Here’s what you’ll do as a Financial Consultant

- Assess clients’ financial situation to help them work towards their financial goals.

- Provide advice on insurance to help companies and individuals plan for their financial futures.

- Help clients with financial planning in areas such as retirement, education, and investments.

- Follow up with clients to assess how developments in their life might affect their financial plan.

Find out more about being a Financial Consultant at Income Insurance Limited!

Fill in your details below and our team will reach out to understand more or set up a coffee session with you!

*By submitting this form, you are granting permission to our team to contact you for more information. Thank you!

Enjoy onboarding incentives and benefits* when you join us

We will help you gain the certifications, soft skills, and knowledge you need to succeed while supporting your growth with structured courses and trainings. Our dedicated managers will constantly be there to guide you through your developmental journey.

▪ Sponsored licensing examinations, and pre-contract funding

▪ Growth opportunities for you to realise your entrepreneurial potential

We provide a structured corporate financing scheme for the first 18 months of your career to fast-track your success in Income.

▪ A fixed monthly allowance payable during the first 18 months of the programme.

▪ Candidates would be subjected to meeting the Cumulative Annualised First Year Commissions (AFYC) targets by end of month.

Eligibility:

▪ Candidates with not more than 2 years financial advisory experience.

▪ Experienced Financial Consultants who have left the industry more than 2 years.

Rookie Achievers Club (RAC) is specially curated by Income to support and springboard new joiners to their path of success together. Through RAC's activities, mentorship, programme and incentives, fellow rookies congregate, interact, and grow together in their crucial introductory year.

Enable:

▪ 12-month structured Training & Development roadmap

▪ Priority registration for high demand training programme

▪ Learn from external and internal subject matter experts

▪ Performance Bootcamp for performing rookies

Engage:

▪ Lunch & Learn webinars

▪ RAC Facebook group

▪ Peer engagement activities

REACH:

▪ Rookies performance challenges

Self-registered candidate with no Insurance / Financial Advisory experience are eligible for an Exam Sponsorship of $688 upon completion of the Capital Markets and Financial Advisory Services (CMFAS) examinations for RES5, Module 9, Module 9A and Certificate in Health Insurance.

We will provide you $1,000 CMFAS allowance upon your completion of the Capital Markets and Financial Advisory Services (CMFAS) examinations for RES5, Module 9, Module 9A and Certificate in Health Insurance within three months prior to appointment date and three months after appointment date^.

Refer to the date appointed with Income as a Financial Consultant (FC) on EXCELeration Programme (EP) scheme.

We will provide you $1,000 training allowance upon your completion of BES Training within 2 months from RNF.

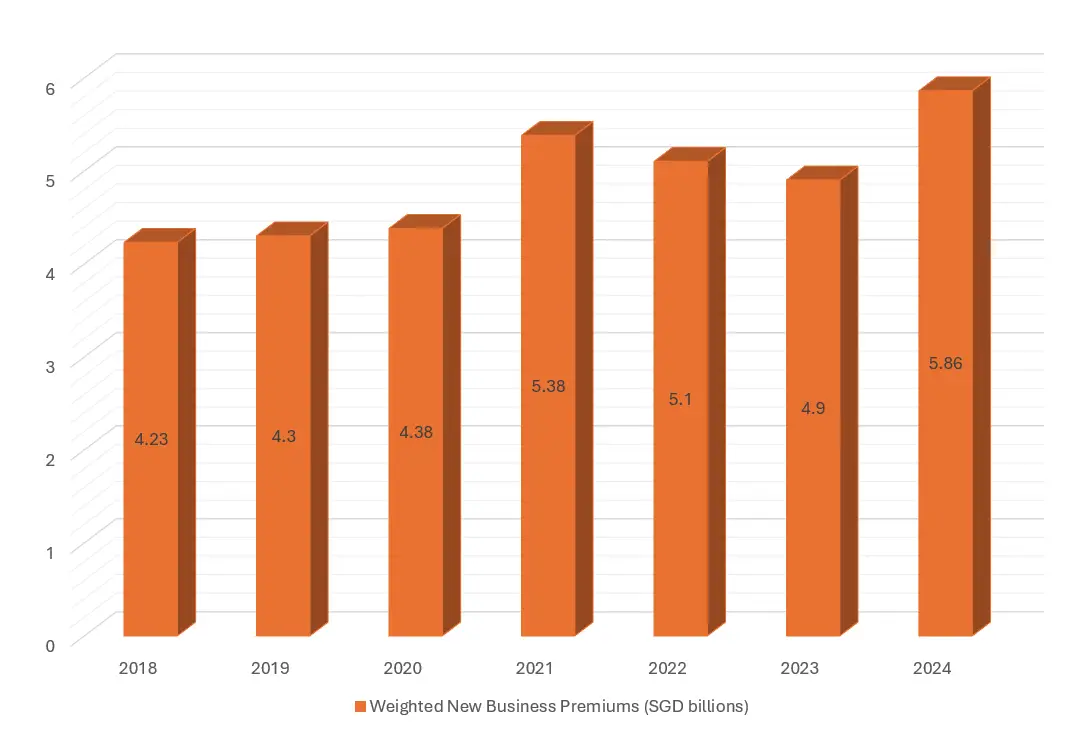

Be part of a resilient industry

Source: Life Insurance Association Singapore (LIA Singapore)

Despite the global headwinds, slowing economic growth and other challenges, Life Insurance Association Singapore (LIA Singapore) reports that the life insurance industry continues to recover and demonstrate resilience as more individuals place greater emphasis on ensuring they are well-protected, which can be seen from an increase in demand for regular premium non-par products.

The industry is expected to remain resilient and continue to ensure the seamless use of digital tools and solutions to enhance the digitalisation journey and experience for consumers.

What does it take to become a Financial Consultant

- Minimum age 21 and above

- Singaporean or Singapore Permanent Resident

- Minimum full certificate in GCE ‘A’ Levels or equivalentRecruitment Survey

- All Income Financial Consultants are required to attain Capital Markets and Financial Advisory Services (CMFAS) certifications for RES5, Module 9, Module 9A and Certificate in Health Insurance

- Enjoy seeing tangible results of your hard work, and be motivated by performance-based incentive structures

- Have good interpersonal skills and be passionate about helping customers achieve their financial goals

*Note: All aforementioned onboarding incentives and benefits are subject to terms and conditions

Source:

Life Insurance industry recorded four per cent growth in 2018 (lia.org.sg)

Life Insurance industry closes 2020 with a positive three per cent growth (lia.org.sg)

Life insurance industry remains resilient to sustain growth in 2021 (lia.org.sg)

Information is correct as at 6 November 2025.