Announcement

The Ministry of Health (MOH) has introduced new design requirements for Integrated Shield Plan (IP) riders that are made available for sale from 1 April 2026 onwards, as per their announcement on 26 November 2025.

The new requirements are:

i) No coverage for minimum IP deductible – IP riders will not cover the main plan’s minimum deductible.

ii) Higher co-payment cap – the minimum co-payment cap of IP riders will increase from $3,000 to $6,000 in each policy year.

The co-payment cap will also exclude the IP main plan’s minimum deductible.

For more details on the new requirements for IP riders, you can refer to MOH’s announcement at go.gov.sg/ipriderchanges2025.

For new customers

If you were to buy a Deluxe Care or Classic Care rider from 27 November 2025 to 31 March 2026 (both dates inclusive), the new requirements will apply to your Deluxe Care or Classic Care rider no later than your next policy renewal after 1 April 2028.

For existing customers

If you had bought a Deluxe Care, Plus, Classic Care or Assist rider before 27 November 2025, the new requirements will not apply to your existing rider for now. As part of our regular review of our IP plans and IP riders, we will continue to assess if changes will be needed to keep healthcare insurance sustainable for our policyholders. Like always, we will keep our policyholders informed of policy changes, if any.

For more details on the impact of the new requirements to Income’s IP riders, please read our FAQs here.

Should you have further queries, we would be most happy to assist you via your preferred mode of contact at income.com.sg/contact-us.

Welcome discount for IncomeShield Standard Plan, Deluxe Care rider and Classic Care rider (for new applications only) from 1 Oct 2025

A one-time 20% Welcome Discount will be applicable to the first-year premium for new applications – between 1 October 2025 and 30 September 2026 – for Enhanced Preferred, Enhanced Advantage, Enhanced Basic, IncomeShield Standard Plan, Deluxe Care rider and Classic Care rider, if there is no additional exclusions or premium loading applied to the policy upon policy issuance.

The Welcome Discount will be applied to the premium payable for additional private insurance coverage portion (does not include the MediShield Life (MSHL) portion) of the main plans as well as the entire premium for any riders, provided it is taken up together with a main plan.

Click here for the full Welcome Discount terms and conditions.

For more information on the changes, please read our FAQs here.

Did you know

Enhance your MediShield Life coverage with IncomeShield Standard Plan

Rest assured, your medical treatment will be well taken care of.

Be covered if something unforeseen happens, so your loved ones are relieved of the financial burden.

Get higher limits for the insured receiving treatment for multiple primary cancers under the Cancer Drug Treatment Benefit[5] and Cancer Drug Services Benefit[6].

Pay for premiums using MediSave, up to the Additional Withdrawal Limits[7], excluding riders (per insured person per year).

For a more detailed look at what you are covered for, you may view the full coverage table here.

Supplement your IncomeShield Standard Plan with a rider

Unlock extra layers of protection to keep your out-of-pocket expenses as low as possible.

| Benefits | Panel[8] | Extended Panel[9] | Non-panel | |

| Cover deductible and co-insurance | Yes Up to benefit limits | |||

| Co-payment | 5% co-payment of the benefits due under your policy[10] | |||

| Co-payment limit (each policy year) | Up to $3,000 limit | No limit | ||

| Extended panel[9] and non-panel payment (each policy year) | Not applicable | Up to $2,000 limit | ||

| Additional Cancer Drug Treatment Benefit for outpatient treatments | Treatment[5] on CDL (each month) | One Primary Cancer: 6x MSHL Limit Multiple Primary Cancers: Sum of the highest cancer drug treatment limit amongst the claimable treatments received for each primary cancer | ||

| Non-CDL treatment[11] (each month) | One Primary Cancer: $5,200 Multiple Primary Cancers: $5,200 x number of primary cancers | |||

| Treatment on CDL co-payment | 5% co-payment of the benefits due under your rider | |||

| Up to $3,000 limit (each policy year) | No limit | |||

| Non-CDL treatment co-payment | 10% co-payment of the benefits due under your rider | |||

| No limit | ||||

| Extra Bed Benefit | Receive up to $80 each day (up to a maximum of 10 days for each hospital stay) for the cost of an extra bed for you to sleep over if your insured child[12] gets warded | |||

Non-panel: Registered medical practitioners, specialists, hospitals or medical institutions that are not our panel[8] or extended panel[9].

Keep your hospital bills affordable with an extra layer of protection.

| Benefits | Panel[8] | Extended Panel[9] | Non-panel | |

| Cover deductible and co-insurance | Yes Up to benefit limits | |||

| Co-payment | 10% co-payment of the benefits due under your policy[10] | |||

| Co-payment limit (each policy year) | Up to $3,000 limit | No limit | ||

| Extended panel[9] and non-panel payment (each policy year) | Not applicable | Up to $2,000 limit | ||

| Additional Cancer Drug Treatment Benefit for outpatient treatments | Treatment[5] on CDL (each month) | One Primary Cancer: 6x MSHL Limit Multiple Primary Cancers: Sum of the highest cancer drug treatment limit amongst the claimable treatments received for each primary cancer | ||

| Non-CDL treatment[11] (each month) | One Primary Cancer: $5,200 Multiple Primary Cancers: $5,200 x number of primary cancers | |||

| Treatment on CDL co-payment | 10% co-payment of the benefits due under your rider | |||

| Up to $3,000 limit (each policy year) | No limit | |||

| Non-CDL treatment co-payment | 20% co-payment of the benefits due under your rider | |||

| No limit | ||||

| Extra Bed Benefit | Receive up to $80 each day (up to a maximum of 10 days for each hospital stay) for the cost of an extra bed for you to sleep over if your insured child[12] gets warded | |||

Non-panel: Registered medical practitioners, specialists, hospitals or medical institutions that are not our panel[8] or extended panel[9].

For withdrawn riders (Plus Rider, Assist Rider, Daily Cash Rider and Child Illness Rider), read more here.

What our customers have said about us!

Your policy toolkit

Eligibility and payment frequency

There is no maximum entry age limit for IncomeShield Standard Plan.

To apply for Deluxe Care Rider or Classic Care Rider, the last entry age is 75 (based on the insured's age next birthday). The plan selected for the Deluxe Care Rider or Classic Care Rider must be the same as your IncomeShield Standard plan.

You need to make payment every year.

View full premium table for Main Plan

View full premium table for Deluxe Care Rider

View full premium table for Classic Care Rider

You may refer to MOH’s website for a comparison of Integrated Shield Plans (IPs) across all insurers, including the estimated premiums you have to pay for an IP over your lifetime.

Learn more about the drivers of premium here.

Your queries answered.

Classic Care Rider is a rider attached that covers the deductible and co-insurance parts of your IncomeShield Standard Plan.

While this rider is in force, there is no deductible or co-insurance due under your policy. However, you will have to make a co-payment and an extended panel and non-panel payment (if it applies) for each claim.

The benefits are as shown in the table.

| Benefits | Classic Care Rider | |||

| Panel1 | Extended Panel2 | Non-panel3 | ||

| Cover deductible and co-insurance |

Yes up to benefit limits |

|||

| Co-payment | 10% co-payment of the benefits due under your policy | |||

| Co-payment limit (each policy year) | Up to $3,000 limit | No limit | ||

| Extended Panel2 and Non-panel payment (each policy year) | Not applicable | Up to $2,000 limit | ||

| Additional Cancer Drug Treatment Benefit for Outpatient Treatments | Treatment on CDL4 (each month) |

One Primary Cancer: 6x MSHL Limit

Multiple Primary Cancers5: Sum of the highest cancer drug treatment limit amongst the claimable treatments received for each primary cancer |

||

| Non-CDL treatment6 (each month) |

One Primary Cancer: $5,200

Multiple Primary Cancers5: $5,200 x number of primary cancers |

|||

| Treatment on CDL4 co-payment | 10% co-payment of the benefits due under your rider | |||

| Up to $3,000 limit (each policy year) | No limit | |||

| Non-CDL treatment6 co-payment | 20% co-payment of the benefits due under your rider | |||

| No limit | ||||

| Extra Bed Benefit | Receive up to $80 each day (up to a maximum of 10 days each hospital stay) for the cost of an extra bed for you to sleep over if your insured child gets warded. | |||

1Panel or preferred partner means a:

- registered medical practitioner;

- specialist;

- hospital;

- or medical institution;

approved by us. The lists of approved panels and preferred partners, which we may update from time to time, can be found at www.income.com.sg/specialist-panel. Our list of approved panels also includes all restructured hospitals, community hospitals and voluntary welfare organisations (VWO) dialysis centres.

2Extended panel means a registered medical practitioner or specialist approved by us to provide cover for the benefits under this rider. The registered medical practitioner or specialist must not also be on our lists of approved panels or preferred partners and must meet other criteria, including being on another Integrated Shield Plan provider’s panel list. The list of our approved extended panel can be found at income.com.sg/specialist-panel. We may update this list from time to time.

3Non-panel means registered medical practitioners, specialists, hospitals or medical institutions that are not our panel1 or extended panel2.

4Cancer Drug List (CDL) means the list of clinically proven and more cost-effective cancer drug treatments on the MOH website (go.gov.sg/moh-cancerdruglist). MOH may update the CDL from time to time.

5The term ‘multiple primary cancers’ is defined as two or more cancers arising from different sites and are of a different histology or morphology group. An application form for higher claim limits for the insured receiving treatment for multiple primary cancers is to be sent to Income Insurance and MOH by their registered medical practitioner for assessment of the Integrated Shield Plan and MediShield Life Plan coverage, respectively.

6For outpatient cancer drug treatments not on the CDL, Income Insurance covers only treatments with drug classes A to E (according to LIA’s Non-CDL Classification Framework). Refer to lia.org.sg/media/3553/non-cdl-classification-framework.pdf for more details. LIA may update the list from time to time.

If the treatment is provided by our panel1 or extended panel2, the co-payment limit per policy year is up to $3000.

If you are claiming for pre-hospitalisation treatment, post-hospitalisation treatment or special benefits (if covered), we will not apply the co-payment limit if the treatment during the insured’s stay in hospital is not provided by our panel1 or extended panel2.

If you are claiming for consultation fees, medicines, examinations or tests for the main outpatient hospital treatment that is covered under your policy, we will apply the co-payment limit only if the main outpatient hospital treatment is provided by our panel1 or extended panel2.

For each claim that meets the limits on special benefits (if they apply) or the limit for each policy year of your policy, the co-payment for that claim will not count towards the co-payment limit of $3,000 for each policy year.

When the insured is under the care of more than one registered medical practitioner or specialist for their stay in hospital or the main outpatient hospital treatment under your policy, we will apply the co-payment limit as long as the main treating registered medical practitioner or specialist (shown in the hospital records as the principal doctor) is part of our panel1 or extended panel2.

For each stay in hospital of 12 months or less, where the treatment is provided by our panel1 or extended panel2, you must pay the co-payment (up to a maximum of $3,000) for one policy year (even if the stay in hospital runs into the next policy year). If the stay in hospital is for a continuous period of more than 12 months but less than 24 months, you must also pay up to the maximum co-payment for the next policy year. And, for each further period of 12 months or less that the stay in hospital extends for, you must pay the co-payment for one extra policy year.

1Panel or preferred partner means a:

- registered medical practitioner;

- specialist;

- hospital;

- or medical institution;

approved by us. The lists of approved panels and preferred partners, which we may update from time to time, can be found at income.com.sg/specialist-panel. Our list of approved panels also includes all restructured hospitals, community hospitals and voluntary welfare organisations (VWO) dialysis centres.

2Extended panel means a registered medical practitioner or specialist approved by us to provide cover for the benefits under this rider. The registered medical practitioner or specialist must not also be on our lists of approved panels or preferred partners and must meet other criteria, including being on another Integrated Shield Plan provider’s panel list. The list of our approved extended panel can be found at income.com.sg/specialist-panel. We may update this list from time to time.

If the treatment is on the Cancer Drug List (CDL)3 and provided by our panel1 or extended panel2, you will have to make a co-payment of 10% of the benefits due under the rider. The co-payment limit per policy year is up to $3000.

If the treatment is on the CDL3 but is not provided by our panel1 or extended panel2, you will have to make a co-payment of 10% of the benefits due under the rider. There will not be a co-payment limit.

If the treatment is not on the CDL3, you will have to make a co-payment of 20% of the benefits due under the rider.

1Panel or preferred partner means a:

- registered medical practitioner;

- specialist;

- hospital;

- or medical institution;

approved by us. The lists of approved panels and preferred partners, which we may update from time to time, can be found at income.com.sg/specialist-panel. Our list of approved panels also includes all restructured hospitals, community hospitals and voluntary welfare organisations (VWO) dialysis centres.

2Extended panel means a registered medical practitioner or specialist approved by us to provide cover for the benefits under this rider. The registered medical practitioner or specialist must not also be on our lists of approved panels or preferred partners and must meet other criteria, including being on another Integrated Shield Plan provider’s panel list. The list of our approved extended panel can be found at income.com.sg/specialist-panel. We may update this list from time to time.

3Cancer Drug List (CDL) means the list of clinically proven and more cost-effective cancer drug treatments on the MOH website (go.gov.sg/moh-cancerdruglist). MOH may update the CDL from time to time.

If the treatment during the insured’s stay in hospital is provided by a registered medical practitioner or specialist who is not from our panel1, or is from the extended panel2, you will have to make an extended panel and non-panel payment (ENP) of up to $2,000 per policy year for your claims for inpatient hospital treatment, pre-hospitalisation treatment, post-hospitalisation treatment or special benefits (if covered). You must pay the co-payment followed by the ENP. We will only pay the amount of your claim which is more than the total of the co-payment and the ENP.

When there is more than one treating registered medical practitioner or specialist for the insured’s stay in hospital, we will apply the ENP as long as the main treating registered medical practitioner or specialist (shown in the hospital records as the principal doctor) is not from our panel1 or is from the extended panel2.

For each stay in hospital of 12 months or less that is provided by a registered medical practitioner or specialist who is not from our panel1 or is from the extended panel2, you must pay the ENP of up to $2,000 for one policy year (even if the stay in hospital runs into the next policy year).

If the stay in hospital is for a continuous period of more than 12 months but less than 24 months, you must also pay the ENP of up to $2,000 for the next policy year. And, for each further period of 12 months or less that the stay in hospital extends for, you must pay the ENP of up to $2,000 for one extra policy year.

1Panel or preferred partner means a:

- registered medical practitioner;

- specialist;

- hospital;

- or medical institution;

approved by us. The lists of approved panels and preferred partners, which we may update from time to time, can be found at income.com.sg/specialist-panel. Our list of approved panels also includes all restructured hospitals, community hospitals and voluntary welfare organisations (VWO) dialysis centres.

2Extended panel means a registered medical practitioner or specialist approved by us to provide cover for the benefits under this rider. The registered medical practitioner or specialist must not also be on our lists of approved panels or preferred partners and must meet other criteria, including being on another Integrated Shield Plan provider’s panel list. The list of our approved extended panel can be found at income.com.sg/specialist-panel. We may update this list from time to time.

Your insured child must be age 18 or younger during the stay in hospital and the insured’s parent or guardian stayed and shared in the same room. We will pay up to 10 days for each stay in hospital. If the insured is in the hospital for only part of a day, we will pay half of this benefit for that day. You do not need to pay the co-payment or ENP if we pay this benefit.

Deluxe Care Rider is a rider that covers the deductible and co-insurance parts of your IncomeShield Standard Plan.

While this rider is in force, there is no deductible or co-insurance due under your policy. However, you will have to make a co-payment and an extended panel and non-panel payment (ENP) (if it applies) for each claim.

The benefits are as shown in the table.

| Benefits | Deluxe Care Rider | |||

| Panel1 | Extended Panel2 | Non-panel3 | ||

| Cover deductible and co-insurance |

Yes up to benefit limits |

|||

| Co-payment | 5% co-payment of the benefits due under your policy | |||

| Co-payment limit (each policy year) | Up to $3,000 limit | No limit | ||

| Extended Panel2 and Non-panel payment (each policy year) | Not applicable | Up to $2,000 limit | ||

| Additional Cancer Drug Treatment Benefit for Outpatient Treatments | Treatment on CDL4 (each month) |

One Primary Cancer: 6x MSHL Limit

Multiple Primary Cancers5: Sum of the highest cancer drug treatment limit amongst the claimable treatments received for each primary cancer |

||

| Non-CDL treatment6 (each month) |

One Primary Cancer: $5,200

Multiple Primary Cancers5: $5,200 x number of primary cancers |

|||

| Treatment on CDL4 co-payment | 5% co-payment of the benefits due under your rider | |||

| Up to $3,000 limit (each policy year) | No limit | |||

| Non-CDL treatment6 co-payment | 10% co-payment of the benefits due under your rider | |||

| No limit | ||||

| Extra Bed Benefit | Receive up to $80 each day (up to a maximum of 10 days each hospital stay) for the cost of an extra bed for you to sleep over if your insured child gets warded. | |||

1Panel or preferred partner means a:

- registered medical practitioner;

- specialist;

- hospital;

- or medical institution;

approved by us. The lists of approved panels and preferred partners, which we may update from time to time, can be found at www.income.com.sg/specialist-panel. Our list of approved panels also includes all restructured hospitals, community hospitals and voluntary welfare organisations (VWO) dialysis centres.

2Extended panel means a registered medical practitioner or specialist approved by us to provide cover for the benefits under this rider. The registered medical practitioner or specialist must not also be on our lists of approved panels or preferred partners and must meet other criteria, including being on another Integrated Shield Plan provider’s panel list. The list of our approved extended panel can be found at income.com.sg/specialist-panel. We may update this list from time to time.

3Non-panel means registered medical practitioners, specialists, hospitals or medical institutions that are not our panel1 or extended panel2.

4Cancer Drug List (CDL) means the list of clinically proven and more cost-effective cancer drug treatments on the MOH website (go.gov.sg/moh-cancerdruglist). MOH may update the CDL from time to time.

5The term ‘multiple primary cancers’ is defined as two or more cancers arising from different sites and are of a different histology or morphology group. An application form for higher claim limits for the insured receiving treatment for multiple primary cancers is to be sent to Income Insurance and MOH by their registered medical practitioner for assessment of the Integrated Shield Plan and MediShield Life Plan coverage, respectively.

6For outpatient cancer drug treatments not on the CDL, Income Insurance covers only treatments with drug classes A to E (according to LIA’s Non-CDL Classification Framework). Refer to lia.org.sg/media/3553/non-cdl-classification-framework.pdf for more details. LIA may update the list from time to time.

If the treatment is provided by our panel1 or extended panel2, the co-payment limit per policy year is up to $3000.

If you are claiming for pre-hospitalisation treatment, post-hospitalisation treatment or special benefits (if covered), we will not apply the co-payment limit if the treatment during the insured’s stay in hospital is not provided by our panel1 or extended panel2.

If you are claiming for consultation fees, medicines, examinations or tests for the main outpatient hospital treatment that is covered under your policy, we will apply the co-payment limit only if the main outpatient hospital treatment is provided by our panel1 or extended panel2.

For each claim that meets the limits on special benefits (if they apply) or the limit for each policy year of your policy, the co-payment for that claim will not count towards the co-payment limit of $3,000 for each policy year.

When the insured is under the care of more than one registered medical practitioner or specialist for their stay in hospital or the main outpatient hospital treatment under your policy, we will apply the co-payment limit as long as the main treating registered medical practitioner or specialist (shown in the hospital records as the principal doctor) is part of our panel1 or extended panel2.

For each stay in hospital of 12 months or less, where the treatment is provided by our panel1 or extended panel2, you must pay the co-payment (up to a maximum of $3,000) for one policy year (even if the stay in hospital runs into the next policy year). If the stay in hospital is for a continuous period of more than 12 months but less than 24 months, you must also pay up to the maximum co-payment for the next policy year. And, for each further period of 12 months or less that the stay in hospital extends for, you must pay the co-payment for one extra policy year.

1Panel or preferred partner means a:

- registered medical practitioner;

- specialist;

- hospital;

- or medical institution;

approved by us. The lists of approved panels and preferred partners, which we may update from time to time, can be found at income.com.sg/specialist-panel. Our list of approved panels also includes all restructured hospitals, community hospitals and voluntary welfare organisations (VWO) dialysis centres.

2Extended panel means a registered medical practitioner or specialist approved by us to provide cover for the benefits under this rider. The registered medical practitioner or specialist must not also be on our lists of approved panels or preferred partners and must meet other criteria, including being on another Integrated Shield Plan provider’s panel list. The list of our approved extended panel can be found at income.com.sg/specialist-panel. We may update this list from time to time.

If the treatment is on the Cancer Drug List (CDL)3 and provided by our panel1 or extended panel2, you will have to make a co-payment of 10% of the benefits due under the rider. The co-payment limit per policy year is up to $3000.

If the treatment is on the CDL3 but is not provided by our panel1 or extended panel2, you will have to make a co-payment of 10% of the benefits due under the rider. There will not be a co-payment limit.

If the treatment is not on the CDL3, you will have to make a co-payment of 20% of the benefits due under the rider.

1Panel or preferred partner means a:

- registered medical practitioner;

- specialist;

- hospital;

- or medical institution;

approved by us. The lists of approved panels and preferred partners, which we may update from time to time, can be found at income.com.sg/specialist-panel. Our list of approved panels also includes all restructured hospitals, community hospitals and voluntary welfare organisations (VWO) dialysis centres.

2Extended panel means a registered medical practitioner or specialist approved by us to provide cover for the benefits under this rider. The registered medical practitioner or specialist must not also be on our lists of approved panels or preferred partners and must meet other criteria, including being on another Integrated Shield Plan provider’s panel list. The list of our approved extended panel can be found at income.com.sg/specialist-panel. We may update this list from time to time.

3Cancer Drug List (CDL) means the list of clinically proven and more cost-effective cancer drug treatments on the MOH website (go.gov.sg/moh-cancerdruglist). MOH may update the CDL from time to time.

Your insured child must be age 18 or younger during the stay in hospital and the insured’s parent or guardian stayed and shared in the same room. We will pay up to 10 days for each stay in hospital. If the insured is in the hospital for only part of a day, we will pay half of this benefit for that day. You do not need to pay the co-payment or ENP if we pay this benefit.

If the treatment during the insured’s stay in hospital is provided by a registered medical practitioner or specialist who is not from our panel1, or is from the extended panel2, you will have to make an extended panel and non-panel payment (ENP) of up to $2,000 in each policy year for your claims for inpatient hospital treatment, pre-hospitalisation treatment, post-hospitalisation treatment or special benefits (if covered). You must pay the co-payment followed by the ENP. We will only pay the amount of your claim which is more than the total of the co-payment and the ENP.

When there is more than one treating registered medical practitioner or specialist for the insured’s stay in hospital, we will apply the ENP as long as the main treating registered medical practitioner or specialist (shown in the hospital records as the principal doctor) is not from our panel1 or is from the extended panel2.

For each stay in hospital of 12 months or less that is provided by a registered medical practitioner or specialist who is not from our panel1 or is from the extended panel2, you must pay the ENP of up to $2,000 for one policy year (even if the stay in hospital runs into the next policy year). If the stay in hospital is for a continuous period of more than 12 months but less than 24 months, you must also pay the ENP of up to $2,000 for the next policy year. And, for each further period of 12 months or less that the stay in hospital extends for, you must pay the ENP of up to $2,000 for one extra policy year.

1Panel or preferred partner means a:

- registered medical practitioner;

- specialist;

- hospital;

- or medical institution;

approved by us. The lists of approved panels and preferred partners, which we may update from time to time, can be found at income.com.sg/specialist-panel. Our list of approved panels also includes all restructured hospitals, community hospitals and voluntary welfare organisations (VWO) dialysis centres.

2Extended panel means a registered medical practitioner or specialist approved by us to provide cover for the benefits under this rider. The registered medical practitioner or specialist must not also be on our lists of approved panels or preferred partners and must meet other criteria, including being on another Integrated Shield Plan provider’s panel list. The list of our approved extended panel can be found at income.com.sg/specialist-panel. We may update this list from time to time.

IncomeShield Standard Plan is Income Insurance’s offering for Standard Integrated Shield Plan (Standard IP).

Integrated Shield Plans (IPs) comprise two components – the MediShield Life component and additional private insurance coverage. Those covered under IPs enjoy the combined benefits of (i) MediShield Life, run by the Central Provident Fund (CPF) Board, and (ii) the additional private insurance coverage for Class A/B1 and private hospital stays, run by private insurers. IncomeShield is Income Insurance’s offering for IP.

The Ministry of Health has worked with private insurers who offer IPs, including Income Insurance, to develop Standard IP to offer affordable coverage with similar benefits across all IP insurers for Class B1 wards. MediShield Life provides coverage for Class B2 and C wards only.

Benefits of Standard IP are standardised across all IP insurers. However, there will be variances in the premiums of Standard IPs offered by different IP insurers as each insurer takes into account the company’s estimation of claims and expenses, risk management policies and other relevant factors.

In designing the Standard IP, it was important to balance between providing adequate coverage and ensuring premiums remain affordable. The Standard IP was thus intended to be a “no-frills”, affordable product targeted at large hospital bills and selected costly outpatient treatments.

MediShield Life is able to cover pre-existing conditions because the cost of providing such coverage is shared among those with pre-existing conditions, the community and the government, which bears the bulk of the costs (about 75%). Unlike MediShield Life, private insurers are unable to provide cover for pre-existing conditions. Hence, these pre-existing conditions will be excluded from the additional private insurance coverage portion under your IncomeShield Standard Plan.

If you are a Singapore Citizen and Permanent Resident, you will continue to be covered by MediShield Life even if you are covered under IncomeShield Standard Plan. This means that you will be enjoying the combined benefits of (i) MediShield Life, run by the Central Provident Fund (CPF) Board, and (ii) the additional private insurance coverage by Income Insurance for Class B1 hospital stay.

No, you can only be insured under one Integrated Shield Plan at any point in time. Your current Integrated Shield Plan will be automatically terminated upon commencement of a new Integrated Shield Plan.

Income Insurance will apply its own guidelines on the assessment of risks. If you have any additional information about your health, you may give this to us for a review of our earlier decision.

Deductible is the amount that you will need to pay first before any claim is payable. Co-insurance is the amount that you need to pay after the Deductible is met.

No, IncomeShield Standard Plan is guaranteed renewable for a lifetime. This means that after you have been accepted, any change to your health status does not affect your current insurance coverage.

You can access our health coverage tool here to find out if your treatment is covered under your plan and get helpful information you need to file your claims. All claims submitted are subjected to review in accordance with the terms and conditions of the policies.

You may get in touch with us through your preferred mode of contact at income.com.sg/contact-us or visit any of our branches to find out more If you are upgrading or adding Rider to Enhanced IncomeShield plans (Enhanced Preferred/Advantage/Basic) or IncomeShield Standard Plan.

Note

- You are not able to apply for an upgrade or add a new Rider to Enhanced IncomeShield Enhanced C plan and IncomeShield plans (Plan P/Plan A/Plan B/Plan C) as these plans are withdrawn. You may upgrade to our Enhanced IncomeShield plan (Enhanced Preferred/Advantage/Basic) or IncomeShield Standard Plan and upgrade or add Rider to these plans.

- If the start date of the new Rider is not aligned with the Enhanced IncomeShield/IncomeShield Standard Plan’s policy renewal date, a pro-rated premium will be charged for the new Rider. Upon the renewal of the Enhanced IncomeShield/IncomeShield Standard Plan policy, the Rider renewal dates will be aligned with that of the Enhanced IncomeShield/IncomeShield Standard Plan policy.

You are only able to purchase either Deluxe Care Rider or Classic Care Rider.

All the exclusions under the Enhanced IncomeShield/IncomeShield/IncomeShield Standard Plan will apply to the Riders. Additional exclusions under the Riders will be specified under the Rider contract.

For existing IncomeShield Standard Plan policyholders, you can choose to upgrade your plan to enjoy better benefit by submitting an upgrade request via My Income customer portal or you can speak to your advisor.

You will need to meet the entry requirements (e.g. maximum entry age) of the plan you wish to upgrade to. Any upgrade of plans will require underwriting.

Your existing Riders will continue to be attached to your new plan. However, the Rider premiums under your new plan may be different.

No, upon approval of your upgrade application, we will issue you a new policy contract. The change will take effect on the start date indicated on your policy contract.

No, you will continue to enjoy cover up to the benefit limits of your previous plan for these medical conditions. For your upgraded plan, you will be covered for any other medical conditions that you are not excluded from.

Upon a request to upgrade your plan, the current policy will be terminated and a new set of policy document will be issued to you. Any unused premiums from the terminated policy will be refunded to you through your respective mode of payment.

We are using the same policy number for your new plan as it is essentially a conversion or upgrade of plan. This will make it easier for you to remember your policy number.

If you wish to upgrade to a higher plan after your first upgrade, you can do so after 40 days from the start date of your upgraded plan.

Yes, you can. However, you should note that re-application will be subject to Income Insurance’s underwriting and acceptance.

Each insured person is issued an individual insurance policy. Therefore, each upgrade is processed independently and may result in a time difference when receiving your policy contracts.

If you are a Singapore Citizen or Permanent Resident, even though you have terminated your Enhanced IncomeShield/IncomeShield/IncomeShield Standard Plan, you will continue to be covered under MediShield Life.

We would like to highlight that by terminating your Enhanced IncomeShield/IncomeShield/IncomeShield Standard Plan, you will need to re-apply if you wish to be covered in the future. The acceptance of your new application will be subject to Income Insurance’s underwriting and acceptance. Before you terminate the cover, we hope that you will reconsider your decision as it is important for you to have catastrophic medical insurance coverage to help defray part of the large medical bills in the event of a serious illness or prolonged hospitalisation.

Anyone who pays for, or is insured under IncomeShield Standard Plan is not eligible for Additional Premium Support (APS) from the Government. ^

If you are currently receiving APS to pay for your MediShield Life and/or CareShield Life premiums, and you choose to be insured under IncomeShield Standard Plan, you will stop receiving APS. This applies even if you are not the person paying for IncomeShield Standard Plan. In addition, if you choose to be insured under IncomeShield Standard Plan, the person paying for IncomeShield Standard Plan will stop receiving APS, if he or she is currently receiving APS.

^ APS is for families who need assistance with MediShield Life and/or CareShield Life premiums, even after receiving premium subsidies and making use of MediSave to pay for these premiums.

You may submit your claims via My Income customer portal (me.income.com.sg). For more information on our claim process and other channels to submit your claims, find out more here.

Your re-application for Enhanced IncomeShield/IncomeShield/IncomeShield Standard Plan will be subject to Income Insurance’s underwriting and acceptance. Depending on the underwriting assessment, your application may be:

- Accepted at standard terms

- Accepted with exclusions on any pre-existing medical conditions

- Postpone or Decline

Understand the details

*We offer 20% off (“Welcome Discount”) first-year premium with the purchase of IncomeShield Standard Plan (“Qualifying Policy”) and/or Deluxe Care Rider or Classic Care Rider (each a “Rider”). The Welcome Discount is only applicable if no additional exclusion or premium loading is applied to the Qualifying Policy and applicable Riders upon policy issuance. The Welcome Discount is only applicable to a Rider if the Rider is taken up together with the Qualifying Policy. The Welcome Discount does not apply to the premium for the MediShield Life portion. Welcome Discount terms and conditions apply. Please refer to income.com.sg/integrated-shield-plan/welcome-discount-tnc.pdf for further details.

#Based on a survey by Nielsen IQ between January 2023 and December 2024, with 7,244 health insurance policyholders between 21 and 65 years old, Income Insurance ranked first as a health insurance company that can be trusted in good and bad times.

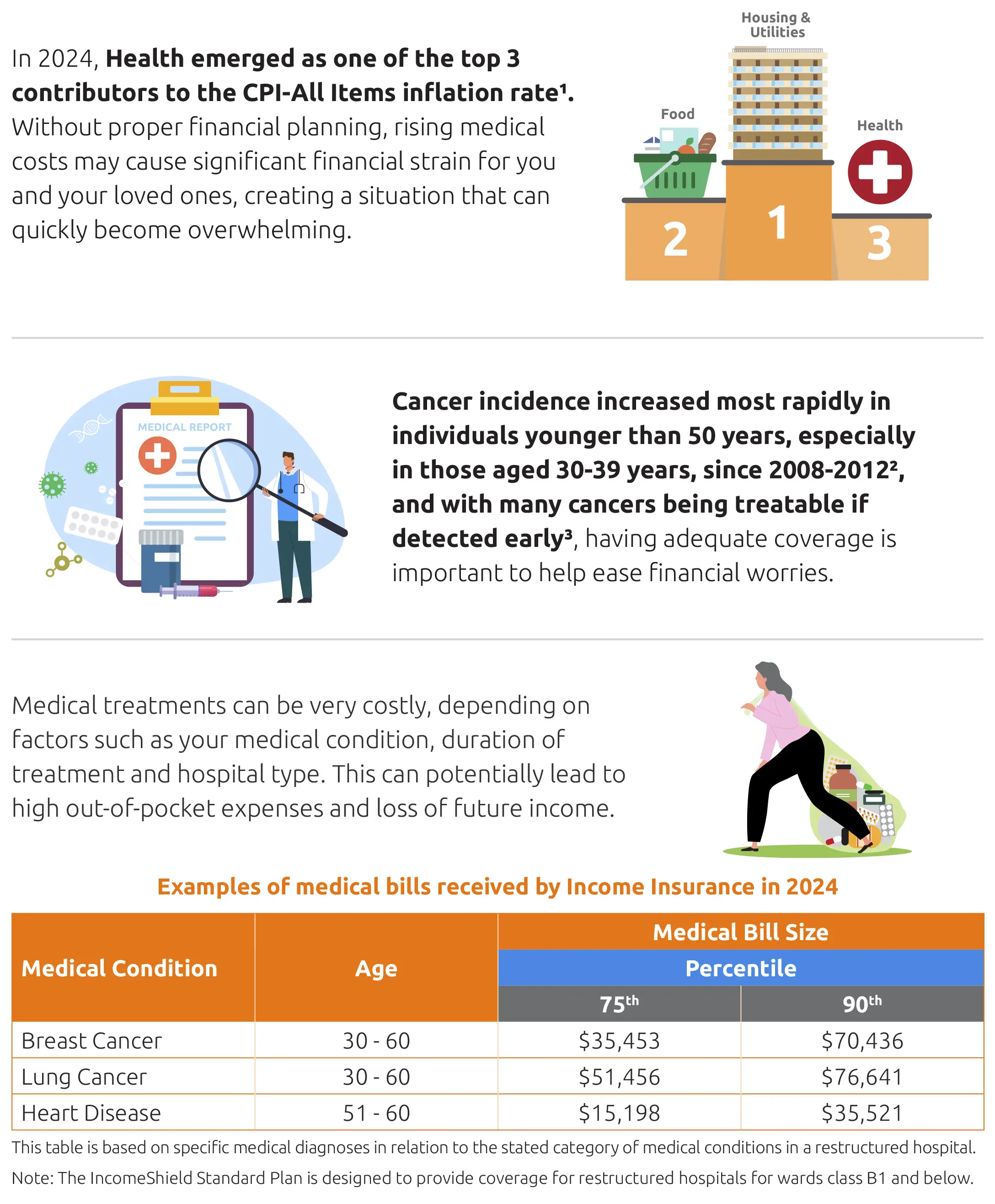

[1]Singapore Department of Statistics, Singapore Consumer Price Index (CPI).

[2]National Registry of Diseases Office, Singapore Cancer Registry Infographic 2022.

[3]National Registry of Diseases Office, Singapore Cancer Registry 50th Anniversary Monograph 1968-2017

[4]Subject to policy year limits and any benefit limits.

[5]This benefit covers the main outpatient hospital treatment received by the insured from a hospital or a licensed medical centre or clinic. For cancer drug treatment, only cancer drug treatments listed on the Cancer Drug List (CDL) and used according to the indications for the cancer drugs, as specified in the CDL on Ministry of Health (MOH) website (go.gov.sg/moh-cancerdruglist) will be covered. For each primary cancer, if the cancer drug treatment on the CDL involves more than one drug, we allow a particular drug to be removed from the treatment or replaced with another drug on the CDL that has the indication ‘for cancer treatment’, only if this is due to intolerance or contraindications (for example, allergic reactions). In such cases, the claim limit of the original cancer drug treatment on the CDL will apply.

For each primary cancer, if more than one cancer drug treatment is administered in a month, the following will apply.

- If any of the cancer drug treatments that are on the CDL has an indication that states ‘monotherapy’, only the treatments on the CDL that have the indication ‘for cancer treatment’ will be covered in that month.

- If none of the cancer drug treatments that are on the CDL has an indication that states ‘monotherapy’:

- if more than one of the cancer drug treatments administered in a month has an indication other than ‘for cancer treatment’, only cancer drug treatments that are on the CDL and have the indication ‘for cancer treatment’ will be covered in that month.

- if one or none of the cancer drug treatments administered in a month has an indication other than ‘for cancer treatment’, all cancer drug treatments that are on the CDL will be covered in that month.

Cancer drug treatments not on the CDL will be considered as having an indication other than ‘for cancer treatment’.

For cancer drug treatment on the CDL, the benefit limit for a plan is a multiple of the MediShield Life (MSHL) Limit for the specific cancer drug treatment. The latest MSHL limits are shown under “MediShield Life Claim Limit per month” in the CDL on MOH’s website (go.gov.sg/moh-cancerdruglist). MOH may update these limits from time to time. The revised list will apply to the cancer drug treatment administered on and after the date the revised list comes into effect.

[6]For cancer drug services, it covers services that are part of any outpatient cancer drug treatment, such as consultations, scans, lab investigations, preparing and administering the cancer drug, supportive-care drugs and blood transfusions. It does not cover services provided before the insured is diagnosed with cancer or after the cancer drug treatment has ended.

The cancer drug services benefit limit is based on a multiple of the MSHL Limit for cancer drug services. For the latest MSHL Limit for cancer drug services, refer to “Cancer Drug Services” under the MSHL benefits on MOH’s website (go.gov.sg/mshlbenefits). MOH may update this from time to time. The revised limit will be applicable to the cancer drug services incurred within the policy year of the revised limit.

[7]The Additional Withdrawal Limit (AWL) is the maximum MediSave limit that you can use for your IncomeShield Standard Plan’s additional private insurance coverage premiums. Please refer to moh.gov.sg/healthcare-schemes-subsidies/medishield-life for the latest AWL

[8]Panel or preferred partner means a registered medical practitioner, specialist, hospital or medical institution approved by us. The list of approved panels and preferred partners, which we may update from time to time, can be found at income.com.sg/specialist-panel. Our list of approved panels also includes all restructured hospitals, community hospitals and voluntary welfare organisations (VWO) dialysis centres.

[9]Extended panel means a registered medical practitioner or specialist approved by us to provide cover for the benefits under this rider. The registered medical practitioner or specialist must not also be on our lists of approved panels or preferred partners and must meet other criteria, including being on another Integrated Shield Plan provider’s panel list. The list of our approved extended panel can be found at income.com.sg/specialist-panel. We may update this list from time to time.

[10]Subject to precise terms, conditions and exclusions specified in the policy conditions for IncomeShield Standard Plan and riders.

[11]For outpatient cancer drug treatments not on the CDL, we cover only treatments with drug classes A to E (according to the Life Insurance Association, Singapore’s (LIA’s) Non-CDL Classification Framework). Refer to lia.org.sg/media/3553/non-cdl-classification-framework.pdf for more details. LIA may update the list from time to time.

[12]The insured child must be aged 18 years or below during the stay in the hospital under the insured child’s policy.

There are certain conditions whereby the benefits under this plan will not be payable. You can refer to your policy conditions for the precise terms, conditions and exclusions of the plan. The policy conditions will be issued when your application is accepted.

IncomeShield Standard Plan is available as a MediSave-approved Integrated Shield Plan for the insured who is a Singapore Citizen or a Singapore Permanent Resident. This applies as long as the insured meets the eligibility conditions under MediShield Life. If the insured is a foreigner who has an eligible valid pass with a foreign identification number (FIN), IncomeShield Standard Plan is not available as an Integrated Shield Plan.

This is for general information only and does not constitute an offer, recommendation, solicitation, or advice to buy or sell any product(s). You can find the usual terms, conditions and exclusions of IncomeShield Standard Plan here, Deluxe Care Rider here and Classic Care Rider here. All our products are developed to benefit our customers but not all may be suitable for your specific needs. If you are unsure if this plan is suitable for you, we strongly encourage you to speak to a qualified insurance advisor. Otherwise, you may end up buying a plan that does not meet your expectations or needs. As a result, you may not be able to afford the premiums or get the insurance protection you want. If you find that this plan is not suitable after purchasing it, you may terminate it within the free-look period and obtain a refund of the premiums paid.

This policy is protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact Income Insurance or visit the GIA/LIA or SDIC websites (www.gia.org.sg or www.lia.org.sg or www.sdic.org.sg).

Protected by copyright and owned by Income Insurance Limited.

Information is correct as at 28 January 2026

Learn more about health insurance.

Whether it’s for you or your loved ones, know your elderly care options so you can make informed decisions when the time comes.