NTUC Income launches SNACKFIT, a first-of-its-kind fitness and lifestyle proposition that offers bonus insurance coverage based on biological age

SNACKFIT encourages healthy lifestyles and empowers users to take control of their health and fitness while boosting their insurance coverage through ReMark’s Biological Age Model solution.

16 December 2021

SINGAPORE, 16 December 2021 – NTUC Income (Income) today launched SNACKFIT, a first-of-its-kind fitness and lifestyle proposition that offers bonus insurance coverage based on biological age. Available on the SNACK by Income mobile app, SNACKFIT calculates one’s biological age based on the fitness and activity data retrieved from linked fitness trackers, such as Garmin and Fitbit, and offers bonus insurance coverage when one’s biological age is younger than the actual age.

SNACKFIT is Income’s latest proposition on its lifestyle-based platform, joining other lifestyle-based propositions such as SNACKUP and SNACK Investment on the SNACK mobile app to make financial products more accessible.

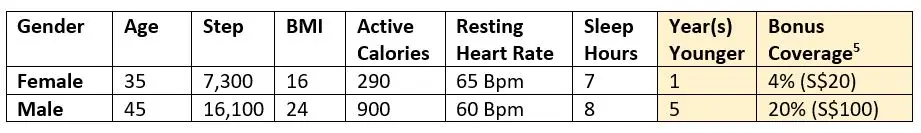

SNACKFIT is powered by ReMark’s Biological Age Model BAMTM, a proprietary dynamic underwriting algorithm derived from global reinsurance company SCOR’s ground-breaking study about the correlation between mortality and morbidity risk and five physical activities. The algorithm analyses five key metrics – Steps, Active Calories, Resting Heart Rate, Sleep Hours and BMI – to calculate a person’s biological age.

Peter Tay, Chief Digital Officer, Income said, “More health risks may come with age and this association is a key consideration for insurers when adjusting insurance premiums generally. However, more Singaporeans are engaging in fitness activities to maintain their overall well-being. The National Population Health Survey showed that 33.4 per cent of Singapore’s population engaged in leisure-time physical activity outside of work or commuting in 2020, up from 29.4 per cent in 2017. SNACKFIT, is thus, an innovative and one-of-a-kind proposition that acknowledges and rewards users for adopting healthier lifestyles.”

“We are heartened to have found in ReMark a like-minded partner who enables us to tap on their data-driven proprietary algorithm, to not just make insurance lifestyle embedded and accessible, but also to incentivise a healthier lifestyle among our customers via SNACKFIT. With this industry-first fitness and lifestyle proposition, we are able to boost customers’ insurance coverage when they accumulate their insurance sum assured via micro premiums as they embark on health and fitness-related activities, a resounding win-win for users,” added Mr Tay.

Vincent Shi, Head of Greater China and SEA, ReMark added, “Through this partnership with Income, we are able to bring our award-winning offerings, BAM and Good Life solution, into Singapore to benefit the growing digital-first population who are increasingly taking a more proactive stance towards keeping fit. From our annual consumer survey, more than 1 in 2 Singaporeans increased their life or health insurance cover during the pandemic, and nearly 70% selected health & wellness apps as one of their top 3 ways to improve their general health. We’re very excited by this partnership and feel it can make a real difference to the lives of end-users.”

Getting Bonus Insurance Coverage with SNACKFIT

SNACKFIT gives users bonus insurance coverage when their biological age is lower than their actual age. A consumer’ biological age can be calculated with the Biological Age Model BAMTM based on their previous day’s activity data received from their fitness trackers. Following which, the consumer will receive the bonus insurance coverage on their micro policies issued the next day. The amount of bonus insurance coverage issued will be dependent on how much younger a consumer’s biological age is, as compared to their actual age.

The table below illustrates how a consumer can receive bonus insurance coverage based on S$500 coverage for every S$0.30 premiums paid on a Life policy, if their biological age, based on his/her activity data, is younger than his/her actual age:

SNACK by Income will also be growing its ecosystem of fitness and health-related partners by teaming up with SNACKUP brands such as Garmin, Revolution, Innervate Fitness and more to cultivate a captive fitness community on SNACK. Users can also enjoy and accumulate more insurance coverage when they spend with these participating partners.

For more information, visit https://www.snackbyincome.sg/ or download the SNACK app from the App Store or Google Play Store.