Frequently Asked Questions

IncomeShield – Letter of Guarantee

-

Q:What are the eligibility criteria for obtaining the IncomeShield LOG?

A:Policies that are on standard terms and have been inforced for at least a year from the start date or the reinstatement date; whichever is later, will be eligible.

The following are some instances where the IncomeShield LOG may not be issued:

- The estimated claimable amount falls within the policy deductible amount;

- There is an exclusion in the policy;

- There is an outstanding recovery amount due to Income Insurance;

- Treatments at private clinics, public hospital's short-stay wards, outpatient treatments and community hospitals;

- Overseas treatments;

- Treatments for excluded conditions such as pregnancy related treatments, cosmetic surgery, HIV infection or AIDS related, please refer to the policy contract for the a full list of exclusions.

Do note that Income Insurance reserves the right to limit or decline the issuance of the IncomeShield LOG, even if the eligibility criteria is met. -

Q:What is an IncomeShield LOG?

A:This is a facility provided to IncomeShield policyholders at major hospitals in Singapore. The IncomeShield Letter of Guarantee or LOG can be used to help with the upfront cash deposit required for hospitalisation or day surgery, subject to the acceptance of the Hospital.

-

Q:What is the maximum amount that can be issued for IncomeShield LOG?

A:An insured who is eligible for IncomeShield LOG receives treatment that is provided by a private specialist from IncomeShield's Panel or Extended Panel, can benefit from an IncomeShield LOG amount of up to $30,000; while it is up to $10,000 for treatment that is not provided by our Panel. For treatment that is provided by specialist from a public hospital, the IncomeShield LOG amount is up to $50,000.

-

Q:When there is issuance of IncomeShield LOG, would it mean that the IncomeShield policy has approved the claim?

A:The IncomeShield LOG is a facility intended to assist in the pre hospitalisation or pre surgery process; it is not an indicator of claim approval and neither is the issued amount an indicator of the claim amount. The filed IncomeShield claim, with details of the medical conditions and its treatments, will require a review by Income Insurance.

-

Q:Which are the participating hospitals/medical institutions in Singapore?

A:Restructured Hospitals/Medical Institutions

- Alexandra Hospital

- Admiralty Medical Centre

- Changi General Hospital

- Khoo Teck Puat Hospital

- KK Women's And Children's Hospital

- National Cancer Centre

- National Heart Centre Of Singapore

- National University Hospital

- Ng Teng Fong General Hospital

- Sengkang General Hospital

- Singapore General Hospital

- Singapore National Eye Centre

- Tan Tock Seng Hospital- Woodlands Health Campus

Private Hospitals/Medical Institutions

- Farrer Park Hospital

- Gleneagles Hospital

- Mount Alvernia Hospital

- Mount Elizabeth Hospital

- Mount Elizabeth Novena Hospital

- Parkway East Hospital

- Raffles Hospital

- Thomson Medical Centre- Crawfurd Hospital

-

Q:How long would it take to request for the IncomeShield LOG?

A:The Hospital administrators will assist to make the request on your behalf. If successful, the IncomeShield LOG will be issued to the hospital on the same day.

-

Q:With the issued IncomeShield LOG, would it mean that no deposit is required?

A:The hospital reserves the right to collect a partial or a full deposit of the bill or accept the issued IncomeShield LOG only for the waiver of the initial deposit. Following are some other situations where a deposit will be required:

- The total of the IncomeShield LOG amount and the estimated CPF Medisave withdrawal amount is insufficient to cover the required deposit;

- The IncomeShield policy is unable to provide coverage for the hospitalisation or day surgery;

- Ineligible claims or ineligible items or medical services that are excluded and/or are not part of the treatment; please refer to the policy contract for details. -

Q:How to request for the IncomeShield LOG?

A:You may approach the participating hospitals' administrators for assistance, they will assist to request for the IncomeShield LOG on your behalf. In order to activate the IncomeShield LOG, you will need to accept the IncomeShield LOG terms and sign the Medical Claims Authorisation Form (MCAF).

IncomeShield – Deductibles

-

Q:What is the deductible?

A:The deductible is the amount that you will need to pay first before any claim is payable.

-

Q:If I need to be hospitalised, which type of hospital should I be admitted to?

A:You are encouraged to attend financial counselling for a better understanding on the costs involved for your upcoming hospitalisation stay and take note of your plan coverage in order to make an informed choice. You can contact your insurance adviser if you need further advice.

-

Q: What is my entitled ward class?

A:You can refer to the following table for your ward entitlement based on the plan type that you have purchased. This is to ensure that your policy coverage under your IncomeShield plan is better able to meet the expenses for your corresponding ward.

Plan Type [1] Ward Type Corresponding Deductibles [2] Enhanced IncomeShield Preferred Standard room in Private Hospital, excluding suites $3,500 Enhanced IncomeShield Advantage Restructured Hospital for Ward Class A $3,500 Enhanced IncomeShield Basic Restructured Hospital for Ward Class B1 $2,500 Enhanced IncomeShield Enhanced C Restructured Hospital for Ward Class B2 and below $2,000 (Ward Class B2 or B2+)

$1,500 (Ward Class C)- For further plan details, please refer to the Policy Contract

- Deductibles for each policy year for an insured aged 80 years or below next birthday

-

Q: If I have taken up Enhanced IncomeShield Basic plan where my entitlement is ward class B1 and below, can I choose to stay in ward class C?

A:Yes, you can choose to stay in ward class C and we will apply the deductible of ward class C to your claim. We will use the benefits of your Enhanced IncomeShield Basic plan to process the claimable amount.

For example:

You are covered under Enhanced IncomeShield Basic plan and stay in ward class C. The benefits used to process the claimable amount will be that of Enhanced IncomeShield Basic plan and the deductible applicable is $1,500.

-

Q:If I have taken up Enhanced IncomeShield Basic plan where my entitlement is ward class B1 and below, can I choose to stay in ward class A?

A:Yes, you can. However, we will only pay the percentage of the reasonable expenses for necessary medical treatment using the pro-ration factor which applies to Enhanced IncomeShield Basic plan as specified in the schedule of benefits.

-

Q:I am on Enhanced IncomeShield Basic plan and stayed in ward class C during my first admission. Can I choose to stay in ward class B1 for my next admission?

A:Yes, you can do so. You should note that if you stayed in a lower ward class (hence entitled to a lower deductible) for the first admission but choose to upgrade to a higher ward class on your second admission (within the same policy year), the difference of the two deductibles will apply for the second claim only.

Claimable amount Ward Class Deductible applied Co-insurance Applied Net amount paid First Admission $3000 Ward Class C $1,500 $150 $1,350 Second Admission $3,000 Ward Class B2 $500 ($2,000 - $1,500) $250 $2,250 Third Admission $3,000 Ward Class B2 $0 $300 $2,700 -

Q: Who can I contact if I require further assistance?

A:You can contact your insurance adviser or email your enquiry to healthcare@income.com.sg. Alternatively, you can call our customer service officers at 6788 1777.

IncomeShield - Recovery

-

Q:Why is Income Insurance recovering claims paid out from my IncomeShield plan?

A:For Medisave-approved integrated medical insurance plans, other insurers providing similar medical coverage are required to refund the amounts paid out under the individual's IncomeShield plan.

-

Q:Why is Income Insurance paying my claim first when I have other insurance cover?

A:For Medisave-approved integrated medical insurance plans, the accredited hospitals/clinics will submit the claims electronically to the insurer via the MediClaim System after your hospital discharge. This is a seamless process where the electronic claim is initiated after you complete the claim form in the hospitals/clinics.

After Income Insurance settles your claim, and if you have other insurance cover, you can still submit the claim to your insurer for reimbursement or recovery back to your IncomeShield plan.

-

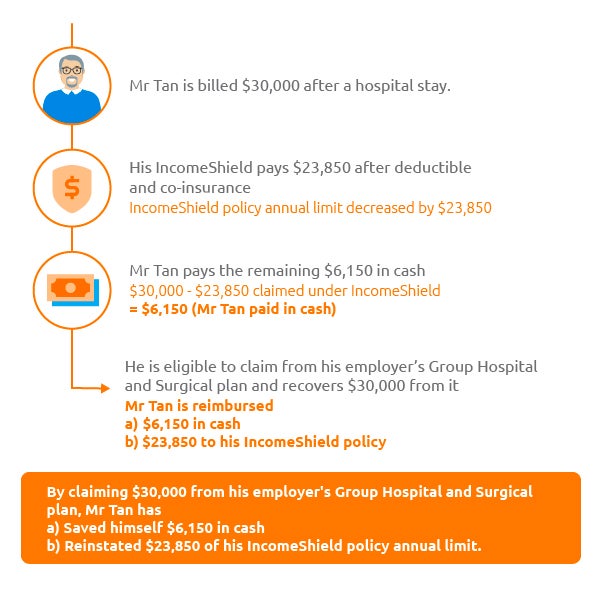

Q:What are the benefits of claiming/recovering from my other medical insurance plans?

A:How does this help you?

1. You can get reimbursement for the expenses that are not covered by IncomeShield (provided these expenses are covered by your other H&S plan).

2. You will preserve the annual benefit limits of your IncomeShield for any future claimable events.

3. Your premiums for IncomeShield can be kept affordable in the long run.

Here’s an example of how this works:

-

Q:I am covered by my employer for medical expenses but I do not know who the insurer is. What should I do?

A:You can reach out to your Human Resource Department to understand the details of your employer’s medical insurance policy and its’ claim submission process.

-

Q:My employer does not pay for my medical bills, but I have a personal accident/travel/medical insurance policy(s). Should I claim from my personal insurance policy(s) too?

A:Yes, you should claim from your personal insurance to enjoy the same benefits stated in FAQ Point 3. You may wish to approach your servicing agent or the insurer directly on the claim submission process.

-

Q:How do I initiate a recovery from my employer and/or other insurer(s) for claims that were paid out under my IncomeShield plan?

A:How can you recover your claims from your employer?

STEP 1: Check with your company’s HR

Ask if you’re eligible for any Group Insurance coverage provided by your employer.

STEP 2: Submit documents to initiate a Group Insurance claim

Once HR confirms you’re eligible, submit the following documents to your company's HR or the respective company Group Insurance provider to initiate the refund:- Group Insurance claim form – ask your company’s HR where to find this.

- Original final and itemised bills.

- Hospital (or Inpatient) Discharge Summary.

- IncomeShield claim settlement letter – You may retrieve it at My Income customer portal | Income Insurance > Document > Letters/Documents > Select document > Download PDF

Your company’s HR will liaise directly with the respective group insurer for the appropriate reimbursements into your IncomeShield plan. You won’t have to take any further action.

-

Q:Why must I submit the claim to my employer and/or other insurer(s) myself, could Income Insurance help me to submit the claim?

A:It is an insurance contract between your employer and/or other insurer(s) and yourself. While we are happy to assist you in the claim submission, we are unable to do so on your behalf as Income Insurance is not a party of your policy.

-

Q:I will be claiming from my employer and/or my personal insurance policy(s) first. If there are still amounts not paid by my employer and/or other insurer(s), can I inform the hospital to submit my claim electronically under my IncomeShield plan?

A:Yes, you will have to inform the hospital of your intention to claim from your employer and/or other insurer(s) first. For the unclaimed balance that you wish to claim under your IncomeShield plan, you will have to return to the hospital to submit the claim electronically via the MediClaim System. To facilitate with the submission request, you will need to bring along the settlement letter from your employer and/or other insurer(s). A copy of the said settlement letter should also be sent to us for review.

You may wish to take note that the submission will be done at the hospital’s discretion according to their internal practices and you may be charged an administrative fee. Therefore, we recommend you check the hospital’s submission procedures prior your hospitalisation, so that you can focus on your recovery without worrying about the claim administrative matters.