4 Types of Insurance Singaporeans Need and Why You Need Them

One of the first things you’ll face as an adult is getting insurance. That sounds straightforward enough until you do a quick search and realise there are many types of insurance in Singapore. That’s when you might ask, what insurance do I need in Singapore? Buy too much and you may end up wasting your money, while buying too little means potentially being underinsured.

Find out in this quick guide as we share the four types of insurance in Singapore that you might need. In order of importance, this includes:

- Health insurance: Supports your health care expenses such as medical and surgery costs in the event of an injury, illness or disability

- Life insurance: Provides a lump sum payout upon your death or terminal illness or total and permanent disability

- Personal accident insurance: Covers your medical costs if you get into an accident

- Critical illness insurance: Gives you a lump sum payout when you get diagnosed with a critical illness

Let’s take a look at each type of insurance in detail.

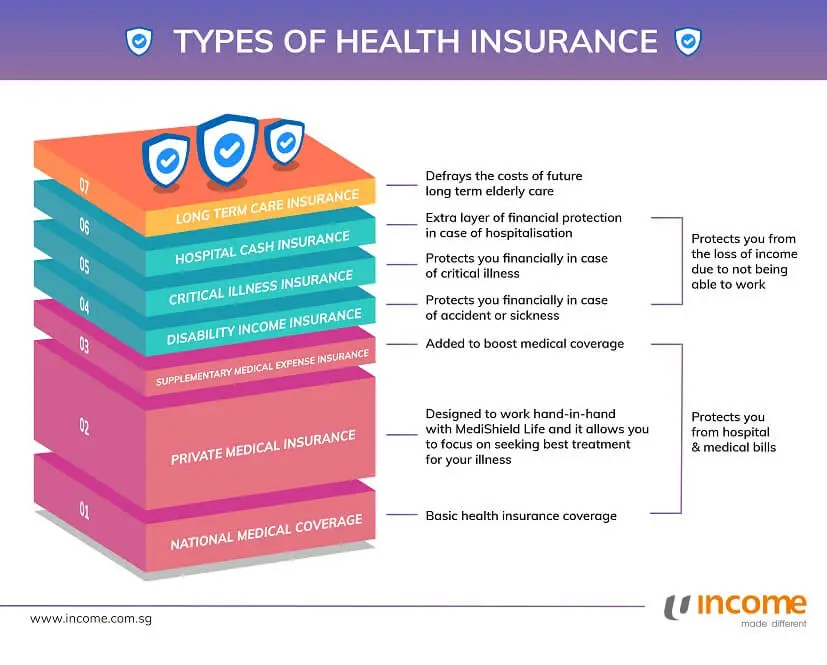

1. Health Insurance

What is Health Insurance?

Health insurance is a financial safety net that helps cover medical expenses incurred due to illness or injury. It can reimburse you for hospitalisation costs, surgical procedures, medications, and even specific outpatient treatments. This support can significantly ease the financial strain associated with unexpected medical needs, allowing you to focus on your recovery without undue worry.

Why is it important to Singaporeans?

While the government provides basic coverage through MediShield Life, it may not be enough for everyone, especially if you prefer private healthcare or higher-class wards in public hospitals. Health insurance provides additional coverage, allowing you to choose your preferred healthcare providers and receive the best possible treatment with a lighter financial burden on your shoulders.

Examples of Health Insurance

Health insurance in Singapore comes in various forms, each offering different levels of coverage and benefits.

- MediShield Life: A basic health insurance plan mandated by the government for all Singaporeans and Permanent Residents. It covers large hospital bills and selected costly outpatient treatments at subsidised rates in public hospitals.

- Integrated Shield Plans (IPs): Private insurance plans that enhance your MediShield Life coverage, offering additional benefits such as coverage for private hospitals, higher-class wards, and broader range of treatments.

- Riders: Optional add-ons to your IP that provide further coverage for specific needs, such as reducing co-payments, covering deductible amounts, or providing additional benefits like outpatient treatments or alternative therapies.

Misconceptions Surrounding Health Insurance

You might not see the need for health insurance while you’re young and healthy, and that MediShield Life is enough. However, unexpected illnesses or accidents can occur at any age, leading to significant medical expenses. And while it provides basic coverage, its limitations might leave you with significant out-of-pocket expenses, especially for private healthcare or extensive treatments.

Securing health insurance early complements MediShield Life as an additional layer of protection and ensures you have adequate coverage when you need it most. Purchasing a health insurance plan also provides an opportunity to secure coverage before any potential health conditions arise, which could affect future insurability or premium costs.

Tips to Finding a Health Insurance that Suits Your Needs

- Understand your policy: Familiarise yourself with the terms, conditions, and coverage limits of your health insurance plan.

- Assess your needs: Assess your healthcare needs and budget to select a plan that offers adequate coverage and fits your financial situation.

- Utilise preventive care benefits: Many health insurance plans cover preventive care services like vaccinations and health screenings. These benefits help in maintaining good health and detect any potential medical issues much sooner.

- Keep track of medical expenses: Maintain records of your medical bills and receipts to facilitate smooth claims processing.

- Review your coverage regularly: As your healthcare needs change, reassess your coverage and make adjustments as necessary to ensure you remain adequately protected.

2. Life Insurance

What is Life Insurance?

Life insurance is a financial safety net that provides a lump sum payout to your beneficiaries upon your death or if you are diagnosed with a terminal illness. It acts as a financial safety net for your loved ones, helping them cope with the loss of your income and cover expenses like outstanding debts, mortgage payments, and future living costs.

Why is it important to Singaporeans?

Life insurance is important for Singaporeans, especially those with dependents like young children or elderly parents. Having a life insurance policy ensures that your family's financial well-being is protected even in your absence. This payout can help them maintain their lifestyle, pay for education, or simply cover daily living expenses during a difficult time.

Examples of Life Insurance

There are two main types of life insurance:

- Term Life Insurance: Provides coverage for a specific period (term). It's generally more affordable and suitable for those seeking temporary protection.

- Whole Life Insurance: Offers lifelong coverage and often includes a savings or investment component. It can be more expensive but provides long-term financial security.

Other types of life insurance include:

- Endowment Plans: These combine life insurance with savings, offering a lump sum payout at the end of the policy term or upon death.

- Investment-Linked Plans (ILPs): These link life insurance with investment opportunities, allowing you to potentially grow your wealth while enjoying life coverage.

Misconceptions Surrounding Life Insurance

A common misconception is that life insurance is only necessary for those with dependents. However, even if you're single or have no children, life insurance can be valuable for covering funeral expenses, outstanding debts, or leaving a legacy for a cause you care about. Another misconception is that it's too expensive, but affordable options exist, especially for term life insurance.

Tips to Choosing a Life Insurance Plan that Works Best for Your Needs

- Assess your needs: Consider your dependents, financial obligations, and future goals to determine the right coverage amount.

- Compare plans: Shop around and compare different life insurance plans to find one that offers the best value for your needs and budget.

- Review your coverage regularly: As your life circumstances change (marriage, children, etc.), adjust your coverage accordingly to ensure it remains adequate.

- Seek professional advice: Consult a financial advisor to understand your options and make informed decisions about life insurance.

3. Personal Accident Insurance

What is Personal Accident Insurance?

Personal accident insurance provides financial protection in the event of an accident resulting in injury, disability, or death. It offers benefits such as medical expense coverage, hospitalisation income, and lump sum payouts for accidental death or permanent disability. Unlike health insurance, which covers illnesses and injuries in general, personal accident insurance specifically focuses on accidents.

Why is it Important to Singaporeans?

Accidents can happen anytime, anywhere, even if you're cautious. For Singaporeans, especially those with active lifestyles or who engage in outdoor activities, personal accident insurance is important to have as it provides an additional layer of financial security. It helps cover medical costs and income loss resulting from an accident, allowing you to focus on recovery without worrying about the financial burden.

Examples of Personal Accident Insurance

Personal accident insurance plans in Singapore come with various coverage options and additional benefits to cater to different needs. Some examples of Income's personal accident insurance plans include:

- Income's PA Secure: PA Secure offers affordable accident coverage for you and your family, with a focus on accidents and infectious diseases1 such as Dengue Fever, Chicken Pox, HFMD, and more. You can enjoy the flexibility to choose between an individual, couple2 or family plan. You can also choose to insure your child only with an individual plan.

- Income's SilverCare Insurance: A personal accident insurance for your loved ones in their silver years, SilverCare provide extensive coverage that includes medical fees, mobility aids, home-care services, and rehabilitation expenses incurred due to an accident. SilverCare Insurance is renewable for life3 when the insured signs up between 50 and 75 years old.

- Income's PA Fitness Protect: A personal accident insurance plan that benefits physically active fitness fanatics, PA Fitness Protect provides adventurous activities or extreme sports coverage4 which most personal accident plans may exclude. On top of 2X coverage for medical expenses due to accidental tears, dislocations and fractures5, the plan also provides third-party liability and sports equipment coverage.

Misconceptions Surrounding Personal Accident Insurance

One common misconception is that personal accident insurance overlaps with health insurance, making it redundant. However, while health insurance focuses on medical expenses, personal accident insurance offers broader coverage, including income replacement and lump-sum payouts.

Another misconception is that it's only for those with risky lifestyles, but accidents can happen to anyone, making personal accident insurance a valuable addition to your overall financial protection plan.

Tips to Choosing A Personal Accident Insurance that Suits Your Needs

Ensure your personal accident insurance provides adequate coverage for your needs with these tips:

- Understand Your Coverage: Thoroughly review your policy to understand what's covered, any exclusions, and the claim process.

- Choose the Right Plan: Assess your lifestyle, occupation, and risk factors to select a plan that offers adequate coverage and benefits.

- Consider Optional Benefits: Evaluate additional benefits like infectious disease coverage or lifestyle benefits based on your needs and priorities.

- Report Accidents Promptly: Notify your insurer as soon as possible after an accident to ensure smooth claims processing.

- Keep Records: Maintain proper documentation of medical bills, police reports, and other relevant documents to support your claims.

4. Critical Illness (CI) Plan

What is Critical Illness Insurance?

Critical illness insurance provides a lump sum payout upon diagnosis of a covered critical illness, such as cancer, heart attack (of specified severity), or paralysis. This financial support helps you focus on treatment and recovery without the added stress of medical bills or loss of income. It's a crucial safety net, offering flexibility and peace of mind during challenging times.

Why is it Important to Singaporeans?

Critical illnesses can strike anyone, regardless of age or lifestyle. The high cost of treatment and potential loss of income during recovery can put a significant strain on individuals and families. Critical illness insurance is important to have because it provides a financial buffer, allowing you to access the best possible care and maintain your quality of life without depleting your savings.

Examples of Critical Illness Insurance

Critical illness insurance policies typically cover a range of major illnesses, with some offering additional benefits and coverage options.

Critical illness plans in Singapore usually offer a lump sum payout to help individuals manage the financial impact of a serious illness. Some common features include:

- Coverage for Major Illnesses: Critical illness plans typically cover a list of major illnesses, such as cancer, heart attack, stroke, major organ failure, and certain types of surgery.

- Early-Stage Critical Illness Benefit: Some plans offer a partial payout for early-stage diagnosis of certain critical illnesses, allowing for timely intervention and treatment.

- Multiple Claim Benefit: Certain policies allow for multiple claims for different critical illnesses, ensuring continued financial support throughout your recovery journey.

- Additional Riders: You can often enhance your coverage with optional riders, such as coverage for specific diseases or additional benefits like income replacement or waiver of premium.

Income's Complete Critical Protect safeguards against dread diseases with comprehensive coverage, from early to advanced stage dread disease.

- Receive up to 200% of the sum assured6,7,8 for advanced stage dread disease with the Protect Max option.

- Coverage against recurrent conditions9,10 like persistent major cancer, recurrent heart attack and recurrent stroke with the Protect Max option.

- First in Singapore to provide Guaranteed Post-DD Cover Option11 - purchase a new term plan for extra coverage upon the diagnosis of an advanced stage dread disease or an impairment of a vital function.

Another option you can consider is Income’s Complete Cancer Care, a term life insurance that provides comprehensive support and financial protection in the event of a cancer diagnosis so that you and your loved ones can focus on cancer treatment and recovery.

- Future premiums waived12 for a specified period up to the end of the policy term upon the diagnosis of major cancer.

- Receive up to 1% of the sum assured per month for up to 24 months13 to help reduce the out-of-pocket expenses for cancer treatment.

- First in Singapore to provide guaranteed post-cancer cover option14 - purchase a new term plan for extra coverage upon the diagnosis of advanced stage major cancer.

Misconceptions Surrounding Critical Illness Insurance

A common misconception is that you can simply get critical illness insurance after you've been diagnosed. Unfortunately, this is not the case. Critical illness policies typically have waiting periods and underwriting processes that assess your health before coverage begins. Once you're diagnosed with a critical illness, it's usually too late to obtain coverage for that specific condition. Another misconception is that it duplicates health insurance coverage. While health insurance helps with medical bills, critical illness insurance provides a lump sum payout for broader financial needs during recovery, like income replacement or lifestyle adjustments.

Tips to Ensuring Your Critical Illness Insurance is Appropriate for Your Needs

Ensure that the critical illness insurance plan you intend to buy is the most suitable one for you with these tips:

- Assess Your Needs: Consider your age, lifestyle, family medical history, and financial obligations to determine the appropriate coverage amount.

- Understand the Definitions: Review the policy's definitions of covered critical illnesses to ensure they align with your understanding and expectations.

- Compare Plans: Evaluate different critical illness plans based on coverage, premiums, waiting periods, and additional benefits to find the best fit for your needs and budget.

- Early Detection Matters: Take advantage of regular health screenings and preventive care to increase the chances of early detection and treatment, potentially leading to a better prognosis and eligibility for early-stage critical illness benefits.

- Seek Professional Advice: Consult a financial advisor to discuss your needs, understand different options, and make informed decisions about critical illness insurance.

Get the Right Insurance for your Needs

When it comes to insurance, the question isn’t “should I get it”, but “what insurance do I need in Singapore?” Insurance is your backup plan when things go awry, so make sure you’re well covered. Start with health insurance, then move on to other types if you can afford it, and choose the right types of insurance that matches your lifestyle and protection needs.

Not sure if you have sufficient coverage? Speak to our friendly advisors or find out how you can enhance your protection with our health and personal accident insurance or life insurance plans.

1 This plan does not cover infectious disease diagnosed within 14 days from the policy start date as well as any infectious disease which has been announced as:

(a) an epidemic by the health authority in Singapore or the Government of the Republic of Singapore; or

(b) a pandemic by the World Health Organisation (WHO),

in the affected countries, from the date of such announcement until the epidemic or pandemic ends.

2 Couple plan covers 2 married adults only.

3 The policy will be renewed as long as:

- the eligibility requirements are met

- claims have not reached the lifetime limit allowed for the respective plans

- the full sum insured under the final expenses or permanent disability benefits have not been claimed.

4 Adventurous activity means any recreational activity which:

-the insured person has undertaken while complying with all safety procedures, such as wearing safety equipment and following rules and regulations, whether specifically advised or generally expected of a reasonable person, and

-where guidance and supervision of licensed guides or instructors are available, the recreational activity must be carried out under the guidance and supervision of licensed guides or instructors of the tour operator or activity provider, and

-is not excluded under the general exclusions listed in part 2 of the general conditions of the policy.

Adventurous activity includes but is not limited to hiking, mountain climbing, scuba-diving, bungee jumping, parasailing, paragliding, parachuting, hang-gliding, skydiving, abseiling, skiing, snowboarding, canoeing, kayaking, white water rafting, dragon boating, paddleboarding, marathon, ultramarathon, biathlon, triathlon, surfing, and snorkeling.

5 PA Fitness Protect covers medical expenses due to accidents during the sport, exercise or adventurous activity.

6 If the policyholder has chosen Protect 100, Income Insurance will pay the early and/or intermediate stage dread disease under the Dread Disease Benefit, subject to the following:

- Dread Disease Benefit has not ceased at the time of any payment of the benefit;

- the insured survives at least 7 days after the date of diagnosis or date of surgery performed for a dread disease covered under this benefit, whichever is later;

- maximum of 1 claim for either the early stage dread disease or intermediate stage dread disease may be approved;

- Vital Function Benefit of the corresponding dread disease, which the same early and/or intermediate stage dread disease belongs to has not been claimed;

- if more than one dread disease covered under the Dread Disease Benefit and/or impairments of the vital functions are diagnosed on the same date, Income Insurance will only approve one claim with the highest possible benefit payout regardless of the number of dread diseases and/or impairments of the vital functions that are diagnosed; and

- the amount Income Insurance will pay for the early and/or intermediate stage dread disease of the same dread disease under this benefit will not be more than a total of $350,000 for each insured, including all policies Income Insurance has issued and paid for the same insured.

If the policyholder has chosen Protect 100, Income Insurance will pay the advanced stage dread disease under the Dread Disease Benefit, subject to the following:

- Dread Disease Benefit has not ceased at the time of any payment of the benefit;

- the insured survives at least 7 days after the date of diagnosis or date of surgery performed for a dread disease covered under this benefit, whichever is later;

- maximum of 1 claim for the advanced stage dread disease may be approved; and

- if more than one dread disease covered under the Dread Disease Benefit and/or impairments of the vital functions are diagnosed on the same date, Income Insurance will only approve one claim with the highest possible benefit payout regardless of the number of dread diseases and/or impairments of the vital functions that are diagnosed.

If the policyholder has chosen Protect 100, the Dread Disease Benefit will end once the total amount Income Insurance has paid under Dread Disease Benefit and Vital Function Benefit reaches 100% of the sum assured.

If the policyholder has chosen Protect 100, Income Insurance will not pay this benefit:

- if the insured suffered symptoms of, was investigated for, or was diagnosed with an early and/or intermediate stage dread disease under major cancer, heart attack of specified severity, other serious coronary artery disease, or coronary artery bypass surgery any time before or within 90 days from the cover start date, whichever is earliest; or

- if the insured was diagnosed with an advanced stage dread disease under major cancer, heart attack of specified severity, coronary artery by-pass surgery or other serious coronary artery disease within 90 days from the cover start date, whichever is earliest.

For coronary artery by-pass surgery, the date of diagnosis will be the date the medical condition that leads to the surgery is diagnosed, and not the date of the surgery.

If the policyholder has chosen Protect Max, Income Insurance will pay the early and/or intermediate stage dread disease under the Dread Disease Benefit, subject to the following:

- Dread Disease Benefit has not ceased at the time of any payment of the benefit;

- the insured survives at least 7 days after the date of diagnosis or date of surgery performed for a dread disease covered under this benefit, whichever is later;

- no claim has been approved for advanced stage of the same dread disease;

- maximum of 1 claim for either the early stage dread disease or intermediate stage dread disease of the same dread disease may be approved;

- maximum of 6 claims for the early stage and/or intermediate stage dread disease may be approved;

- Vital Function Benefit of the corresponding dread disease, which the same early and/or intermediate stage dread disease belongs to has not been claimed;

- if more than one dread disease covered under the Dread Disease Benefit and/or recurrent condition and/or impairments of vital function are diagnosed on the same date, Income Insurance will only approve one claim with the highest possible benefit payout regardless of the number of dread diseases and/or recurrent condition and/or impairments of the vital functions that are diagnosed;

- the amount Income Insurance will pay for the early and/or intermediate stage dread disease of the same dread disease under this benefit will not be more than a total of $350,000 for each insured, including all policies Income Insurance has issued and paid for the same insured; and

- the amount Income Insurance will pay for the early and/or intermediate stage dread disease under this benefit will not be more than a total of $1.05 million for each insured, including all policies Income Insurance has issued and paid for the same insured.

If the policyholder has chosen Protect Max, Income Insurance will pay the advanced stage dread disease under the Dread Disease Benefit, subject to the following:

- Dread Disease Benefit has not ceased at the time of any payment of the benefit;

- the insured survives at least 7 days after the date of diagnosis or date of surgery performed for a dread disease covered under this benefit, whichever is later;

- only 1 claim is allowed for the advanced stage of each dread disease;

- if more than one dread disease covered under the Dread Disease Benefit and/or recurrent condition and/or impairments of vital function are diagnosed on the same date, Income Insurance will only approve one claim with the highest possible benefit payout regardless of the number of dread diseases and/or recurrent condition and/or impairments of the vital functions that are diagnosed; and

- for terminal illness (advanced stage) and loss of independent existence (advanced stage), the amount payable will be determined after deducting any claims paid under the Dread Disease Benefit and Vital Function Benefit. If the total claims paid under the Dread Disease Benefit and Vital Function Benefit have reached 200% of the sum assured or more, no benefit will be payable for future claims under terminal illness (advanced stage) and loss of independent existence (advanced stage).

If the policyholder has chosen Protect Max, the Dread Disease Benefit will end once the total amount Income Insurance has paid under Dread Disease Benefit, Recurrent Benefit and Vital Function Benefit reaches 1000% of the sum assured.

If the policyholder has chosen Protect Max, Income Insurance will not pay this benefit:

- if a claim arises from any early, intermediate or advanced stage dread disease which occurs within 12 months from the date of diagnosis or date of surgery performed, whichever is later, of the latest claim approved under the Dread Disease Benefit for another dread disease, Recurrent Benefit or Vital Function Benefit;

- if the insured suffered symptoms of, was investigated for, or was diagnosed with an early and/or intermediate stage dread disease under major cancer, heart attack of specified severity, other serious coronary artery disease, or coronary artery by-pass surgery any time before or within 90 days from the cover start date, whichever is earliest; or

- if the insured was diagnosed with an advanced stage dread disease under major cancer, heart attack of specified severity, coronary artery by-pass surgery or other serious coronary artery disease within 90 days from the cover start date, whichever is earliest.

For coronary artery by-pass surgery, the date of diagnosis will be the date the medical condition that leads to the surgery is diagnosed, and not the date of the surgery.

The policy will continue even if this benefit ends.

7 If the policyholder has chosen Protect Max, the total Income Insurance will pay under the following benefits:

- Dread Disease Benefit;

- Recurrent Benefit; and

- Vital Function Benefit,

are aggregated and will not be more than 1000% of the sum assured, less any amount the policyholder owes Income Insurance.

If the insured is also covered by Dread Disease Benefit, Recurrent Benefit and Vital Function Benefit (or equivalent benefits) under any policies which have been issued and paid (whether issued and paid by Income Insurance or by any other insurer), the total of these benefits under all these policies cannot be more than $3.6 million (including premiums waived due to dread disease but excluding bonuses). In this case, Income Insurance will first take into account the amounts due under the earlier policies and then pay out only an amount to bring the total payments to $3.6 million (including premiums waived due to dread disease but excluding bonuses).

8 If the policyholder has chosen Protect 100, the total Income Insurance will pay under the following benefits:

- Dread Disease Benefit; and

- Vital Function Benefit,

are aggregated and will not be more than 100% of the sum assured, less any amount the policyholder owes Income Insurance.

If the insured is also covered by Dread Disease Benefit, Recurrent Benefit and Vital Function Benefit (or equivalent benefits) under any policies which have been issued and paid (whether issued and paid by Income Insurance or by any other insurer), the total of these benefits under all these policies cannot be more than $3.6 million (including premiums waived due to dread disease but excluding bonuses). In this case, Income Insurance will first take into account the amounts due under the earlier policies and then pay out only an amount to bring the total payments to $3.6 million (including premiums waived due to dread disease but excluding bonuses).

9 If the policyholder has chosen Protect Max, the total Income Insurance will pay under the following benefits:

- Dread Disease Benefit;

- Recurrent Benefit; and

- Vital Function Benefit,

are aggregated and will not be more than 1000% of the sum assured, less any amount the policyholder owes Income Insurance.

If the insured is also covered by Dread Disease Benefit, Recurrent Benefit and Vital Function Benefit (or equivalent benefits) under any policies which have been issued and paid (whether issued and paid by Income Insurance or by any other insurer), the total of these benefits under all these policies cannot be more than $3.6 million (including premiums waived due to dread disease but excluding bonuses). In this case, Income Insurance will first take into account the amounts due under the earlier policies and then pay out only an amount to bring the total payments to $3.6 million (including premiums waived due to dread disease but excluding bonuses).

10 The Recurrent Benefit is only applicable if the policyholder has chosen Protect Max. Income Insurance will pay the Recurrent Benefit, less any amount the policyholder owes Income Insurance, as long as the following conditions are met:

- Recurrent Benefit has not ceased at the time of any payment of the benefit;

- the insured survives at least 7 days after the date of diagnosis or date of surgery performed for a dread disease covered under this benefit, whichever is later;

- if more than one dread disease covered under the Dread Disease Benefit and/or recurrent condition and/or impairments of vital function are diagnosed on the same date, Income Insurance will only approve one claim with the highest possible benefit payout regardless of the number of dread diseases and/or recurrent condition and/or impairments of the vital functions that are diagnosed; and

- maximum of 3 claims may be approved under this benefit.

This benefit will end once:

- 300% of the sum assured has been fully paid out under this benefit; or

- the total amount Income Insurance has paid under Dread Disease Benefit, Recurrent Benefit and Vital Function Benefit reaches 1000% of the sum assured,

whichever is earlier.

Income Insurance will not pay this benefit:

- if your claim arises from any recurrent condition covered under this benefit occurring within 24 months from the date of diagnosis or date of surgery performed, whichever is later, of the latest claim approved under the Dread Disease Benefit, Recurrent Benefit or Vital Function Benefit; or

- if the insured was diagnosed with persistent major cancer, recurrent heart attack of specified severity or repeated coronary artery by-pass surgery within 90 days from the cover start date. For repeated coronary artery by-pass surgery, the date of diagnosis will be the date the medical condition that leads to the surgery is diagnosed, and not the date of the surgery.

The policy will continue even if this benefit ends.

11 Upon diagnosis of the insured with an advanced stage dread disease covered under Dread Disease Benefit or an impairment covered under Vital Function Benefit, a new term policy covering the insured may be taken up with only death and terminal illness benefits, without Income Insurance having to assess the insured’s health. Total and permanent disability will not be covered by the new term policy. The waiting period for the new term policy is 2 years. If the event giving rise to a claim occurs during the 2 years waiting period, Income Insurance will refund 100% of the premiums paid for the new term policy. The new term policy does not allow any reinstatement.

The sum assured for the new term policy will be limited to:

- 100% of the original sum assured for this policy; or

- $200,000 per life aggregating policies issued under the Guaranteed Post-DD Cover Option,

whichever is lower.

Income Insurance will decide the type of new term policy to be offered, and the insured must meet all the following conditions to take up this option:

- this option must be exercised within 6 months from the claim approval date or diagnosis date, whichever is later, of the advanced stage dread disease covered under Dread Disease Benefit or impairment covered under Vital Function Benefit;

- the insured must not have terminal illness at the time of taking up this option;

- the insured must be 60 years old last birthday or under at the time of taking up this option; and

- the relevant documents must be provided to support the diagnosis of advanced stage dread disease covered under Dread Disease Benefit or impairment covered under Vital Function Benefit.

12 Income will pay the Premium Waiver Benefit according to your selected option under the Major Cancer Benefit.

- If the policyholder selected Care 50, upon diagnosis of early or intermediate stage major cancer, Income will waive the premiums up to 60 months or end of policy term, whichever is earlier, and the policyholder will have to pay premiums thereafter. This benefit for early or intermediate stage major cancer can only be claimed once. Income will waive the premiums until the end of policy term upon diagnosis of advanced stage major cancer.

- If the policyholder selected Care 100, Income will waive the premiums until the end of policy term upon diagnosis of any stage of major cancer.

The premium waiver will start from the policy month immediately after the diagnosis date of the major cancer. The policy will continue to apply for the remaining unclaimed benefits during this premium waiver period even though the policyholder is not paying the premiums. Income will not pay this benefit if the insured suffered symptoms of, had investigations for, or was diagnosed with, any stage of major cancer any time before or within 90 days from the cover start date.

13 Income will pay a Monthly Cancer Therapy Benefit as long as the insured is diagnosed with major cancer by a specialist and recommended in writing that the treatment is a necessary medical treatment for cancer according to relevant guidelines from Ministry of Health (MOH) and has started cancer treatment as advised by a specialist. Income will make the first payment starting from the policy month immediately after the cancer treatment start date. For more details on the types of cancer treatment, please refer to the policy conditions. The maximum amount Income will pay for this benefit is $60,000 per life. Income will not pay more than a total number of 12 payouts for early or intermediate stage major cancer. If the insured has already received payouts during early stage, there will not be further payouts during intermediate stage. The sum of the total number of payouts for this benefit will not exceed 24 payouts. The number of payouts for the advanced stage major cancer will be 24 less the number of payouts Income have paid for the early or intermediate stage major cancer under this benefit. Income will not pay this benefit if the insured suffered symptoms of, had investigations for, or was diagnosed with, any stage of major cancer any time before or within 90 days from the cover start date. Please refer to the policy conditions for further details.

14 Upon diagnosis with advanced stage major cancer, the insured may choose to take up a new term policy with only death, terminal illness and total and permanent disability (TPD) benefits on the insured own life, without Income having to assess their health. The waiting period of the new term policy is 2 years. If the insured makes a claim on the new term policy during the 2 years of waiting period, Income will refund 100% of the premiums paid on the term policy issued under this option.

The sum assured for the new term policy will be limited to:

- 100% of the sum assured for this policy; or

- $200,000 per life

aggregating policies issued under the guaranteed post-cancer cover option, whichever is lower.

Income will decide the type of new policy to be offered and the insured must meet all the following conditions to take up this option:

- The insured must take up this option within 6 months from the date of claim admittance of the advanced stage major cancer benefit.

- The insured must not be totally and permanently disabled, terminally ill or be diagnosed with an advanced-stage dread disease other than major cancer, at the time of taking up this option.

- The insured must be 60 years old last birthday or under at the time of taking up this option.

This article is meant purely for informational purposes and does not constitute an offer, recommendation, solicitation or advise to buy or sell any product(s). It should not be relied upon as financial advice. The precise terms, conditions and exclusions of any Income Insurance products mentioned are specified in their respective policy contracts. Please seek independent financial advice before making any decision.

These policies are protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact Income Insurance or visit the GIA/LIA or SDIC websites (www.gia.org.sg or www.lia.org.sg or www.sdic.org.sg).

This advertisement has not been reviewed by the Monetary Authority of Singapore.

Related Articles