Legacy Planning in Singapore: When is the right time to plan for your family?

There's no way to know what events or illnesses might come your way. What happens to your family when you are unable to earn a living or when you are gone?

The answer to that question is legacy planning.

To put it simply, legacy planning is distributing your hard-earned money according to your wishes. This involves identifying, preserving and distributing your wealth in a thoughtful manner.

What is Legacy Planning?

Legacy planning is a structured process that involves thoughtfully organising your assets and affairs to ensure your wishes are carried out after your passing. It encompasses a wide range of considerations, including estate planning, wealth distribution, charitable giving, and even the preservation of personal values and memories.

By creating a comprehensive legacy plan, you gain control over how your assets are managed and distributed, minimising potential conflicts and providing financial security for your loved ones.

Why is Legacy Planning Important?

Legacy planning ensures that your wealth and hard-earned money is preserved to support your family and future generations. This is especially important when your children are young and you want to ensure that they have the best education to meet their aspirations.

In essence, legacy planning involves thinking of how to preserve your money for your family.

With proper legacy planning, you can better secure and pass your wealth to your loved ones in an unfortunate event.

What Happens When You Don't Have a Legacy Plan

While a legacy plan isn't legally mandatory in Singapore, its absence can lead to complications and uncertainties for your loved ones during an already difficult time. Let's explore some potential consequences of not having a legacy plan in place.

Intestacy Laws Dictate Asset Distribution

Without a will or a legacy plan, the distribution of your assets will be governed by Singapore's intestacy laws. This means your estate will be divided according to a predetermined formula, which may not reflect your true wishes.

Certain individuals you intended to benefit might be excluded, while others you hadn't considered might receive a share. This can create conflicts and disputes among family members, adding further stress to an already emotional situation.

Financial Hardship for Your Loved Ones

The unexpected loss of a loved one can be emotionally devastating, but it can also lead to significant financial challenges.

Without a legacy plan, your family may face immediate financial burdens, such as funeral expenses, outstanding debts, or ongoing living costs. This can be particularly difficult if your dependents rely on your income or if you haven't made provisions for their future needs like education or healthcare.

Unnecessary Stress and Delays

Settling an estate without a will can be a lengthy and complicated process. Your loved ones may have to navigate legal complexities, gather extensive documentation, and potentially engage in court proceedings.

These delays can prevent them from accessing funds or assets when they need them most, creating additional stress and uncertainty during an already difficult period of grief and adjustment.

Benefits of Legacy Planning

A well-thought-out legacy plan can be a thoughtful roadmap that guides how your assets should be managed and distributed. By taking control of your legacy, you can ensure your wishes are honoured, your wealth is protected, and your family is provided for, even in your absence.

Let's delve into the key advantages of having a well-structured legacy plan:

1. Empowering You with Control Over Asset Distribution

A well-crafted legacy plan empowers you to handpick the beneficiaries of your hard-earned wealth, from cherished family heirlooms to valuable investment portfolios. This ensures your assets reach the intended individuals, preventing unintended claims and preserving your legacy according to your wishes.

2. Facilitating Efficient and Tax-Optimised Wealth Transfer

Legacy planning isn't just about deciding who inherits your assets; it's also about ensuring they receive the maximum value. A thoughtfully crafted plan can help minimise taxes and ensure your loved ones receive the full benefit of your hard work. By identifying and strategically allocating assets, including those that might be overlooked, you can create a lasting legacy that stands the test of time.

3. Fostering Harmony and Preserving Family Bonds

In the absence of a clear legacy plan, disagreements over inheritance can strain family relationships and lead to lasting conflicts. A clear and comprehensive legacy plan provides transparency and clarity, outlining your wishes and minimising the potential for disputes.

How to Start Your Legacy Planning Journey

While professional services can be invaluable in navigating the complexities of legacy planning, you can also take proactive steps on your own. Let's explore the key elements involved.

1. Craft Your Will: The Cornerstone of Your Legacy

The foundation of any legacy plan is a well-drafted will. This legal document outlines your wishes regarding the distribution of your assets after your passing. Regardless of the size of your estate, having a will ensures your intentions are respected and minimises potential conflicts among your loved ones.

If you're new to will-writing, consider seeking guidance from an experienced lawyer to ensure your will is comprehensive and legally sound. Alternatively, online will-writing platforms offer user-friendly templates and resources to help you craft a valid will.

Remember, it's crucial to review and update your will periodically, especially after major life events like marriage, the birth of a child, or significant changes in your assets.

2. Make CPF Nominations: Safeguard Your Retirement Savings

Your Central Provident Fund (CPF) savings are not covered by your will. However, you can designate beneficiaries for your CPF monies through a CPF nomination. This covers savings in your Ordinary, Special, MediSave, and Retirement Accounts, as well as any unused CPF LIFE premiums.

Ensure your CPF savings are distributed according to your wishes by making a CPF nomination online or at a CPF service centre.

3. Set Up Trusts: Protect Your Loved Ones' Future

A trust acts as a protective shield for your family's assets, especially when beneficiaries are young or might not be equipped to manage a substantial inheritance. By establishing a trust, you can control the timing and conditions for asset distribution, ensuring your loved ones receive their inheritance when they are ready and capable of managing it responsibly.

4. Establish a Lasting Power of Attorney (LPA)

Empower your trusted individuals to make critical decisions on your behalf should you become mentally incapacitated. By appointing them as your Donees in a Lasting Power of Attorney (LPA), you ensure your personal welfare and financial affairs are handled according to your wishes, even if you're unable to express them yourself.

In Singapore, you can conveniently complete the LPA process online through the Office of the Public Guardian Online (OPGO) portal. Once your Donees have accepted their appointment, visit a certificate issuer to certify your LPA, and then submit it for registration via OPGO.

5. Engage in Advance Care Planning (ACP)

Take control of your healthcare decisions even in the face of severe illness or injury. Advance Care Planning (ACP) involves thoughtful discussions with your loved ones and healthcare providers about your treatment preferences and end-of-life care. Documenting these conversations ensures your voice is heard and your wishes are respected, even if you're unable to communicate them directly.

6. Envision and Plan for a Comfortable Retirement

Set aside adequate resources to support your desired lifestyle, accounting for living expenses, potential medical costs, travel aspirations, and other leisure activities. By planning for a comfortable retirement, you can enjoy your later years without depleting your assets or burdening your loved ones.

Term Life Insurance: A Cornerstone of Legacy Planning

Term life insurance offers a powerful way to secure your legacy by providing financial protection for a specific period, typically ranging from 10 to 40 years or up to a predetermined age. Should the unexpected occur during this term, your loved ones will receive a lump sum payout, known as the sum assured.

Unlike other life insurance types, term life policies focus solely on protection, without any investment or savings component. This makes them an affordable and efficient way to safeguard your family's financial future. In the context of legacy planning, term life insurance acts as a safety net, ensuring your loved ones are financially supported and your obligations are met, even if you're no longer there to provide for them.

The Benefits of Income’s TermLife Solitaire

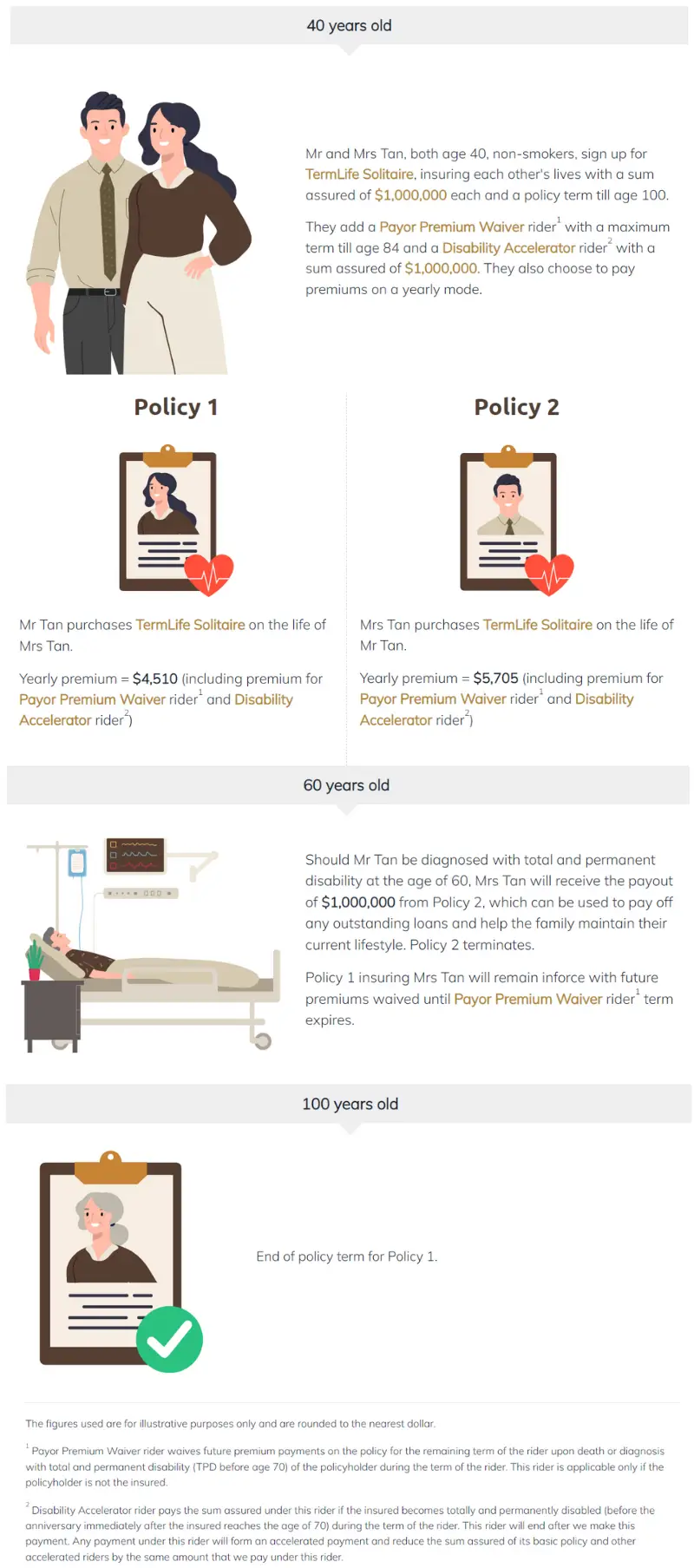

Income’s TermLife Solitaire provides high insurance protection against death and terminal illness1, catering to those keen on legacy planning. It provides a wide coverage term range (up to age 100), with the option to add on riders for extra coverage against TPD (before the anniversary immediately after the insured reaches the age of 70) and enjoy a waiver of future premium payments during the rider term.

Here are several key benefits that TermLife Solitaire provides:

- High Coverage: Stay protected against death and terminal illness with a sum assured1 of $500,000 or more

- Guaranteed Renewal: Option of renewing your policy to continue your coverage after your policy term expires with guaranteed renewal2 up to a maximum age of 100 (last birthday)

- Enhanced Coverage Options: Enhance your life insurance coverage with a variety of riders such as Disability Accelerator3, Hospital CashAid4, Essential Protect5 and several premium waiver options

- Payment Frequency: Make premium payments monthly, quarterly, bi-annually or annually

To illustrate how life insurance works and how TermLife Solitaire helps your legacy planning, let’s look at the case of Mr John Tan, a 40-year-old engineer and his wife Ann, 40, who is a homemaker.

At 70 years old, Mr Tan dies of liver cancer and leaves the following assets and liabilities for Mrs Tan.

What Mr Tan Leaves His Family

While Mrs Tan has $150,000 in cash at her disposal, she is stretching it thin for multiple purposes – her living and medical expenses, paying off the housing loan and Mr Tan’s funeral expenses, just to name a few. As the cost of living continues to rise, these expenses will increase accordingly.

While Mrs Tan can liquidate her husband’s investments, she may make a loss if the market is doing poorly.

If Mr and Mrs Tan bought TermLife Solitaire on each other’s life, the situation will be different.

As indicated in the infographic, Mrs Tan can use the payout to defray her living expenses and pay off the debt concurrently.

TermLife Solitaire Protects the Wealth You Accumulated

In this scenario, TermLife Solitaire acts as a financial safety net for Mrs. Tan. The payout from Mr. Tan’s policy provides financial relief, allowing her to settle outstanding debts and cover living expenses without having to hastily liquidate investments at a potential loss. This allows Mrs. Tan the space to grieve without the added burden of financial strain, and importantly, it preserves the wealth Mr. Tan worked hard to build, giving his investments the time they need to potentially grow and continue providing for his family's future.

Since Mrs Tan can use the lump sum payout and existing savings to pay for her expenses, she can continue accumulating wealth from Mr Tan’s investments.

Getting a Peace of Mind

Find out how you can benefit from TermLife Solitaire or how life insurance works by speaking to one of our financial advisors today. You can also learn more about protecting and planning your finances for your family.

So, what are you waiting for? Start planning for your legacy now, while you are young, healthy and have the resources.

1 If the insured becomes terminally ill or dies during the term of the policy, Income Insurance will pay the sum assured. The policy will end when Income Insurance make this payment.

2 Income Insurance will renew your policy for the same policy term at its prevailing sum assured only if your policy has not ended as a result of a claim during its term and the insured is age 74 (last birthday) and below. However, if the original policy term is not a multiple of five years, or if the original policy term is a multiple of five years but the anniversary immediately after the insured’s 100th birthday falls within the next policy term, Income Insurance will renew it for a shorter term that is a multiple of five years, as long as the minimum term is 10 years, such that the renewal term will neither go beyond the original policy term, nor the anniversary immediately after the insured’s 100th birthday. Income Insurance will work out the renewal premium based on the policy’s renewal term, sum assured and the age of the insured at the time the policy is renewed.

3 Disability Accelerator rider pays the sum assured under this rider if the insured becomes totally and permanently disabled (before the anniversary immediately after the insured reaches the age of 70) during the term of the rider. This rider will end after Income Insurance make this payment. Any payment under this rider will form an accelerated payment and reduce the sum assured of its basic policy and other accelerated riders by the same amount that Income Insurance pays under this rider.

4 For Hospital CashAid, the premium will be based on the prevailing premium rates as of the insured’s age and sum assured at the anniversary. Please refer to the policy contract for further details.

5 Total Protect, Essential Protect, Enhanced Payor Premium Waiver and Dread Disease Premium Waiver.

You can find the list of specified dread diseases and their definitions in their respective policy contracts. Income Insurance will not pay this benefit if the insured is diagnosed with the disease within 90 days from the cover start date for major cancer, heart attack of specified severity, coronary artery by-pass surgery, angioplasty and other invasive treatment for coronary artery or other serious coronary artery disease.

If the insured undergoes angioplasty and other invasive treatment for coronary artery during the term of the rider, Income Insurance will pay 10% of the sum assured, up to S$25,000. Income Insurance will only pay for this condition once under this benefit. After this payment, Income Insurance will reduce the sum assured of this rider accordingly. Income Insurance will work out any future premiums or claims based on the reduced sum assured.

For Dread Disease Premium Waiver and Enhanced Payor Premium Waiver, the premium waiver benefits do not apply for angioplasty and other invasive treatment for coronary artery.

This article is meant purely for informational purposes and does not constitute an offer, recommendation, solicitation or advise to buy or sell any product(s). It should not be relied upon as financial advice. The precise terms, conditions and exclusions of any Income Insurance products mentioned are specified in their respective policy contracts. Please seek independent financial advice before making any decision.

These policies are protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact Income Insurance or visit the GIA/LIA or SDIC websites (www.gia.org.sg or www.lia.org.sg or www.sdic.org.sg).

This advertisement has not been reviewed by the Monetary Authority of Singapore.

Related Articles