Not sure which plan suits you? Find out more.

Get covered for what you truly need.

Get up to $150,000 personal accident coverage for unexpected injuries, up to $200,000 overseas medical expenses coverage and up to $500,000 emergency medical evacuation coverage. Plus, get COVID-19 coverage at no extra cost!

Get coverage for loss of handphones and electronic devices due to robbery and snatch theft.

Extend or shorten your trip coverage[2] as you need it – all from My Income app.

Get the most out of your travel budget with FlexiTravel Plus! For as little as $3 per day[1], get essential coverage for your trips in Asia, including Malaysia, Thailand, South Korea, China, Japan and more! Enjoy great value that lets you embrace new adventures with peace of mind – without breaking the bank.

Additional benefits for your travels within Asia.

Purchase up to 8 hours after departure from Singapore, with minimum coverage period of 24 hours.

Reimbursement for your unused entertainment tickets purchased for your trip[3].

Add on Sports Equipment Rider to protect your precious gear including bikes and golf equipment from accidental damages while travelling.

Enjoy partner rates for travel vaccinations at Parkway Shenton Medical clinics if you sign up now till 15 March 2026. Find out more here.

Your coverage at a glance.

| Key benefits | Maximum benefit (S$) limit per insured person | |

|---|---|---|

| Personal accident & medical expenses benefits | Personal accident | 150,000 |

| Medical expenses overseas | 200,000 | |

| Emergency medical evacuation | 500,000 | |

| Travel inconvenience benefits | Travel delay | 500 |

| Loss or damage of baggage and personal belongings | 1,500 | |

| Unused entertainment ticket | 400 | |

| Optional benefit | ||

| Sports equipment cover | Overall section limit | 2,000 |

| Limit for loss or damage of sports equipment (for each item, set or pair) | 800 | |

| Limit for rental of replacement sports equipment per day | 100 | |

| Limit for unused activity fees | 400 | |

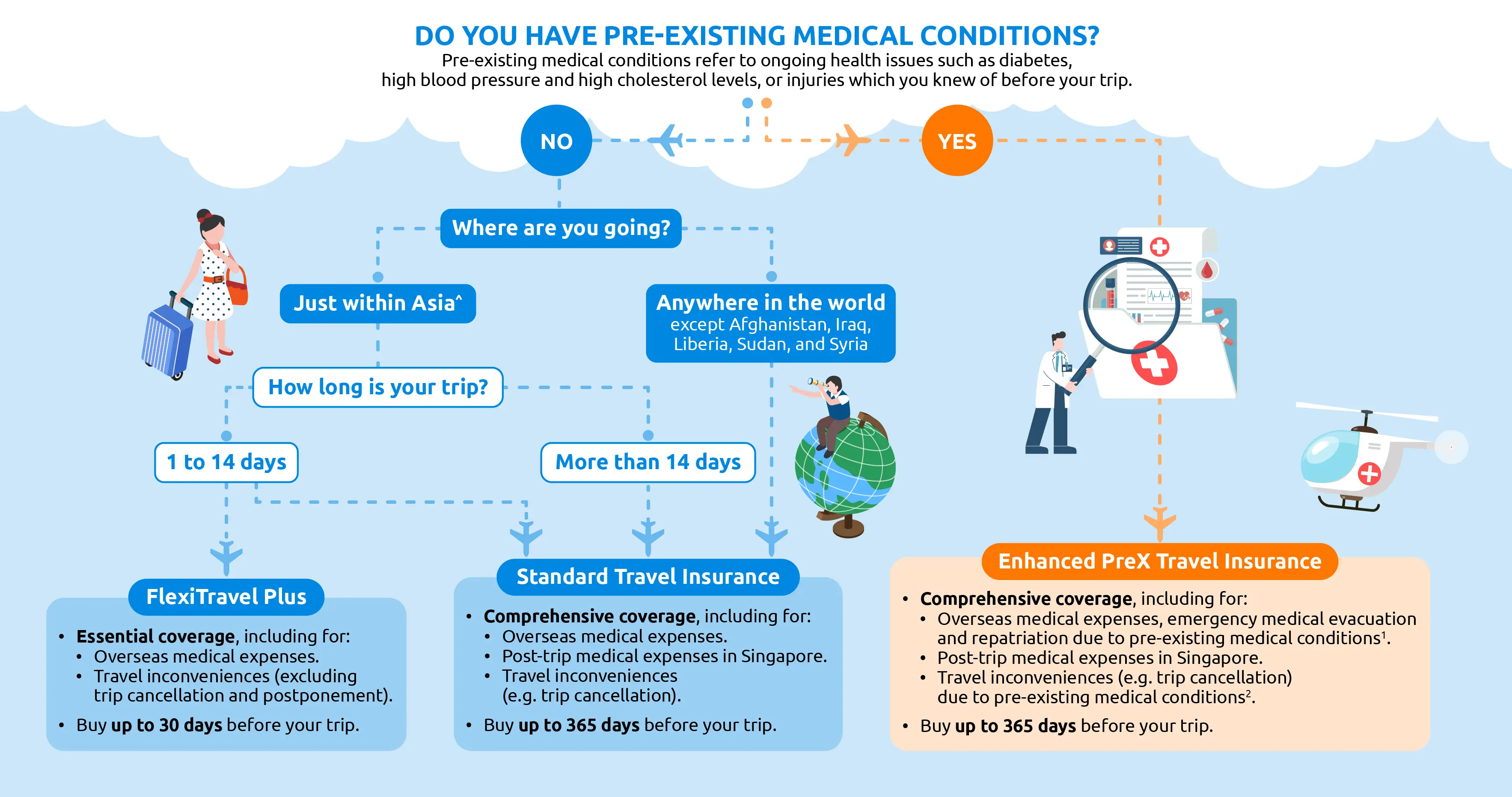

Find out which plan is suitable for you

Check out Standard Travel Insurance here and Enhanced PreX Travel Insurance here.

^Australia, Brunei, Cambodia, China (excludes Mongolia & Tibet), Hong Kong, India, Indonesia, Japan, Korea, Laos, Macau, Malaysia, Myanmar, New Zealand, Philippines, Sri Lanka, Taiwan, Thailand and Vietnam.

1. We do not cover claims arising from a pre-existing medical condtion where you have been given a terminal prognosis with a life expectancy of under 12 months. Please refer to policy conditions for the precise definition of pre-existing medical conditions.

2. For trip cancellation, postponement, shortening and disruption under Enhanced PreX Superior and Prestige Plans. A 25% co-payment will apply for claims due to pre-existing medical conditions.

Here's a quick comparison of FlexiTravel Plus and Standard Travel Insurance

| FlexiTravel Plus Essential travel coverage of affordable rates within Asia! | Travel Insurance (Per-trip plan) Comprehensive Travel Insurance for worldwide destinations! | |

| Premium | Hourly rate[1] | Daily rate |

| Destinations | Asia countries | All countries (except Afghanistan, Iraq, Liberia, Sudan, and Syria) |

| Medical Expenses (Overseas) | Up to $200,000 | Up to $1,000,000[4] |

| Medical Expenses (Singapore) | - | Up to $50,000[4] |

| Travel Delay (Overall section limit) | Up to $500 | Up to $2,000[5] |

| Trip Cancellation | - | Up to $15,000[5] |

| Loss of Personal Belongings (Overall section limit) | Up to $1,500 | Up to $8,000[5] |

| Pre-existing conditions | - | Covered with Enhanced PreX Travel Insurance [6] |

| Flexibility to shorten/extend trip via My Income app | Covered[2] | - |

| Automatic extension feature | - | Up to 14 days |

| Post-departure purchase | Up to 8 hours after departure | Up to a day after departure |

| Purchase period | Up to 30 days prior to start of trip | Up to 365 days prior to start of trip |

| Period of insurance | 6 hours to 14 days | 1 day to 180 days |

| BUY IN APP NOW | BUY NOW |

Your policy toolkit

Eligibility

You must:

- Be living or working in Singapore

- Be holding a valid Singapore identification document such as a NRIC, employment pass, work permit, long-term visit pass or student pass

- Be starting and ending your trip in Singapore

- Have bought your policy before leaving Singapore, except if the post-departure purchase extension under section 25 applies

- Have fully paid your premium

- Be more than 30 days old

Policy conditions

Top FlexiTravel Plus Insurance Queries

FlexiTravel Plus is an innovative product developed by Income to provide hourly insurance coverage to travellers going on short trips, and who may not require coverage for whole days.

Here are the main differences of FlexiTravel Plus and our usual Per Trip Travel Insurance:

| Differences | FlexiTravel Plus | Per Trip Travel Insurance |

|---|---|---|

| Premium structure |

Chargeable by the hour (minimum charge of 6 hours) |

Chargeable by the day |

| Covered destinations | Up to ASIA region |

All countries (Except Afghanistan, Iraq, Liberia, Sudan, and Syria) |

| Minimum period of insurance | 6 hours | 1 day |

| Maximum period of insurance | 14 days | 180 days |

| Activation platforms | My Income App |

|

The coverage for your FlexiTravel Plus policy:

a) Starts at the later of:

i. The start of your period of insurance; or

ii. When you leave Singapore, and

b) Ends at the earlier of:

i. The end of your period of insurance; or

ii. When you arrive in Singapore.

Yes, FlexiTravel Plus will cover you against all travel related benefits except any conditions that arise from your pre-existing medical conditions¹.

If you have pre-existing medical conditions and wish to be covered for them, we will recommend you to take up an Enhanced PreX plan under our Travel Insurance which will cover pre-existing medical conditions. You can learn more about our Enhanced PreX Travel Insurance here.

¹ Pre-existing medical condition means any injury or sickness (including any complications which may arise):

a. which you knew about before the start of your trip; or

b. which you have received diagnosis, consultation, medical treatment or prescribed drugs for in the 12 months before the start of your trip; or

c. which you have been asked to get medical treatment or medical advice for by a medical practitioner within 12 months before the start of your trip.

The pre-existing medical condition definition also applies to injury or sickness of your family member.

We cover leisure activities that are accessible to the general public/tourists such as bungee jumping, scuba diving, motorcycling (including pillion riding), horse riding, winter sports, water rafting in our standard policy terms.

However, dangerous or professional sports and activities are not covered in our policy terms. You may send us an enquiry here if you wish to check if the activity you are taking part in is covered. We will get back to you within 3 working days.

Yes, a Family covers the policyholder and his or her:

a. spouse; and/or

b. parents; and/or

c. parents-in-law; and/or

d. biological or legally adopted children less than 21 years old; and/or

e. grandparents; and/or

f. grandparents-in-law; and/or

g. grandchildren.

No, you will not be able to purchase a FlexiTravel Plus policy for your child if your child is travelling alone. FlexiTravel Plus can only be bought by the policyholder to cover themselves and their family members on the same trip.

If your child is travelling alone, you may wish to purchase Travel Insurance for them.

The maximum travel period for FlexiTravel Hourly Insurance is 14 days. Please purchase Travel Insurance for trips beyond 14 days.

You can only purchase FlexiTravel Plus up to 30 days in advance.

Yes, you will be charged for a minimum premium payable equivalent to 6 hours of coverage.

No, you must start and end your trip in Singapore.

You can activate your FlexiTravel Plus coverage via My Income app under 'Buy Travel Insurance'.

You will need to indicate the start date and time as well as the end date and time of your trip for the period of insurance. The start and end date and time will be based on Singapore time. Start date: The date you are departing from Singapore (e.g., If you are departing from Singapore on 1 Jan 2022 23:50, you should indicate the start date and time as 1 Jan 2022, 11:50pm). End date: The date you are arriving in Singapore (e.g. If you are arriving in Singapore on 05 Jan 2022 09:30, you should indicate the end date as 5 Jan 2022, 9:30am).

You can extend or shorten your period of insurance to cover your entire trip as required under “Edit trip details” via My Income app if your policy has not expired.

If you choose to shorten your trip after it has commenced, you would only be charged for the hours you have consumed, subject to a minimum premium that is equivalent to six hours of coverage. You should only end your coverage upon arrival in Singapore through the My Income app, if not, your policy will not be valid.

Yes, under our post-departure purchase extension section, you can purchase FlexiTravel Plus up to 8 hours after you have already departed from Singapore for your trip. Do note that there is a minimum requirement of at least 24 hours for your period of insurance. If not, your policy will not be valid.

You can pay your premium by credit card (Visa/MasterCard).

Yes, the premiums will be computed on an hourly basis and the final premium will be deducted from the credit card you have provided us at the end of your policy application.

For trips less than 6 hours, please note that a minimum premium that is equivalent to 6 hours of coverage will apply.

Income Insurance’s FlexiTravel Plus provides COVID-19 coverage under sections 1 to 22 via Section 24 - COVID-19 cover extension.

Please note that we will not pay for claims arising from COVID-19 for all the other benefits other than those stated above.

You will be eligible for the COVID-19 benefits as long as you fulfil all vaccination, pre-departure tests and post-arrival tests requirements (if any) imposed by the destination country or transport operator at the time of the trip.

No, we do not cover any expenses incurred for mandatory COVID-19 diagnostic tests that you are required to take for the trip, such as Antigen Rapid Test (ART), Polymerase Chain Reaction (PCR) test, rostered routine tests, pre-departure tests and post-arrival tests.

No. FlexiTravel Plus seeks to cover people who are travelling to ASEAN and Asia regions, for leisure purposes. It is not intended to cover people who are travelling to seek medical treatment.

Yes, we will reimburse you the necessary and reasonable cost of emergency medical, surgical, hospital, dental treatment and ambulance recommended or requested by a medical practitioner for you to be treated while overseas, up to the limit shown in the table of cover or up to a period of 30 days from the date of the first treatment, whichever comes first.

Yes, we will pay for the necessary and reasonable costs of emergency dental treatment recommended or requested by a medical practitioner for you to be treated while overseas, up to the limit shown in the table of cover or up to a period of 30 days from the date of the first treatment, whichever comes first.

Yes, our FlexiTravel Plus will cover you for your specialist medical treatment expenses provided that the specialist medical treatment is considered necessary, and you are referred by a general practitioner. This is for up to the limit shown in the table of cover or up to a period of 30 days from the date of the first treatment, whichever comes first.

No, you will not be covered for medical expenses incurred in Singapore.

No, medical treatment from a Chinese medicine practitioner or chiropractor is not covered under FlexiTravel Plus.

Yes, one of your family members can come over to visit you provided that you are hospitalised overseas for at least three full days due to injury or sickness sustained during your trip and no adult family member or travelling companion is with you at that time.

We will pay for the reasonable economy-class transport expenses (for air, sea or land travel) and hotel accommodation expenses for one family member to travel and be with you or one travelling companion to stay with you until you are confirmed medically fit by a medical practitioner to continue with your trip or to return to Singapore or for up to 14 days from the date the trip ends, whichever comes first.

No, either Income or our appointed assistance company will arrange and decide on the best suited means of evacuation. It may include air ambulance, surface ambulance, regular air transportation or any other appropriate means. You can be assured that our decisions will be based solely on your severity and medical necessity.

Sending you home benefit covers the costs incurred for the transportation and return of the insured’s body back to Singapore or to his home country. This is provided that death occurs due to an injury or sickness which occurred whilst overseas.

We will pay for the transport expenses (air, sea or land travel) and accommodation costs that you have paid or have agreed to pay under a contract and which you cannot get back (including the travel agent’s cancellation fee). We will also pay for extra economy-class transport expenses (air, sea or land travel) and reasonable accommodation expenses that you have to pay to return to Singapore. To view the applicable limits for this benefit, please refer to the table of cover.

We will pay for the transport expenses (air, sea or land travel) and accommodation costs that you have paid or have agreed to pay under a contract and which you cannot get back (including the travel agent’s cancellation fee).

We will also pay for extra economy-class transport expenses (air, sea or land travel) and reasonable accommodation expenses that you have to pay to return to Singapore.

No, you will only be reimbursed for accommodation and transport expenses. Other expenses such as taxi fares, meals and drinks will not be covered.

Yes, you will be covered up to the limit and sub-limits as shown in Section 15 of the table of cover.

Yes, you will be reimbursed up to the limit and sub-limits as shown in Section 15 for your lost or damaged baggage.

You will be reimbursed for loss of money as shown in Section 16 if your money was stolen from you while you are overseas.

We will pay for reasonable economy-class transport (air, sea or land travel) and accommodation expenses of a standard room which you have to pay while overseas to apply to replace the lost passport or travel documents. We will also pay for the administrative fee which you have to pay to get a replacement passport, passport photograph, driver’s license or travel documents.

You will be eligible for the Unused entertainment ticket benefit under the following conditions, provided they happen on the day of the entertainment event or on the date of expiry of the entertainment ticket, whichever is later:

a. Your death, serious sickness or serious injury resulting in your hospitalization.

b. A sudden riot, strike or civil commotion breakout at your destination.

c. The bankruptcy or insolvency of the entertainment provider or booking agency from which you have bought your prepaid entertainment ticket from; if the bankruptcy or insolvency takes place after the purchase date of this policy and the petition for bankruptcy or a similar petition was not filed before the purchase date of this policy.

d. Natural disasters which happen at the destination you are in or plan to travel to.

You will also be eligible for the Unused entertainment ticket benefit if you have to shorten or disrupt your trip and for which you have made a claim which we will pay under section 6 – Shortening your trip or section 7 - Trip disruption.

We will pay for the unused entertainment ticket expenses that you have paid or have agreed to pay under a contract and which you cannot get back from the entertainment provider or booking agency.

Entertainment ticket refers to any ticket granting admission to shows, performances, concerts, sporting events where you are a spectator, theme parks, attractions, that are purely for leisure and entertainment. This does not include courses, conferences, seminars, talks, trade shows, tours, excursions, permits and other incidental charges.

You must have purchased the optional Sports Equipment rider in order to be eligible for this cover.

If your sports equipment is stolen, damaged or lost due to an accident or theft while overseas, we will either replace or pay a cash equivalent for your lost sports equipment subject to wear and tear.

If you need to rent sports equipment to continue with your overseas sports activity when your sports equipment is stolen, damaged or lost, we will pay for the rental fees of the sports equipment if you have made a successful claim for your lost sports equipment.

In order to claim for your lost sports equipment, you must show that:

a. You have taken all possible steps and been careful to protect the security of your sports equipment and prevent loss and ensure that they are secured in a safe place and are not left unattended in a public place; and

b. for sports equipment that were stolen from your accommodations or motor vehicle, there must be proof that your accommodation or motor vehicle has been broken into or the lock has been tampered with; and

c. You have reported the loss to the police or to the relevant authority where the loss has happened within 24 hours of discovering the loss.

Yes. To claim for your non-refundable, pre-paid and unused activity fees, you must:

a. provide a written report of your medical condition from a medical practitioner confirming your inability to participate in the sports activity as a result of injury or sickness; and

b. You have reported your inability to participate in the sports activity to the activity provider as soon as practicable and apply for a refund of the pre-paid and unused activity fees.

We will reduce your claim by the amount the activity provider has refunded you.

Personal accident benefit covers you against injury caused by accident that result in death, permanent total disability or disabilities such as loss of limb(s) or sight within 90 days from the date of accident.

Yes, we will pay you a cash benefit for each full day (i.e., 24 hours in a row) up to the benefit limit if you are held hostage following a kidnapping whilst overseas.

You will only be reimbursed for the actual telephone charges up to the benefit limit for calls made to our appointed assistance company or your bank.

This is provided that:

a. there is a medical emergency, and you have made a claim which we will pay under sections 1 – Personal accident, 2 – Medical expenses overseas, 3 – Emergency medical evacuation, or 4 – Sending you home; or

b. you need to call the bank when your bank card has a fraudulent charge and for which you have made a claim which we will pay under section 17 – Fraudulent use of bank card.

FlexiTravel Plus covers for any of the losses listed in the policy arising from or in relation to an act of terrorism, up to the limit as shown in the table of cover.

Understand the details

[1] Premiums will be charged on an hourly basis subject to a minimum premium payable that is equivalent to 6 hours of coverage, and capped at $3 per day.

[2] You must sign up for the coverage prior to leaving Singapore, except if the post-departure purchase extension under Section 25 applies, and end your coverage upon arrival in Singapore through My Income app. If you are intending to make a claim under Section 6 Shortening your trip, you are not to shorten your trip through the My Income app, as your period of insurance needs to include the whole duration of your original trip.

[3] We will only pay for the unused entertainment ticket expenses if you are prevented from using it due to reasons like serious sickness or serious injury resulting in your hospitalisation, if it happens on the day of the entertainment event or on the date of expiry of the entertainment ticket, whichever is later. Please refer to Section 8 for more details.

[4] Based on Income's Travel Insurance Preferred plan, for an adult under 70 years old.

[5] Based on Income's Travel Insurance Preferred plan.

[6] We do not cover claims arising from a pre-existing medical condition where you have been given a terminal prognosis with a life expectancy of under 12 months. Please refer to Income's Travel Insurance policy conditions for the precise definition of pre-existing medical conditions.

There are certain conditions whereby the benefits under this plan will not be payable. You can refer to your policy contract for the precise terms, conditions and exclusions of the plan. The policy contract will be issued when your application is accepted.

This is for general information only and does not constitute an offer, recommendation, solicitation or advice to buy or sell any product(s). You can find the usual terms, conditions and exclusions of this plan in the policy conditions. All our products are developed to benefit our customers, but not all may be suitable for your specific needs. If you are unsure if this plan is suitable for you, we strongly encourage you to speak to a qualified insurance advisor. Otherwise, you may end up buying a plan that does not meet your expectations or needs. As a result, you may not be able to afford the premiums or get the insurance protection you want.

This policy is protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact Income Insurance Limited or visit the GIA/LIA or SDIC web-sites (www.gia.org.sg or www.lia.org.sg or www.sdic.org.sg).

Apple and the Apple logo are trademarks of Apple Inc. registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Google Play and the Google Play logo are trademarks of Google LLC.

Information is correct as at 15 January 2026

Read more about FlexiTravel Plus

If you want to go on a quick family getaway without breaking the bank, check out these easy trips!

Planning your next holiday? Why not try one of these off-the-beaten-path destinations in Malaysia?

Planning a road trip to Malaysia? We share tips and places to go on your next road trip.