Grab these deals

Get up to 9,800,000 STAR$® when you purchase an eligible Legacy Flex Solitaire plan! 🛡️

Find Out MoreHere’s what Legacy Flex Solitaire offers.

High protection coverage[1] from $500,000, with up to 83 times[2] the annual premiums, while offering the potential for wealth accumulation. Plus, benefit from continuous protection[3] for the first 15 years of the policy to keep your legacy secure.

Receive up to 0.5% annual loyalty bonus[4] starting from the end of the minimum investment period (MIP)[5].

Starting from the 5th policy anniversary, you can withdraw up to 5% of your prevailing policy value (excluding the top-up account) once a year, and your sum assured will remain unchanged, providing financial access without compromising your protection.

Flexibility to increase the policy’s sum assured without a health reassessment when any specified life events[7] occur.

Ensure your legacy lives on with the flexibility to choose whether the death benefit[1] is paid as a lump sum or in yearly instalments[8] over a period of 5 to 10 years.

Here are other benefits you can get.

Invest in an extensive range of funds that are continuously being monitored by a team of experienced investment professionals.

Tailor your investment to suit your lifestyle and preferences with the option to top up[9] your investment. You also have the flexibility to switch[10] your investments between available funds anytime at no charge[10].

Grow further with flexibility. Enjoy the option to continue paying premiums beyond the MIP[11] and maximise your investment potential.

Choose to reduce your policy’s sum assured to as low as zero and start receiving potential dividend payouts[12] after 20 years of investment or when the original insured turns 65, whichever is later with Retirement Option[13].

Continuity of wealth accumulation with a secondary insured[14].

If you are aged 75 (last birthday) and below, you can apply for high protection coverage[1] while maximising your investment. Choose to pay a single premium[15] or regular premiums with a MIP[5] of 5 or 10 years for added flexibility.

Need more protection?

Enhance your coverage with a rider

(Only applicable if the insured is not the policyholder) You will not need to make future premium payments for the basic policy that you have bought for a loved one, if you pass away, or are totally and permanently disabled (TPD before age 70) during the term of the rider. Applicable only to regular premium policies.

(Only applicable if the insured is not the policyholder) You will not need to make future premium payments for the basic policy that you have bought for a loved one, if you pass away, are totally or permanently disabled (before age 70), or are diagnosed with dread disease[16] (except for angioplasty and other invasive treatment for coronary artery) during the term of the rider. Applicable only to regular premium policies.

You will not need to make future premium payments for your basic policy if you are diagnosed with dread disease[16] (except for angioplasty and other invasive treatment for coronary artery) during the term of the rider. Applicable only to regular premium policies.

Let us walk you through Legacy Flex Solitaire.

Mr Tan, age 50, non-smoker, owns an e-commerce business worth $2 million and $1.5 million in cash. He has two children. His daughter, Zoey, is helping with his business, while his son, Charlie is a doctor and has no interest in running the family business.

Without Legacy Flex Solitaire

As his two children have different interests in his business, it may be difficult for Mr Tan to distribute his main asset, which is his business.

Mr Tan, age 50

- He has an e-commerce business worth $2 million and $1.5 million in cash.

- Difficulty in ensuring asset equalisation among two children who have different interests in his business.

With Legacy Flex Solitaire

To preserve his legacy and ensure asset equalisation among his two children, Mr Tan signs up for Legacy Flex Solitaire with $2 million sum assured and opts to pay a single premium1 of $277,778. He exercises the Bequest Option2 and chooses to have the death benefit3 paid in yearly instalments across 10 years to his nominated beneficiary, Charlie, and leaves his business to his daughter, Zoey.

Mr Tan's total assets:

E-commerce business worth $2 million + $1.5 million in cash

Single Premium Paid: $277,778

After settling the single premium, Mr Tan can keep the remaining $1.2 million as additional funds for retirement.

Upon Mr Tan's passing at age 80:

Zoey:

She inherits the e-commerce business worth $2 million.

With Legacy Flex Solitaire, Mr Tan's total assets grow from $3.5 million to $5.3 million4.

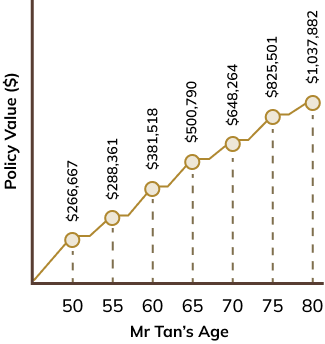

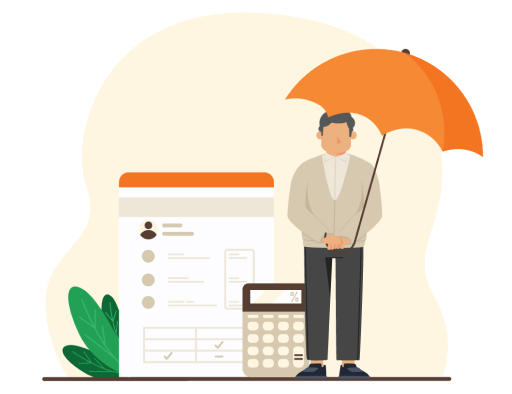

Mr Tan has the flexibility to withdraw5 up to 5% of the prevailing policy value (excluding the top-up account) starting from the 5th policy year, without reducing his sum assured.

Policy fees and charges apply. Please refer to the policy conditions for further details. Diagram is not drawn to scale. The figures used are non-guaranteed, illustrated at an investment return of 8% p.a., rounded to the nearest dollar, and based on the assumption that no withdrawals are made during the policy term.

Should the illustrated investment rate of return be 4.00% p.a. and based on the assumption that no withdrawals were made during the policy term, the illustrated policy value would be $266,6676 at age 50, $233,7186 at age 55, $251,2256 at age 60, $260,6606 at age 65, $249,7146 at age 70, $196,1796 at age 75 and $61,7266 at age 80. Should Mr Tan pass away3 at age 80, the policy pays $210,2006 each year for 10 years2, and the total payout would be $2.1 million6, which is 7.56x6 of the single premium paid. Mr Tan's total assets would grow to $5.3 million6. Both rates of return used (4% p.a. and 8% p.a.) do not represent the upper or lower limits of the investment performance. The policy will end once the policy value is insufficient to pay for the applicable fees and charges.

Important Notes

1 The minimum investment period (MIP) will be fixed at 5 years and cannot be changed.

2 The policyholder may opt for the death benefit to be paid in yearly instalments over a period of 5 to 10 years. This option may only be selected at the point of application for this policy. The benefit payout period cannot be changed.

If this option is selected, the following will apply when the death benefit is payable under this policy:

- the death benefit will be paid on a yearly basis over the benefit payout period chosen by the policyholder;

- the first instalment and any outstanding instalment due will be paid on the date we approve the claim;

- the subsequent future instalments will be paid on a yearly basis on each subsequent anniversary of the date of death of the insured, until the death benefit has been fully paid; and

- each instalment payout is calculated using the death benefit multiplied by the applicable factor as shown in the policy conditions.

Terms apply for the benefit. Please refer to the policy conditions for further details.

3 During the term of this policy, if the insured becomes terminally ill or dies, we will pay the adjusted sum assured at the claim event date or the policy value at the time we are told about the claim; whichever is higher. We will take off any fees and charges which apply to the policyholder's policy. If the policyholder makes any transactions (including top-ups and withdrawals) after the claim event date, we reserve the right to adjust the amount payable for the claim accordingly. The policy will end when we make this payment. We will not pay any further benefits. If the policyholder has appointed a secondary insured before the insured dies, we will not pay this benefit. Upon the death of the insured, the secondary insured becomes the insured and this policy will continue.

4 This figure is based on an illustrated investment return of 8.00% per annum. The rate of return used is before deducting the annual management fees of the funds. The figures above assume that the annual management fee is 1.50% p.a. The performance of the funds is not guaranteed, and the policy value may be less than the capital invested.

5 From the 5th anniversary, the policyholder may choose to exercise withdrawals of up to 5% of the prevailing policy value (excluding the top-up account) without any withdrawal charge. Any withdrawals made under this option will reduce the policy value accordingly and the sum assured will remain unchanged. This option may only be exercised once per policy year. Withdrawals under this option will continue to be subject to the applicable withdrawal limits set out in the policy conditions.

6 This figure is based on an illustrated investment return of 4.00% per annum. The rate of return used is before deducting the annual management fees of the funds. The figures above assume that the annual management fee is 1.50% p.a. The performance of the funds is not guaranteed, and the policy value may be less than the capital invested.

© 2026 Income Insurance. All rights reserved.

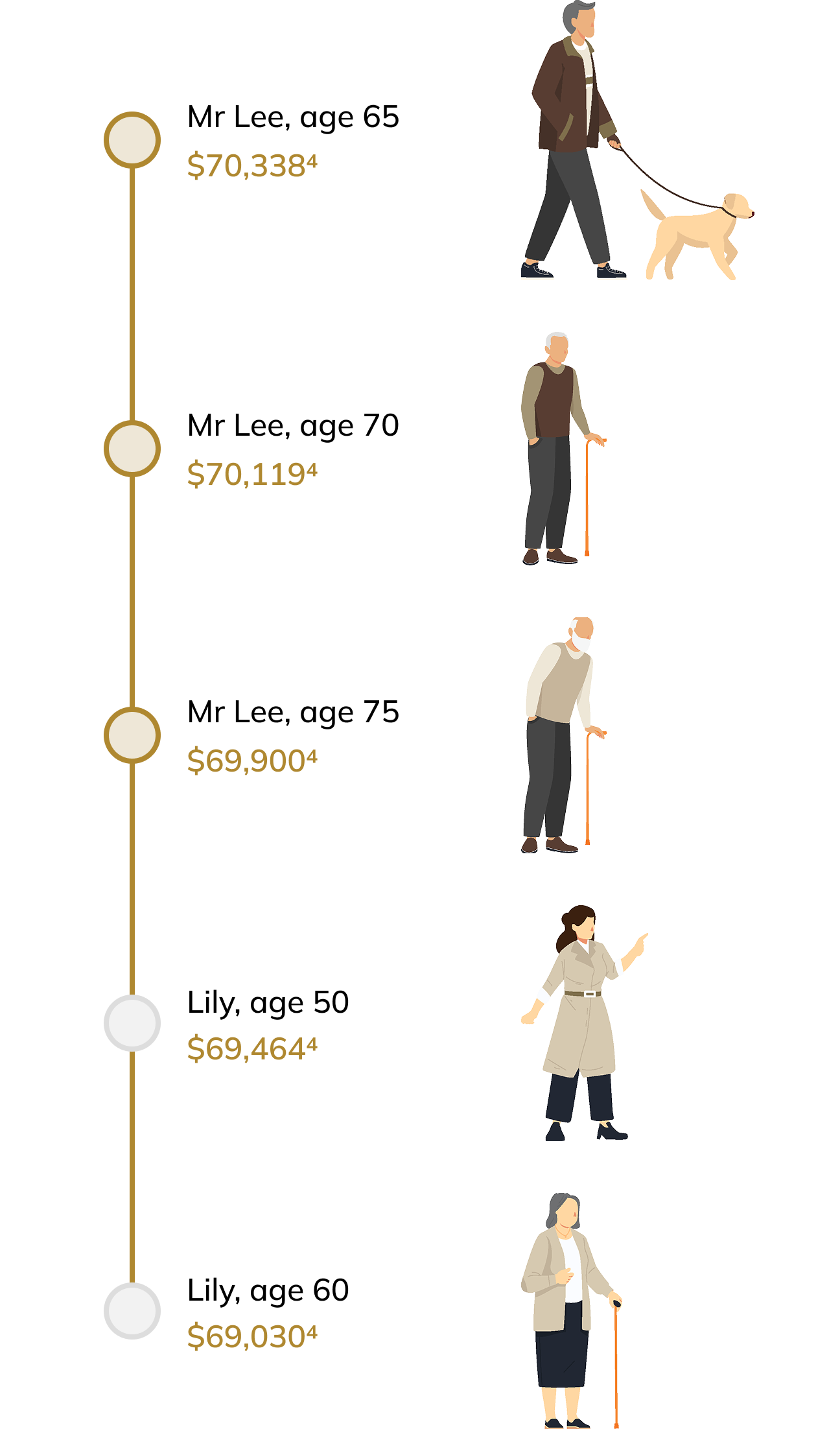

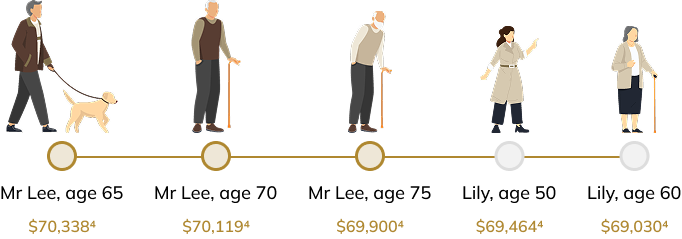

Mr Lee, age 40, non-smoker, wants to grow his wealth and retire confidently at age 65 while protecting his family's financial future. He signs up for Legacy Flex Solitaire with a sum assured of $1 million, selects a 5-year minimum investment period (MIP)1, and opts to pay annual regular premiums of $20,161. He appoints his daughter, Lily (age 5) as the secondary insured2.

Age 42

Mr Lee purchases a new home and has the option to increase his existing coverage3 without a health reassessment, but chooses not to.

Age 65

Mr Lee retires and stops paying his annual premium.

Illustrated policy value: $1,075,6264

He exercises the Retirement Option7 to reduce his policy's sum assured to $0, selects a dividend-paying fund8 with an illustrated potential dividend payout of 6.5%^ p.a., and chooses to receive the dividend payouts as his potential monthly retirement income.

Mr Lee has indicated in his will for Lily to be assigned ownership of the policy upon his passing.

Age 80

Mr Lee passed away at age 80, and the policy continues with Lily, age 45, as the insured.

She continues to receive potential dividend payouts8.

(If Mr Lee is still alive at age 80, the illustrated policy value is $1,065,5754. The total potential dividends paid from age 65 to 80 would be $1,050,4694.)

Potential dividend payouts received each year, at the respective ages, from the dividend-paying fund8 selected.

Total potential dividend (from Mr Lee age 65 to Lily age 65): $2,435,8424

Policy fees and charges apply. Please refer to the policy conditions for further details.

^Non-guaranteed, subject to declaration by the sub-funds and for illustration purposes.

Diagram is not drawn to scale. The figures used are non-guaranteed, illustrated at an investment return of 8% p.a. and rounded to the nearest dollar.

Should the illustrated investment rate of return be 4.00% p.a., the illustrated policy value would be $72,06410 when Mr Lee is at age 45, $304,40510 at age of 55 after a partial withdrawal6 of $16,02110, and $619,11410 at age 65. Should Lily pass away at age 65, her family would receive the death benefit9 of $389,28710. If the potential dividend payout is 4%^ p.a., each year Mr Lee would receive $24,69310 at age 65, $23,10910 at age 70, and $21,62710 at age 75, while Lily would receive $18,94210 at age 50 and $16,59010 at age 60. The total potential dividends paid from Mr Lee age 65 to Lily age 65 would be $696,07310. If Mr Lee is still alive at age 80, the illustrated policy value would be $507,47410, and the total potential dividends paid from age 65 to 80 would be $338,12410. Both rates of return used (4% p.a. and 8% p.a.) do not represent the upper and lower limits of the investment performance. The policy will end once the policy value is insufficient to pay for the applicable fees and charges.

Important Notes

1 Minimum investment period (MIP) refers to the period the policyholder has chosen during which certain charges may apply. The MIP cannot be changed.

2 The secondary insured must be yourself (before the age of 75 years old), your spouse (before the age of 75 years old), or your child or ward (before the age of 18 years old) at the time of exercising this option. The policyholder can exercise this option to appoint a secondary insured no more than three times during the policy term. Terms apply for the benefit. Please refer to the policy conditions for further details.

3 Each time the original insured experiences a life event, the policyholder may choose to increase the sum assured without us having to assess the original insured's health, subject to the policy's terms and conditions. We will limit the increase in sum assured to 50% of the sum assured when this policy was issued, or S$500,000, whichever is lower.

If the original insured is covered for any benefits in policies issued by us that offer a guaranteed insurability option to buy another life policy, guaranteed insurability option to increase the sum assured of the policy or other similar guaranteed insurability option benefit, the aggregate of the insured amounts under such guaranteed insurability option benefit cannot exceed S$500,000 for the original insured.

Please refer to the policy conditions for further details on the life events and the applicable terms and conditions.

4 This figure is based on an illustrated investment return of 8.00% per annum. The rate of return used is before deducting the annual management fees of the funds. The figures above assume that the annual management fee is 1.50% p.a. The performance of the funds is not guaranteed, and the policy value may be less than the capital invested.

5 We will provide an annual loyalty bonus starting from the end of the MIP shown in the policy conditions. The loyalty bonus will be provided on the next working day from the end of the MIP. The loyalty bonus is a percentage of the policy value of the premium account based on the policy anniversary. It will be used to invest in the funds the policyholder has chosen.

The policyholder's policy must meet all the following conditions to receive the loyalty bonus:- this policy must not have ended when the loyalty bonus is provided; and

- the policyholder did not make any partial withdrawals, (except for any withdrawals made under Withdrawal Access Option or from the top-up account) for the past 12 months before the date of the loyalty bonus payment.

The loyalty bonus will commence from the end of the MIP, irrespective of any premium holiday that may have been taken. Please refer to the policy conditions for further details.

6 From the 5th anniversary, the policyholder may choose to exercise withdrawals of up to 5% of the prevailing policy value (excluding the top-up account) without any withdrawal charge. Any withdrawals made under this option will reduce the policy value accordingly and the sum assured will remain unchanged. This option may only be exercised once per policy year. Withdrawals under this option will continue to be subject to the applicable withdrawal limits set out in the policy conditions.

7 The policyholder may choose to exercise this Retirement Option starting from the later of:

- 20 years from policy entry date; or

- the date the original insured turns 65 years old, or where a secondary insured becomes the insured under this policy, the date the original insured would have turned 65 years old.

When the policyholder exercises this Retirement Option, the policyholder may choose any or both of the following.

- Reduce the sum assured of the policy to as low as zero. Any reduction must be made in multiples of an amount as determined by us from time to time.

- Receive distribution payouts in accordance with the policy conditions.

Please refer to the policy conditions for further details.

8 Dividend refers to the distribution for certain funds which have a distribution option that we may declare. The policyholder will be entitled to receive these distributions if the policy has not ended and has units in these funds on the declaration date of the distribution. The distribution amount will depend on the number of units the policyholder holds in these funds on the date we declare the distribution. The frequency and/or amount of distributions (if at all) may be varied at our absolute discretion. Distributions are not guaranteed. We may or may not pay a distribution every year. If the distribution amount for a fund meets the minimum amount we tell the policyholder, the policyholder can choose to receive all future distributions from that funds as payouts.

Distributions may be made out of the income and/or capital of the sub-fund. Any payout of distributions from the capital of the sub-fund may result in an immediate reduction of the net asset value per share/unit. Please refer to the policy conditions for further details on the declaration of distributions, reinvesting distributions, distribution via exercising of Retirement Option, and the applicable terms and conditions.

9 During the term of this policy, if the insured becomes terminally ill or dies, we will pay the adjusted sum assured at the claim event date or the policy value at the time we are told about the claim; whichever is higher. We will take off any fees and charges which apply to the policyholder's policy. If the policyholder makes any transactions (including top-ups and withdrawals) after the claim event date, we reserve the right to adjust the amount payable for the claim accordingly. The policy will end when we make this payment. We will not pay any further benefits. If the policyholder has appointed a secondary insured before the insured dies, we will not pay this benefit. Upon the death of the insured, the secondary insured becomes the insured and this policy will continue.

10 The figure is based on an illustrated investment return of 4.00% per annum. The rate of return used is before deducting the annual management fees of the funds. The figures above assume that the annual management fee is 1.50% p.a. The performance of the funds is not guaranteed, and the policy value may be less than the capital invested.

© 2026 Income Insurance. All rights reserved.

Your policy toolkit

Eligibility and payment frequency

Entry Age (Age Last Birthday)

| Minimum | Maximum | |

| Insured | 0 | 75 |

| Policyholder | 18 | N.A. |

For single premium policy, the minimum single premium amount is $6,000. The minimum amount required may be higher depending on the insured's profile and sum assured selected.

For regular premium policy, you can make your payments monthly, quarterly, half-yearly, or yearly.

Brochures

Policy conditions

Your queries answered.

Legacy Flex Solitaire is a whole life investment-linked plan^ that provides protection and investment opportunities. You can choose either single premium or regular premium for this plan. The plan provides coverage against terminal illness and death, and provides additional flexibility with the withdrawal access option, secondary insured option, retirement option, bequest option and future premium option. The future premium option is only applicable for regular premium policy.

^An investment-linked plan has both a life insurance and an investment component. Your premiums are used to pay for units in one or more investment funds of your choice. The value of these units depends on their price, which in turn depends on the investment fund’s performance.

During the term of this policy, if the insured dies, we will pay:

- the adjusted sum assured1 at the claim event date; or

- the policy value at the time we are told about the claim;

whichever is higher.

We will take off any fees and charges which apply to your policy.

If you make any transactions (including top-ups and withdrawals) after the claim event date, we reserve the right to adjust the amount payable for the claim accordingly.

The policy will end when we make this payment.

If you have appointed a secondary insured before the insured dies, we will not pay this benefit. Upon the death of the insured, the secondary insured becomes the insured and this policy will continue.

1Adjusted sum assured means the sum assured plus the total top-ups made, less total withdrawals made under the policy (except withdrawals made under withdrawal access option).

If the insured commits suicide within one year from the cover start date, we will pay the policy value less any bonus at the time we are told about the claim and this policy will end.

During the term of this policy, if the insured becomes terminally ill, we will pay:

- the adjusted sum assured1 at the claim event date; or

- the policy value at the time we are told about the claim;

whichever is higher.

We will take off any fees and charges which apply to your policy.

If you make any transactions (including top-ups and withdrawals) after the claim event date, we reserve the right to adjust the amount payable for the claim accordingly.

The policy will end when we make this payment.

1Adjusted sum assured means the sum assured plus the total top-ups made, less total withdrawals made under the policy (except withdrawals made under withdrawal access option).

Terminal illness, and terminally ill, means “any condition caused by illness or injury, where at the time of claim, despite all reasonable medical treatment, the insured is expected to live for no more than 12 months.”

The specialist medical practitioner treating the condition must provide supporting evidence of the condition, possible medical treatment, the prognosis after undergoing the possible medical treatment, and certify that the insured is expected to live for no more than 12 months despite all possible medical intervention. We reserve the right to appoint an independent medical specialist who is an expert in the condition to confirm the diagnosis and prognosis.

Terminal Illness in the presence of HIV infection is excluded.

We will not pay this benefit if your claim arises from:

- deliberate acts such as self-inflicted injuries, illnesses or attempted suicide;

- unlawful acts, provoked assault, or deliberate exposure to danger; or

- the effects of alcohol, drugs or any dependence.

During the first 15 years from the policy entry date of this policy, if the policy value is not enough to cover the fees and charges due on your policy, we will apply the NLG benefit and we will not end the policy. In other words, the policy will continue during this period.

When we apply the NLG benefit, you will still need to pay the fees and charges due on your policy and your unit deducting rider, if any. We will take these fees and charges from any policy value or claim proceeds that you may be receiving under your policy.

For single premium policy, the NLG benefit will no longer apply if you have made a withdrawal (except for any withdrawals made under the withdrawal access option or from the top-up account).

For regular premium policy, the NLG benefit will no longer apply if:

- a premium holiday charge has been applied to the policy during the minimum investment period; or

- you have made a withdrawal (except for any withdrawals made under the withdrawal access option or from the top-up account).

Once we end the NLG benefit, we will not reinstate it.

From the 5th anniversary, you may choose to exercise withdrawals of up to 5% of the prevailing policy value (excluding the top-up account) without any withdrawal charge. Any withdrawals made under this option will reduce the policy value accordingly and the sum assured will remain unchanged.

This option may only be exercised once per policy year.

Withdrawals under this option will continue to be subject to the applicable withdrawal limits set out in the policy.

You may appoint or remove a secondary insured before the death of the insured provided the following conditions are met:

- the premium of this policy is paid only with cash;

- no nomination of beneficiary has been made for this policy; and

- there is no change to the ownership of this policy except via absolute assignment.

The secondary insured becomes the insured of the policy only upon death of the insured. This policy can only have one insured at any point of time.

The secondary insured must be yourself (before the age of 75 years old), your spouse (before the age of 75 years old), or your child or ward (before the age of 18 years old) at the time of exercising this option.

You can exercise this option to appoint a secondary insured no more than three times during the policy term.

The future premium option is only applicable to regular premium policies.

If you pay more regular premiums than are needed, we will treat them (without any interest) as future premiums paid in advance for future months for this policy and any rider(s). We will use only future premiums paid in advance for the policy to buy units in the funds you have chosen. For the avoidance of doubt, regular premiums paid in advance for any rider(s) will not be used to buy units under this policy.

We will not accept any future premiums that are:

- paid more than 24 months ahead of its due date; or

- not equal to, or not a whole multiple of, your regular premium amount based on your selected premium frequency. This means that we will not accept amounts paid in advance that are partial payment of your regular premium amount.

We may change the way we treat these premiums by giving you notice.

MIP refers to the period you have chosen during which certain charges may apply.

You may choose to increase the sum assured without us having to assess the original insured’s health if the original insured experiences any of the following life events:

- turning 21;

- marriage;

- divorce;

- becoming a parent;

- death of spouse; or

- purchase of a residential property.

We will limit the increase in sum assured to 50% of the sum assured when this policy was issued, or S$500,000, whichever is lower.

If the original insured is covered for any benefits in policies issued by us that offer a guaranteed insurability option to buy another life policy, guaranteed insurability option to increase the sum assured of the policy or other similar guaranteed insurability option benefit, the aggregate of the insured amounts under such guaranteed insurability option benefit cannot exceed S$500,000 for the original insured.

The original insured must meet all of the following conditions for you to take up this option.

- You must take up this option within three months after the date of the original insured’s life event.

- The original insured must not be totally and permanently disabled, or be diagnosed with an advanced stage dread disease at the time of taking up this option.

- The original insured must be 50 years old or under at the time of taking up this option.

- The life event must have taken place no earlier than 12 months after the cover start date of this policy.

At our request, the original insured must provide to our satisfaction, documentary proof of a life event.

You can take up this option no more than two times. Each time you take up this option, it must be on a different life event of the original insured.

When you take up this option to increase the sum assured, we may require you to pay an additional single top-up of an amount we determine. The single top-up will be placed into the top-up account and used to buy into the funds you have chosen.

When you exercise the retirement option, you may choose any or both of the following.

- Reduce the sum assured of the policy to as low as zero. Any reduction must be made in multiples of an amount as determined by us from time to time.

- Receive distribution payouts in accordance with the policy conditions.

After you choose the retirement option to reduce the sum assured, the insurance cover charge for this policy will be based on the new sum assured, from the next date when the insurance cover charge is due.

You may choose to exercise this retirement option starting from the later of:

- 20 years from policy entry date; or

- the date the original insured turns 65 years old, or where a secondary insured becomes the insured under this policy, the date the original insured would have turned 65 years old.

You may opt for the death benefit to be paid in yearly instalments over a period of 5 to 10 years. This option may only be selected at the point of application for this policy.

If this option is selected, the following will apply when the death benefit is payable under this policy:

- the death benefit will be paid on a yearly basis over the benefit payout period chosen by you;

- the first instalment and any outstanding instalment due will be paid on the date we approve the claim;

- the subsequent future instalments will be paid on a yearly basis on each subsequent anniversary of the date of death of the insured, until the death benefit has been fully paid; and

- each instalment payout is calculated using the death benefit multiplied by the applicable factor as shown in the table below.

| Benefit Payout Period | Applicable Factor |

| 5 years | 0.2046 |

| 6 years | 0.1715 |

| 7 years | 0.1478 |

| 8 years | 0.1301 |

| 9 years | 0.1163 |

| 10 years | 0.1051 |

How we apply the applicable factor and calculate instalment payouts (Figures are for illustration purposes only.) Example (assuming no top-up or withdrawal made) Sum Assured is S$1,000,000 Benefit Payout Period: 10 years Applicable Factor: 0.1051 Each instalment payout payable: S$105,100 (calculated as S$1,000,000 x Applicable Factor of 0.1051) and rounded to the nearest dollar. |

Where you are the insured under this policy and choose to make a nomination under your policy in accordance with applicable law, the following will apply.

- If at the time of your death, any nominated beneficiary is not a natural person, the bequest option will be cancelled by us.

- If, after your death, your nominated beneficiary passes away before all the instalments of the death benefit have been paid, all unpaid instalments will be immediately aggregated and become payable in one sum to each of the deceased beneficiary’s estate and the surviving beneficiaries (if any), in their respective shares in accordance with applicable law.

If you are the insured under this policy and have not made a policy nomination before your death, the bequest option will be cancelled by us.

Where you and the insured are not the same person the following will apply.

- If you die before all the instalments of the death benefit have been paid, all unpaid instalments will be immediately aggregated and paid in one sum to your estate, subject to applicable law.

- If you die before the insured, the bequest option will be cancelled by us.

You may submit a request to cancel the bequest option before the death of the insured. If you cancel the bequest option, the bequest option cannot be exercised again in the future. When the bequest option is cancelled, the death benefit will be paid in accordance with the terms of this policy. You cannot cancel the bequest option after the death of the insured.

This bequest option does not apply if you are not a natural person.

The benefit payout period cannot be changed.

For avoidance of doubt:

- you are not allowed to select the bequest option after the policy entry date; and

- if the bequest option is selected, it will continue to apply if the policy is assigned to a natural person.

We will provide an annual loyalty bonus starting from the end of the minimum investment period shown in the table below. The loyalty bonus will be provided on the next working day from the end of the minimum investment period.

The loyalty bonus is a percentage of the policy value of the premium account based on the policy anniversary. It will be used to invest in the funds you have chosen.

| Policy Type | Minimum Investment Period (MIP) | Loyalty Bonus from the end of MIP |

| Single Premium | 5 years | 0.25% |

| Regular Premium | 5 years | 0.25% |

| Regular Premium | 10 years | 0.50% |

Your policy must meet all the following conditions to receive the loyalty bonus:

- this policy must not have ended when the loyalty bonus is provided; and

- you did not make any partial withdrawals, (except for any withdrawals made under withdrawal access option or from the top-up account) for the past 12 months before the date of the loyalty bonus payment.

The loyalty bonus will commence from the end of the minimum investment period, irrespective of any premium holiday that may have been taken.

Yes, your policy has a cash-in or surrender value.

The value will be the amount available when your units are multiplied by the bid price, less any fees and charges we may take.

The cut-off time used to determine the pricing of units is 3.00 pm (Singapore time) on each business day (Monday to Friday, excluding weekends and public holidays). If it is not a business day (for example, it is a Saturday, Sunday or public holiday), we will deal with your instructions on the following business day.

Buying a life insurance policy is a long-term commitment and an early termination of the policy usually involves high costs and the surrender value, if applicable, may be less than the total premiums paid.

No, you can only use cash to buy this plan.

| Payment Frequency | Minimum single premium |

| Single Premium | $6,000 |

The minimum amount required may be higher depending on the insured’s profile and sum assured selected.

In addition to the minimum single premium requirements above, the premium amount used to buy units in the fund you have chosen must not be lower than the amount as set out below:

| Payment Frequency | Minimum premium amount |

| Single Premium | $2,500 |

| Payment Frequency | Minimum regular premium |

| Yearly | $6,000 |

| Half-Yearly | $3,000 |

| Quarterly | $1,500 |

| Monthly | $500 |

The minimum amount required may be higher depending on the insured’s profile and sum assured selected.

In addition to the minimum regular premium requirements above, for each regular premium payment, the premium amount that is used to buy units in the fund you have chosen must not be lower than the amount as set out below:

| Payment Frequency | Minimum premium amount |

| Yearly | $600 per year |

| Half-yearly | $300 per half-year |

| Quarterly | $150 per quarter |

| Monthly | $50 per month |

You can add premium payments called ‘top-ups’ at any time. Top-ups will be placed into the top-up account and used to buy into the funds you have chosen.

We may set a minimum amount for each top-up.

We will use 100% of your top-ups less any premium charge to buy units (at the bid price) in the funds you choose.

Top-ups do not form part of your premiums and will not increase the sum assured of the policy.

You cannot make any top-ups when your policy is on premium holiday.

You may reduce the sum assured for your policy only from the 5th anniversary. If we agree to the reduction in sum assured, we will make this change at the next insurance cover charge’s deduction date.

You may reduce your sum assured as long as it is not less than the minimum sum assured of S$500,000. This requirement will be waived if the retirement option has been exercised to reduce the sum assured.

The insurance cover charge will decrease correspondingly.

You cannot change your sum assured when your policy is on premium holiday.

No, you cannot backdate your policy.

Forward pricing means that the prices of your transacted funds will only be computed after the close of each dealing day.

The prices will be updated on our website here after 2 working days from the close of each dealing day.

For cash policies, all transactions and premiums received by us by 3.00 pm (Singapore time) each day will be executed based on the unit prices of the same business day.

For transactions submitted on a non-business day (i.e. Saturday, Sunday or public holiday), the execution will be based on the prices valued for the following business day.

The bid price will be used to work out the policy value.

Our fund prices are updated daily on our website here.

Premium holiday is only applicable to regular premium policies.

Premium holiday is a feature that allows you to stop paying your regular premium for a certain period of time for as long as the policy value is able to cover the fees and charges that continue to be due on the policy. Fees and charges are still applicable when your policy is on premium holiday.

This policy will enter into a premium holiday if:

- you still have not paid the premium after the grace period; or

- you have applied for the policy to go on premium holiday,

provided the policy value is able to cover the fees and charges that continue to be due on your policy.

The premium holiday charge may be payable during the premium holiday if it is within the minimum investment period. The premium paying rider(s), if any, will end if this policy is on premium holiday.

We will take this premium holiday charge from the policy value of your policy by cancelling units at the bid price. We will take this premium holiday charge from the premium account. If there are insufficient funds in the premium account to fully pay the premium holiday charge, we will take the remaining amount from the top-up account by cancelling units at the bid price.

You cannot make any top-ups during the premium holiday.

Any premium holiday will end once you start paying your regular premiums again. We may not accept regular premiums for the period of any premium holiday that you have taken.

Yes, your insurance coverage will continue to be provided during premium holiday.

Yes, you can make partial withdrawal from your funds via My Income customer portal subject to the following terms:

- The minimum partial withdrawal amount is $500 each time; and

- You need to hold a minimum policy value of $1,000 in aggregate (across all funds) under the policy.

During the minimum investment period, we will apply a partial withdrawal charge for each partial withdrawal of the units in your fund(s) you make. There is no limit to the amount of partial withdrawals you may make.

If the policy value of the units for a partial withdrawal after deducting the partial withdrawal charge falls below the required minimum policy value, your withdrawal request will not be accepted and you will not receive any payout.

Upon cancellation during free look, we will refund you:

- The premiums you have paid; or

- The value of your policy units (excluding bonus units) based on the applicable bid price on the date we receive your cancellation request, plus any applicable fees and charges deducted from the policy,

whichever is lower, less any medical fees and other expenses such as payments for medical check-ups and medical reports incurred by us.

The maximum amount payable to you under this policy (including any refunds and distributions) in the event of such cancellation is the total amount of premiums paid (without interest).

The policy will end when we make this refund.

The annual management fee is not the same for all ILP funds. We work this out as a percentage of the value of your chosen funds. The fee for each fund can be found in the Semi-Annual Fund Report and the Annual Fund Report.

You must pay a policy fee based on the sum assured at policy entry date and the original insured’s entry age. The policy fee payable is calculated using the sum assured at policy entry date multiplied by the applicable rate as shown in the table below. You must pay this fee monthly.

| Original insured’s entry age | Applicable rate |

| 0 – 20 | 0.16% |

| 21 – 25 | 0.20% |

| 26 – 30 | 0.24% |

| 31 – 35 | 0.32% |

| 36 – 40 | 0.40% |

| 41 – 45 | 0.53% |

| 46 – 50 | 0.66% |

| 51 – 55 | 0.85% |

| 56 – 60 | 0.92% |

| 61 – 65 | 1.07% |

| 66 – 70 | 1.22% |

| 71 – 75 | 2.00% |

The policy fee applies for the first four policy years of your policy and we will take this policy fee from the policy value of your policy by cancelling units at the bid price. You must pay this fee monthly. For avoidance of doubt, this policy fee will not be changed even if there is a reduction in the sum assured. We will take this policy fee from the premium account by cancelling units at the bid price. If there are insufficient funds in the premium account to fully pay the policy fee, we will take the remaining from the top-up account by cancelling units at the bid price.

You must pay a monthly insurance cover charge. We will work out this charge based on the insured’s age, sex, whether they smoke and sum at risk* at the time this charge is due. We will use details of the insured’s sex and whether they smoke at the time of application unless you tell us differently. We will take this insurance cover charge from the policy value of your policy by cancelling units at the bid price. We will take this insurance cover charge from the premium account. If there are insufficient funds in the premium account to fully pay the insurance cover charge, we will take the remaining amount from the top-up account by cancelling units at the bid price.

However, if the sum at risk* is zero or less (negative value), we will not apply the insurance cover charge for that month.

*Sum at risk means the difference between the adjusted sum assured and the policy value.

You must pay a premium charge based on a percentage of your premium(s).

We will also deduct a premium charge of 3% for each top-up.

During the minimum investment period, we will deduct a surrender charge from the policy value if you surrender the policy in full.

If you surrender the policy after 12 months from the policy entry date, the surrender charge will not apply to units from your top-up account.

If your policy cash-in value after surrender charge is zero or less, we will not pay any benefit and your policy will end.

During the minimum investment period, we will apply a partial withdrawal charge for each partial withdrawal of the units in your fund(s) you make. The partial withdrawal charge will be taken from the account the partial withdrawal is made. We will deduct the partial withdrawal charge before we pay the partial withdrawal amount.

The partial withdrawal charge is not applicable for the amount withdrawn under the withdrawal access option.

If a partial withdrawal from the top-up account is made after 12 months from the policy entry date, the partial withdrawal charge will not apply to units withdrawn from your top-up account.

If the policy value of the units for a partial withdrawal after deducting the partial withdrawal charge falls below the required minimum policy value, your withdrawal request will not be accepted and you will not receive any payout.

Premium holiday charge is only applicable to regular premium policies.

During the minimum investment period, you must pay the premium holiday charge on a monthly basis 30 days from the premium due date if:

- you stop paying premiums; or

- you request for a premium holiday.

The premium holiday charge applies if you did not pay any premiums, until the end of the minimum investment period or when the policy ends.

We will take this premium holiday charge from the policy value of your policy by cancelling units at the bid price. We will take this premium holiday charge from the premium account. If there are insufficient funds in the premium account to fully pay the premium holiday charge, we will take the remaining amount from the top-up account by cancelling units at the bid price.

No, you cannot take a loan from this policy.

You can refer to our website here for more information.

For all funds that declare distributions, we will reinvest each distribution into the fund from which it is paid. We do this by buying units at the bid price (unless we say otherwise) on the payout date. Units reinvested is managed as part of your unit holdings in the policy. To avoid doubt, for any withdrawals including funds that declare distribution, fees and charges may apply.

If the distribution amount for a fund meets the minimum amount we tell you, you can choose to receive all future distributions from that fund as payouts instead, by telling us in writing at least 30 days before the next declaration date.

We will then follow this same choice for the later distributions of that fund if the distributions meet the minimum amount we tell you, unless you tell us your new choice at least 30 days before the next declaration date.

For avoidance of doubt, only reinvestment of the distributions is allowed, unless you have chosen to receive distribution payouts by exercising the retirement option.

There is no restriction on the number of funds if you are able to meet the minimum investment amount for each selected fund as set out below:

Regular Premium / Recurring Top-ups:

| Monthly | Quarterly | Half-yearly | Yearly |

| $50 per month | $150 per quarter | $300 per half-year | $600 per year |

Single Top-ups:

The investment amount to buy unit in the funds you have chosen must not be lower than $1,000 for each top-up. You may submit your request via My Income customer portal.

Yes, you can switch funds via My Income customer portal subject to the following terms:

- We may tell you to leave a minimum amount in that fund if you are not switching out of a fund completely; and

- We may charge you a small amount, set a minimum amount for each switch and/or limit the number of switches you can carry out.

Understand the details

[1] During the term of this policy, if the insured becomes terminally ill or dies, we will pay the adjusted sum assured at the claim event date or the policy value at the time we are told about the claim; whichever is higher. We will take off any fees and charges which apply to the policyholder’s policy. If the policyholder makes any transactions (including top-ups and withdrawals) after the claim event date, we reserve the right to adjust the amount payable for the claim accordingly. The policy will end when we make this payment. We will not pay any further benefits. If the policyholder has appointed a secondary insured before the insured dies, we will not pay this benefit. Upon the death of the insured, the secondary insured becomes the insured and this policy will continue.

[2] This is calculated based on an annual regular premium of $6,000 paid by a male, non-smoker aged 30, with a sum assured of $500,000, selecting a 10-year minimum investment period (MIP).

[3] During the first 15 years from the policy entry date of this policy, if the policy value is not enough to cover the fees and charges due on the policyholder’s policy, we will apply the no lapse guarantee (NLG) benefit and we will not end the policy. In other words, the policy will continue during this period. When we apply the NLG benefit, the policyholder will still need to pay the fees and charges due on the policyholder’s policy and unit deducting rider, if any. We will take these fees and charges from any policy value or claim proceeds that the policyholder may be receiving under the policyholder’s policy. For single premium policy, the NLG benefit will no longer apply if the policyholder has made a withdrawal (except for any withdrawals made under the Withdrawal Access Option or from the top-up account). For regular premium policy, the NLG benefit will no longer apply if a premium holiday charge has been applied to the policy during the MIP or the policyholder has made a withdrawal (except for any withdrawals made under the Withdrawal Access Option or from the top-up account). Please refer to the policy conditions for further details.

[4] We will provide an annual loyalty bonus starting from the end of the MIP shown in the policy conditions. The loyalty bonus will be provided on the next working day from the end of the MIP. The loyalty bonus is a percentage of the policy value of the premium account based on the policy anniversary. It will be used to invest in the funds the policyholder has chosen.

The policyholder’s policy must meet all the following conditions to receive the loyalty bonus:

- this policy must not have ended when the loyalty bonus is provided; and

- the policyholder did not make any partial withdrawals, (except for any withdrawals made under Withdrawal Access Option or from the top-up account) for the past 12 months before the date of the loyalty bonus payment.

The loyalty bonus will commence from the end of the MIP, irrespective of any premium holiday that may have been taken. Please refer to the policy conditions for further details.

[5] MIP refers to the period the policyholder has chosen during which certain charges may apply. The MIP cannot be changed.

[6] From the 5th anniversary, the policyholder may choose to exercise withdrawals of up to 5% of the prevailing policy value (excluding the top-up account) without any withdrawal charge. Any withdrawals made under this option will reduce the policy value accordingly and the sum assured will remain unchanged. This option may only be exercised once per policy year. Withdrawals under this option will continue to be subject to the applicable withdrawal limits set out in the policy conditions.

[7] Each time the original insured experiences a life event, the policyholder may choose to increase the sum assured without us having to assess the original insured’s health, subject to the policy’s terms and conditions. We will limit the increase in sum assured to 50% of the sum assured when this policy was issued, or S$500,000, whichever is lower.

If the original insured is covered for any benefits in policies issued by us that offer a guaranteed insurability option to buy another life policy, guaranteed insurability option to increase the sum assured of the policy or other similar guaranteed insurability option benefit, the aggregate of the insured amounts under such guaranteed insurability option benefit cannot exceed S$500,000 for the original insured.

Please refer to the policy conditions for further details on the life events and the applicable terms and conditions.

[8] The policyholder may opt for the death benefit to be paid in yearly instalments over a period of 5 to 10 years. This option may only be selected at the point of application for this policy. The benefit payout period cannot be changed.

If this option is selected, the following will apply when the death benefit is payable under this policy:

- the death benefit will be paid on a yearly basis over the benefit payout period chosen by the policyholder;

- the first instalment and any outstanding instalment due will be paid on the date we approve the claim;

- the subsequent future instalments will be paid on a yearly basis on each subsequent anniversary of the date of death of the insured, until the death benefit has been fully paid; and

- each instalment payout is calculated using the death benefit multiplied by the applicable factor as shown in the policy conditions.

Terms apply for the benefit. Please refer to the policy conditions for further details.

[9] We may set a minimum amount for each top-up. We will use 100% of the top-ups less any premium charge to buy units (at the bid price) in the funds the policyholder chooses. Top-ups do not form part of the premiums and will not increase the sum assured of the policy. The policyholder cannot make any top-ups when the policy is on a premium holiday.

[10] The policyholder can switch between funds at any time. If the policyholder is not switching out of a fund completely, we may tell the policyholder to leave a minimum amount in that fund. We reserve the right to charge the policyholder a small amount and set a minimum amount for each switch. We may also limit the number of switches the policyholder can carry out. Please refer to the policy conditions for further details.

[11] If the policyholder decides to stop paying premiums after the MIP, the policy will end if the policy value is insufficient to pay for the applicable fees and charges.

[12] Dividend refers to the distribution for certain funds which have a distribution option that we may declare. The policyholder will be entitled to receive these distributions if the policy has not ended and has units in these funds on the declaration date of the distribution. The distribution amount will depend on the number of units the policyholder holds in these funds on the date we declare the distribution. The frequency and/or amount of distributions (if at all) may be varied at our absolute discretion. Distributions are not guaranteed. We may or may not pay a distribution every year. If the distribution amount for a fund meets the minimum amount we tell the policyholder, the policyholder can choose to receive all future distributions from that fund as payouts.

Distributions may be made out of the income and/or capital of the sub-fund. Any payout of distributions from the capital of the sub-fund may result in an immediate reduction of the net asset value per share/unit. Please refer to the policy conditions for further details on the declaration of distributions, reinvesting distributions, distribution via exercising of Retirement Option, and the applicable terms and conditions.

[13] The policyholder may choose to exercise this Retirement Option starting from the later of:

- 20 years from policy entry date; or

- the date the original insured turns 65 years old, or where a secondary insured becomes the insured under this policy, the date the original insured would have turned 65 years old.

When the policyholder exercises this Retirement Option, the policyholder may choose any or both of the following.

- Reduce the sum assured of the policy to as low as zero. Any reduction must be made in multiples of an amount as determined by us from time to time.

- Receive distribution payouts in accordance with the policy conditions.

Please refer to the policy conditions for further details.

[14] The secondary insured must be yourself (before the age of 75 years old), your spouse (before the age of 75 years old), or your child or ward (before the age of 18 years old) at the time of exercising this option. The policyholder can exercise this option to appoint a secondary insured no more than three times during the policy term. Terms apply for the benefit. Please refer to the policy conditions for further details.

[15] The MIP will be fixed at 5 years and cannot be changed.

[16] We will not pay this benefit if the insured was diagnosed with the disease within 90 days from the date we issue the rider, include or increase any benefit, or reinstate the rider (whichever is latest) for major cancer, heart attack of specified severity, coronary artery by-pass surgery, angioplasty and other invasive treatment for coronary artery or other serious coronary artery disease.

There are certain conditions whereby the benefits under this plan will not be payable. You can refer to your policy contract for the precise terms, conditions and exclusions of the plan. The policy contract will be issued when your application is accepted.

This is for general information only and is not to be construed as an offer, recommendation, solicitation or advice for the subscription, purchase or sale of any investment-linked plan (ILP) sub-fund or product(s). It does not constitute any financial advice and does not have regard to the specific investment objectives, financial situation, and particular needs of any person.

Investments are subject to investment risks, including the possible loss of the principal amount invested. Before committing to the minimum investment period, you may want to consider how long is your investment expectations or needs and whether you are able to keep up with the premium payment should your financial situation change. Past performance, as well as the prediction, projection or forecast on the economy, securities markets or the economic trends of the markets, are not necessarily indicative of the future or likely performance of the ILP sub-fund. The performance of the ILP sub-fund is not guaranteed, and the value of the units in the ILP sub-fund and the income accruing to the units, if any, may fall or rise. A product summary and product highlights sheet(s) relating to the ILP sub-fund are available and can be obtained from your insurance advisor or online at income.com.sg/funds. A potential investor should read the product summary and product highlights sheet(s) before deciding whether to subscribe for units in the ILP sub-fund.

You can find the usual terms, conditions and exclusions of this policy in the policy conditions. All our products are developed to benefit our customers but not all may be suitable for your specific needs. If you are unsure if this product is suitable for you, we strongly encourage you to speak to a qualified insurance advisor. Otherwise, you may end up buying a product that does not meet your expectations or needs. As a result, you may not be able to afford the premiums or get the insurance protection you want. Buying a life insurance policy is a long-term commitment on your part. If you cancel your policy prematurely, the cash value you receive may be zero or less than the premiums you have paid for the policy.

This policy is protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact Income Insurance or visit the GIA/LIA or SDIC websites (www.gia.org.sg or www.lia.org.sg or www.sdic.org.sg).

This advertisement has not been reviewed by the Monetary Authority of Singapore.

Information is correct as at 02 February 2026