FAQs

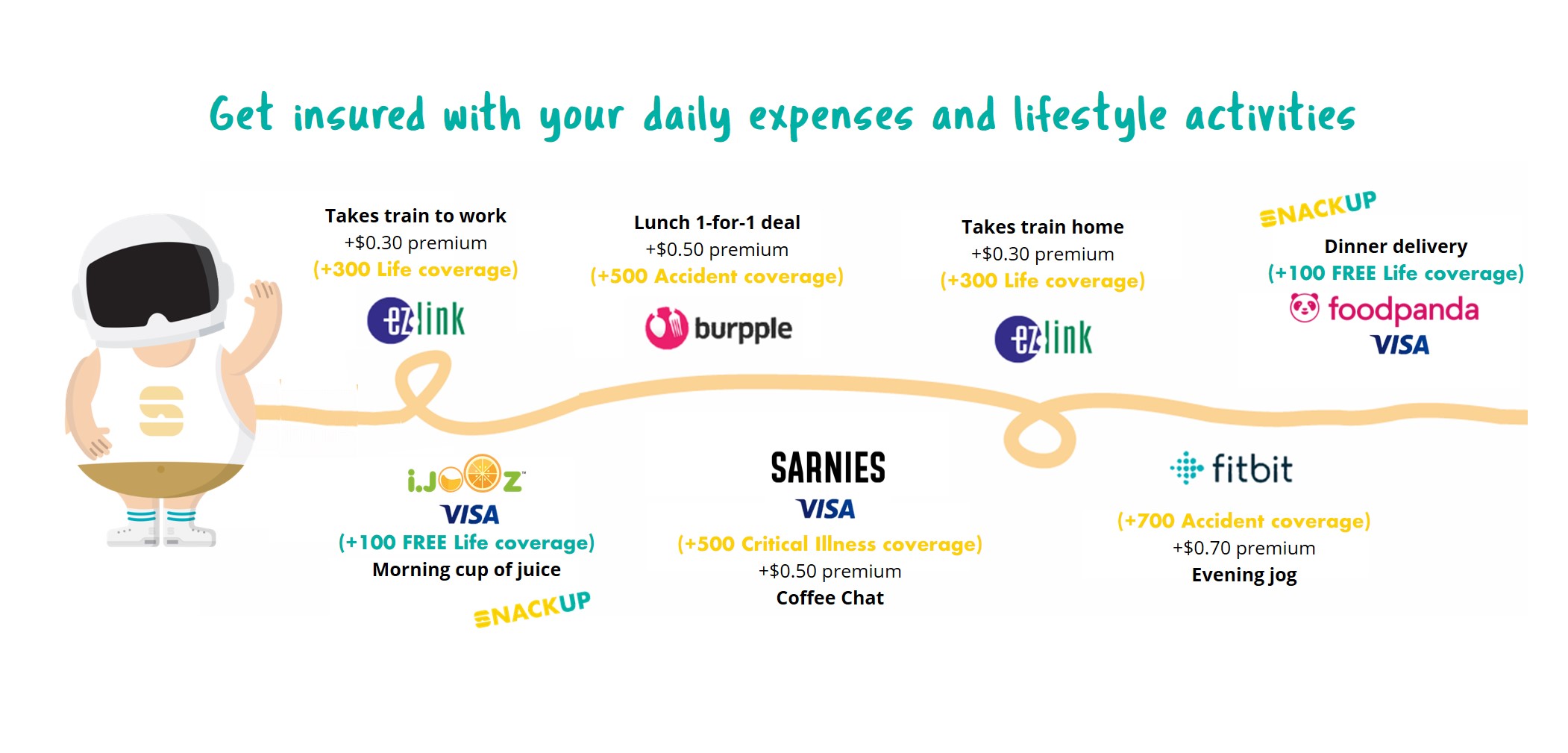

What is a lifestyle trigger, and how does it work

Lifestyle triggers are activities you perform on a daily basis (e.g. take the MRT, buy a cup of coffee etc). Completing your selected lifestyle trigger will trigger the purchase of your selected a micro-insurance policy on SNACK.

There are currently eight lifestyle triggers on SNACK:

- Steps

- Transport

- Food & Drinks

- Retail

- Groceries

- Entertainment

- Petrol

- Utilities

What is a trigger source, and how does it work

A trigger source is product or service from our partner(s) that provide us with the necessary information to verify that you've performed your the lifestyle triggers (activities).

For example, we work with EZ-link to receive information whenever you take the bus or train with the EZ-Link card.

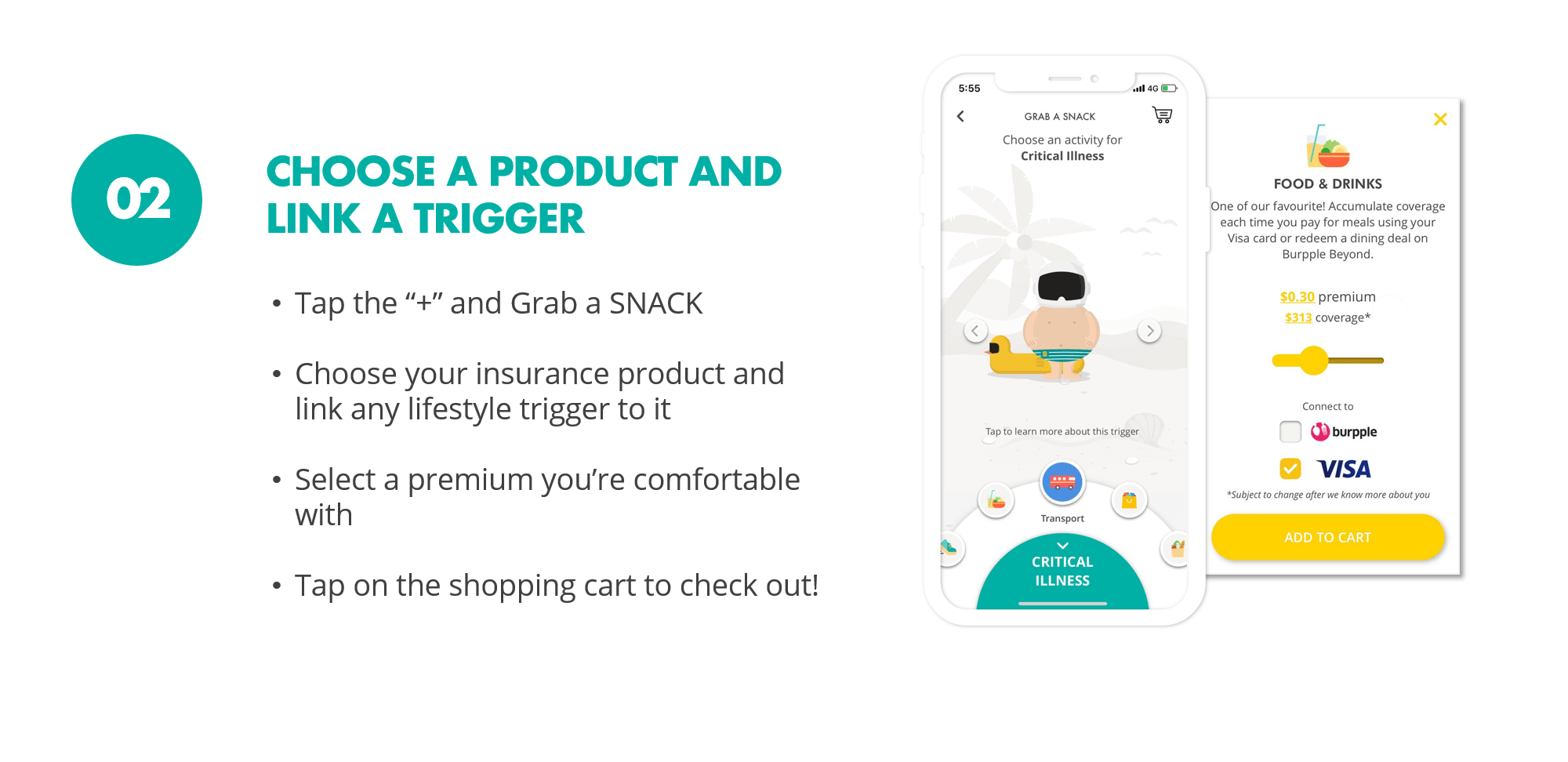

What are the micro-insurance products available on SNACK

There are currently 3 products on SNACK:

- SNACK-Life (Term Life protection)

- SNACK-Critical Illness (Critical Illness protection)

- SNACK-Accident (Personal Accident protection)

These insurance policies are underwritten by NTUC Income. More products will be introduced in the near future. Stay tuned for updates! Click here to learn more.

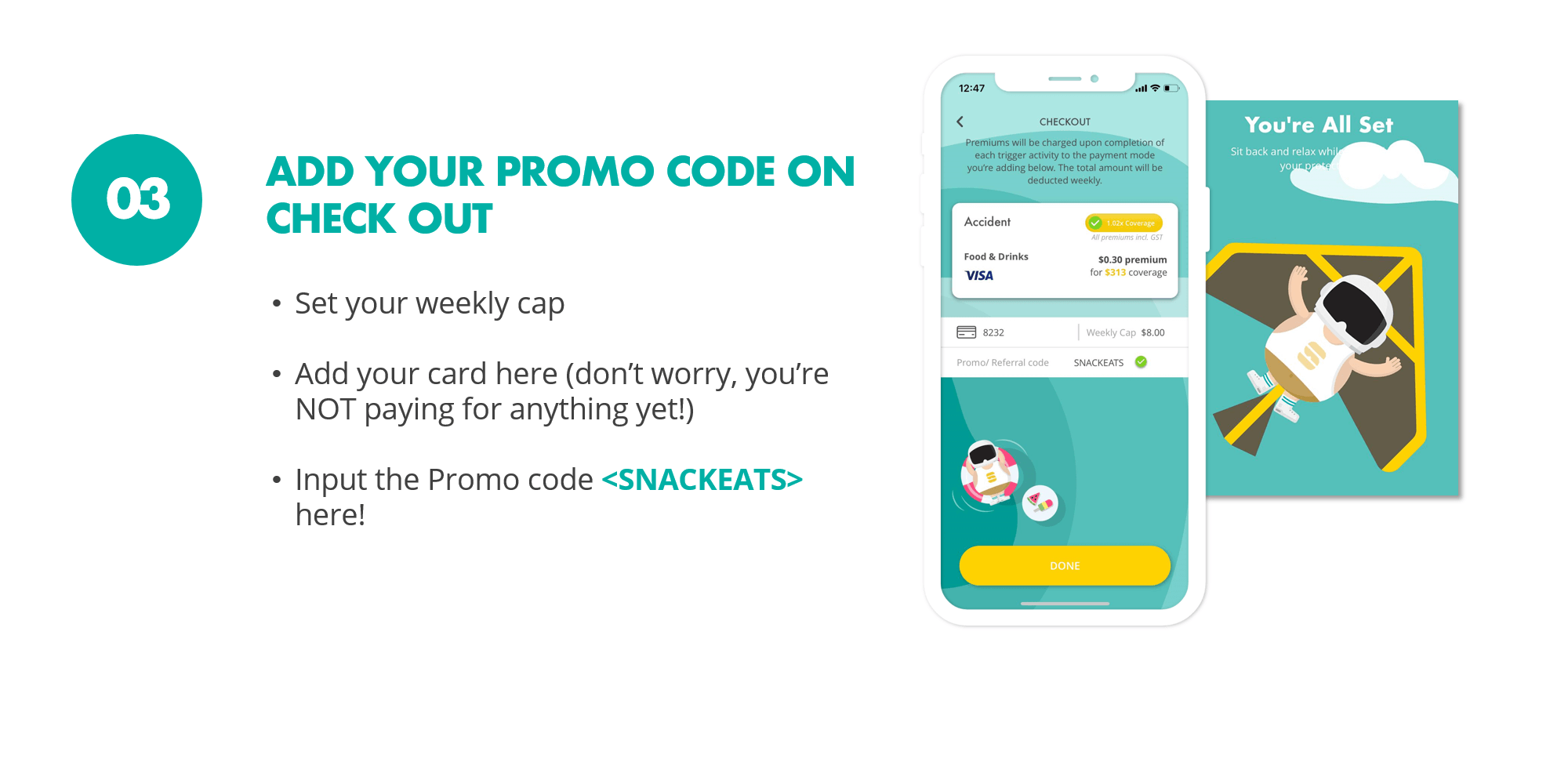

Is there a limit to the premiums that are charged to my credit/debit card

Yes, there is a limit to the premiums charged to your credit or debit card depending on the weekly cap you've set up. Once you've hit this weekly cap, we will no longer charge you premiums when you complete lifestyle triggers and you will not be issued any more policies for that week.

How long am I covered for

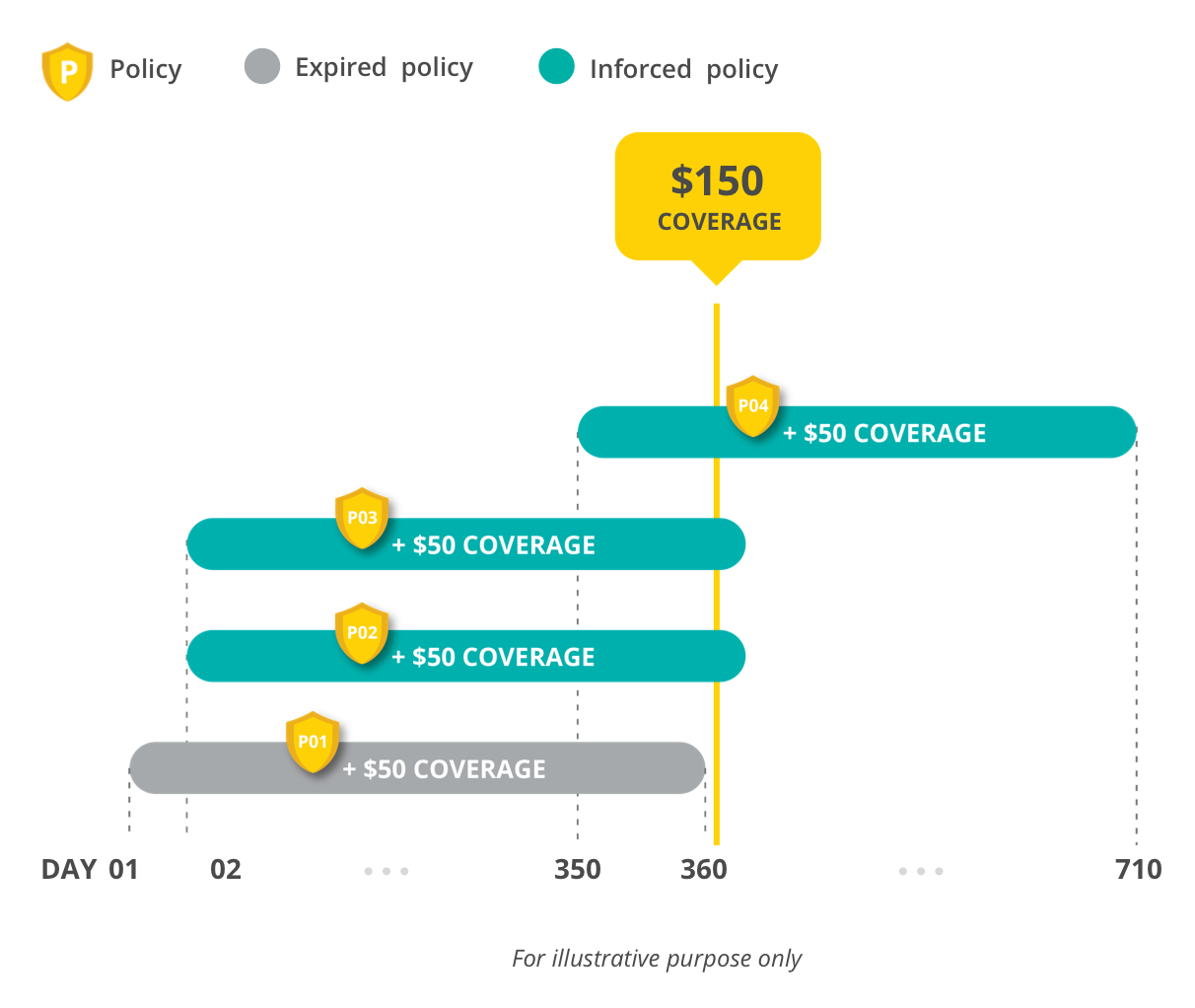

Each SNACK policy covers you for 360 days, starting from the date of policy issuance. Even if you stop using your triggers or remove them, you will still be covered under the respective products until your policies end.

What happens after my policy expires

Each SNACK micro-insurance policy covers you for 360 days. When your policy expires, the coverage amount for that policy will not be effective anymore. However, as you continue going about your day-to-day life and continue using your lifestyle triggers, your coverage will still continue building up.

See how it works:

Example:

Zac was issued a SNACK micro-insurance policy (P01) of $50 coverage on Day 1 after completing a lifestyle trigger activity he has selected. He continues to perform and complete the lifestyle activities he has selected in Day 2 and beyond which triggers the issuance of more SNACK micro-insurance policies (P02 and more).

At Day 360, policy P01 would have expired. This means that the $50 coverage would no longer be effective. Zac's overall coverage amount is thus reduced by $50. However, all other SNACK policies that was issued after Day 1 (P02 and beyond), would still be effective and Zac is still covered by those policies and the respective coverage amount.

When will I be charged for my premiums

You’ll only be charged for your premiums each time you complete your chosen lifestyle trigger(s).