions.

All our products are developed to benefit our customers but not all may be suitable for your specific needs. If you are unsure if this plan is suitable for you, we strongly encourage you to speak to a qualified insurance adviser. Otherwise, you may end up buying a plan that does not meet your expectations or needs. As a result, you may not be able to afford the premiums or get the insurance protection you want. If you find that this plan is not suitable after purchasing it, you may terminate it within the free-look period, and obtain a refund of premiums paid. We may recover from you any expense incurred in underwriting this plan.

PA Assurance, SilverCare Insurance, PA Secure and PA Guard are protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic, and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact Income Insurance or visit the GIA/LIA or SDIC web-sites (www.gia.org.sg or www.lia.org.sg or www.sdic.org.sg).

Information is correct as at 30 June 2025.