Frequently Asked Questions

Complete Critical Protect

Product Coverage

-

Q:What is Complete Critical Protect?

A:Complete Critical Protect is a plan that provides insurance protection against dread disease. It provides dread disease benefit, recurrent benefit, vital function benefit, special benefit, juvenile benefit, critical impact benefit, guaranteed post-DD cover option, therapy support benefit, and death benefit. This policy cannot be cashed in. You can choose either Protect 100 or Protect Max option which offers different level of coverage. The option must be chosen at policy inception and cannot be changed.

Dread Disease Benefit

-

Q:What is the dread disease benefit payable?

A:Dread disease consists of early stage, intermediate stage and advanced stage dread disease.

If the insured is diagnosed with a dread disease by a specialist during the term of this policy, based on the option you have chosen, the benefit shown below will be paid according to its severity level.

Please refer to (I) if you have chosen Protect 100 or (II) if you have chosen Protect Max.

(I) Protect 100

Severity Level Benefit Early stage dread disease and/or Intermediate stage dread disease Total of 100% of sum assured Advanced stage dread disease 100% of sum assured less claim paid for:

- Early stage and/or intermediate stage dread disease; and

- Vital function benefit

If you have chosen Protect 100, the total we will pay under the following benefits:

- dread disease benefit; and

- vital function benefit,

are aggregated and will not be more than 100% of the sum assured, less any amount you owe us.

This benefit will end once the total amount we have paid under the following benefits:- dread disease benefit; and

- vital function benefit,

reaches 100% of the sum assured.

The early and/or intermediate stage dread disease benefit will be paid, subject to the following:- dread disease benefit has not ceased at the time of any payment of the benefit;

- the insured survives at least 7 days after the date of diagnosis or date of surgery performed for a dread disease covered under this benefit, whichever is later;

- maximum of 1 claim for either the early stage dread disease or intermediate stage dread disease may be approved;

- vital function benefit of the corresponding dread disease which the same early and/or intermediate stage dread disease belongs to has not been claimed;

- if more than one dread disease covered under the dread disease benefit and/or impairments of the vital functions are diagnosed on the same date, only one claim with the highest possible benefit payout will be approved regardless of the number of dread diseases and/or impairments of the vital functions that are diagnosed; and

- the amount we will pay for the early and/or intermediate stage dread disease of the same dread disease under this benefit will not be more than a total of S$350,000 for each insured, including all policies we have issued and paid for the same insured.

The advanced stage dread disease benefit will be paid, subject to the following:- dread disease benefit has not ceased at the time of any payment of the benefit;

- the insured survives at least 7 days after the date of diagnosis or date of surgery performed for a dread disease covered under this benefit, whichever is later;

- maximum of 1 claim for the advanced stage dread disease may be approved; and

- if more than one dread disease covered under the dread disease benefit and/or impairments of the vital functions are diagnosed on the same date, only one claim with the highest possible benefit payout will be approved regardless of the number of dread diseases and/or impairments of the vital functions diagnosed.

If the insured is also covered for dread disease benefit, recurrent benefit and vital function benefit (or equivalent benefits) under any policies which have been issued and paid (whether issued and paid by us or by any other insurer), the total of these benefits under all these policies cannot be more than S$3.6 million (including premiums waived due to dread disease but excluding bonuses).This policy will continue even if this benefit ends.

Please refer to the policy contract for the list and full definitions of early stage, intermediate stage and advanced stage dread diseases covered under this benefit.

(II) Protect Max

Severity Level Benefit Early stage dread disease and/or Intermediate stage dread disease Total of 100% of sum assured Advanced stage dread disease 200% of sum assured less claim paid for:

- Early stage and/or intermediate stage dread disease of the same dread disease; and

- Vital function benefit of the corresponding dread disease

If you have chosen Protect Max, the total we will pay under the following benefits:

- dread disease benefit;

- recurrent benefit; and

- vital function benefit,

are aggregated and will not be more than 1000% of the sum assured, less any amount you owe us.

This benefit will end once the total amount we have paid under the following benefits:

- dread disease benefit;

- recurrent benefit; and

- vital function benefit,

reaches 1000% of the sum assured.

The early and/or intermediate stage dread disease benefit will be paid, subject to the following:

- dread disease benefit has not ceased at the time of any payment of the benefit;

- the insured survives at least 7 days after the date of diagnosis or date of surgery performed for a dread disease covered under this benefit, whichever is later;

- no claim has been approved for advanced stage of the same dread disease;

- maximum of 1 claim for either the early stage dread disease or intermediate stage dread disease of the same dread disease may be approved;

- maximum of 6 claims for the early stage and/or intermediate stage dread disease may be approved;

- vital function benefit of the corresponding dread disease which the same early and/or intermediate stage dread disease belongs to has not been claimed;

- if more than one dread disease covered under the dread disease benefit and/or recurrent condition and/or impairments of vital function are diagnosed on the same date, only one claim with the highest possible benefit payout will be approved regardless of the number of dread diseases and/or recurrent condition and/or impairments of the vital functions that are diagnosed;

- the amount we will pay for the early and/or intermediate stage dread disease of the same dread disease under this benefit will not be more than a total of S$350,000 for each insured, including all policies we have issued and paid for the same insured; and

- the amount we will pay for the early and/or intermediate stage dread disease under this benefit will not be more than a total of S$1.05 million for each insured, including all policies we have issued and paid for the same insured.

The advanced stage dread disease benefit will be paid, subject to the following:- dread disease benefit has not ceased at the time of any payment of the benefit;

- the insured survives at least 7 days after the date of diagnosis or date of surgery performed for a dread disease covered under this benefit, whichever is later;

- only 1 claim is allowed for the advanced stage of each dread disease;

- if more than one dread disease covered under the dread disease benefit and/or recurrent condition and/or impairments of vital function are diagnosed on the same date, only one claim with the highest possible benefit payout will be approved regardless of the number of dread diseases and/or recurrent condition and/or impairments of the vital functions that are diagnosed; and

- for terminal illness (advanced stage) and loss of independent existence (advanced stage), the amount payable will be determined after deducting any claims paid under the dread disease benefit and vital function benefit. If the total claims paid under the dread disease benefit and vital function benefit have reached 200% of the sum assured or more, no benefit will be payable for future claims under terminal illness (advanced stage) and loss of independent existence (advanced stage).

If the insured is also covered for dread disease benefit, recurrent benefit and vital function benefit (or equivalent benefits) under any policies which have been issued and paid (whether issued and paid by us or by any other insurer), the total of these benefits under all these policies cannot be more than S$3.6 million (including premiums waived due to dread disease but excluding bonuses).This policy will continue even if this benefit ends.

Please refer to the policy contract for the list and full definitions of early stage, intermediate stage and advanced stage dread diseases covered under this benefit.

-

Q:What are the exclusion(s) for dread disease benefit?

A:We only cover the dread disease we define in this policy. The full definition of an early stage, intermediate stage or advanced stage dread disease covered and the circumstances in which you can claim are given in this policy.

If you have chosen Protect 100, we will not pay the benefit if your claim arises from:

- an early and/or intermediate stage dread disease under major cancer, heart attack of specified severity, other serious coronary artery disease, or coronary artery by-pass surgery, where the insured suffered symptoms of, was investigated for, or was diagnosed with the disease any time before or within 90 days from the cover start date, whichever is earliest. For coronary artery by-pass surgery, the date of diagnosis will be the date the medical condition that leads to the surgery is diagnosed, and not the date of the surgery; or

- an advanced stage dread disease under major cancer, heart attack of specified severity, coronary artery by-pass surgery or other serious coronary artery disease, where the insured was diagnosed with the disease within 90 days from the cover start date, whichever is earliest. For coronary artery by-pass surgery, the date of diagnosis will be the date the medical condition that leads to the surgery is diagnosed, and not the date of the surgery.

If you have chosen Protect Max, we will not pay the benefit if your claim arises from:

- any early, intermediate or advanced stage dread disease which occurs within 12 months from the date of diagnosis or date of surgery performed, whichever is later, of the latest claim approved under:

- dread disease benefit for another dread disease;

- recurrent benefit; or

- vital function benefit; - an early and/or intermediate stage dread disease under major cancer, heart attack of specified severity, other serious coronary artery disease, or coronary artery by-pass surgery, where the insured suffered symptoms of, was investigated for, or was diagnosed with the disease any time before or within 90 days from the cover start date, whichever is earliest. For coronary artery by-pass surgery, the date of diagnosis will be the date the medical condition that leads to the surgery is diagnosed, and not the date of the surgery; or

- an advanced stage dread disease under major cancer, heart attack of specified severity, coronary artery by-pass surgery or other serious coronary artery disease, where the insured was diagnosed with the disease within 90 days from the cover start date, whichever is earliest. For coronary artery by-pass surgery, the date of diagnosis will be the date the medical condition that leads to the surgery is diagnosed, and not the date of the surgery.

Recurrent Benefit (for Protect Max only)

-

Q:What is the recurrent benefit payable?

A:This benefit is only applicable if you have chosen Protect Max.

If the insured is diagnosed with a recurrent condition during the term of this policy, 100% of the sum assured will be paid less any amount you owe us.

The recurrent benefit will be paid, subject to the following conditions:

- recurrent benefit has not ceased at the time of any payment of the benefit;

- the insured survives at least 7 days after the date of diagnosis or date of surgery performed for a dread disease covered under this benefit, whichever is later;

- if more than one dread disease covered under the dread disease benefit and/or recurrent condition and/or impairments of vital function are diagnosed on the same date, only one claim with the highest possible benefit payout will be approved regardless of the number of dread diseases and/or recurrent condition and/or impairments of the vital functions that are diagnosed; and

- maximum of 3 claims may be approved under this benefit.

The total we will pay under the following benefits:- dread disease benefit;

- recurrent benefit; and

- vital function benefit,

are aggregated and will not be more than 1000% of the sum assured.

This benefit will end once:- 300% of the sum assured has been fully paid out under this benefit; or

- the total amount we have paid under the following benefits:

- dread disease benefit;

- recurrent benefit; and

- vital function benefit,

reaches 1000% of the sum assured,

whichever is earlier.

If the insured is also covered for dread disease benefit, recurrent benefit and vital function benefit (or equivalent benefits) under any policies which have been issued and paid (whether issued and paid by us or by any other insurer), the total of these benefits under all these policies cannot be more than S$3.6 million (including premiums waived due to dread disease but excluding bonuses).

This policy will continue even if this benefit ends.Please refer to the policy contract for the list and full definitions of recurrent conditions covered under this benefit.

-

Q:What are the exclusion(s) for recurrent benefit?

A:We will not pay this benefit if your claim arises from:

- any recurrent condition covered under this benefit occurring within 24 months from the date of diagnosis or date of surgery performed, whichever is later, of the latest claim approved under:

- dread disease benefit;

- recurrent benefit; or

- vital function benefit; or - persistent major cancer, recurrent heart attack of specified severity or repeated coronary artery by-pass surgery, where the insured was diagnosed with the disease within 90 days from the cover start date. For repeated coronary artery by-pass surgery, the date of diagnosis will be the date the medical condition that leads to the surgery is diagnosed, and not the date of the surgery.

- any recurrent condition covered under this benefit occurring within 24 months from the date of diagnosis or date of surgery performed, whichever is later, of the latest claim approved under:

Vital Function Benefit

-

Q:What is the vital function benefit payable?

A:If the insured is diagnosed with an impairment of heart, lungs or kidneys by a specialist during the term of this policy the benefit shown below will be paid according to your chosen option less any amount you owe us.

Please refer to (I) if you have chosen Protect 100 or (II) if you have chosen Protect Max.

(I) Protect 100

The benefit payable is 100% of sum assured less claim paid for early stage and/or intermediate stage dread disease.

The vital function benefit will be paid, subject to the following:

• vital function benefit has not ceased at the time of any payment of the benefit;

• no claim has been approved for advanced stage dread disease;

• the insured survives at least 7 days after the date of diagnosis on a vital function covered under this benefit; and

• if more than one dread disease covered under the dread disease benefit and/or recurrent

condition and/or impairments of vital function are diagnosed on the same date,

only one claim with the highest possible benefit payout will be approved

regardless of the number of dread diseases and/or recurrent condition

and/or impairments of the vital functions that are diagnosed.

If you have chosen Protect 100, the total we will pay under the following benefits:

• dread disease benefit; and

• vital function benefit,

are aggregated and will not be more than 100% of the sum assured.

This benefit will end once:

• a claim has been paid out under this benefit; or

• the total amount we have paid under the following benefits:

• dread disease benefit; and

• vital function benefit,

reaches 100% of the sum assured,

whichever is earlier.

If the insured is also covered for dread disease benefit, recurrent benefit and vital function benefit (or equivalent benefits) under any policies which have been issued and paid (whether issued and paid by us or by any other insurer), the total of these benefits under all these policies cannot be more than S$3.6 million (including premiums waived due to dread disease but excluding bonuses).

This policy will continue even if this benefit ends.

Please refer to the policy contract for the full definitions of vital functions covered under this benefit.

(II) Protect Max

The benefit payable is 200% of sum assured less claim paid for early stage and/or intermediate stage dread disease of the corresponding dread disease.

The corresponding dread disease under dread disease benefit are:

The vital function benefit will be paid, subject to the following:

• vital function benefit has not ceased at the time of any payment of the benefit;

• no claim has been approved for advanced stage dread disease;

• the insured survives at least 7 days after the date of diagnosis on a vital function covered under this benefit; and

• if more than one dread disease covered under the dread disease benefit and/or

recurrent condition and/or impairments of vital function are diagnosed

on the same date, only one claim with the highest possible benefit payout

will be approved regardless of the number of dread diseases and/or recurrent

condition and/or impairments of the vital functions that are diagnosed.

If you have chosen Protect Max, the total we will pay under the following benefits:

• dread disease benefit;

• recurrent benefit; and

• vital function benefit,

are aggregated and will not be more than 1000% of the sum assured.

This benefit will end once:

• a claim has been paid out under this benefit; or

• the total amount we have paid under the following benefits:

• dread disease benefit;

• recurrent benefit; and

• vital function benefit,

reaches 1000% of the sum assured,

whichever is earlier.

If the insured is also covered for dread disease benefit, recurrent benefit and vital function benefit (or equivalent benefits) under any policies which have been issued and paid (whether issued and paid by us or by any other insurer), the total of these benefits under all these policies cannot be more than S$3.6 million (including premiums waived due to dread disease but excluding bonuses).

This policy will continue even if this benefit ends.

Please refer to the policy contract for the full definitions of vital functions covered under this benefit.

-

Q:What are the exclusion(s) for vital function benefit?

A:We will not pay this benefit if:

- your claim arises within 12 months from the:

- date of diagnosis of early and/or intermediate stage dread disease of the latest claim approved under early and/or intermediate stage dread disease outside of the corresponding dread disease; or

- date of surgery performed under early and/or intermediate stage dread disease of the latest claim approved under early and/or intermediate stage dread disease outside of the corresponding dread disease,

whichever is later; or

- the insured is diagnosed with any impairment of a vital function covered under this benefit any time before or within 90 days from the cover start date.

- your claim arises within 12 months from the:

Special Benefit

-

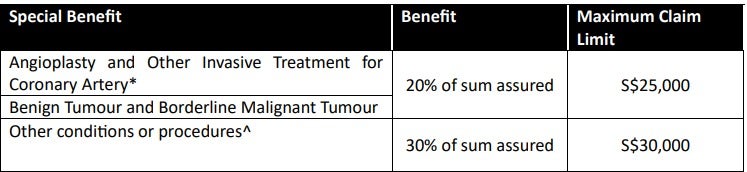

Q:What is the special benefit payable?

A:If the insured is diagnosed by a specialist with any of the conditions or has undergone any of the procedures shown below before the insured reaches 85 age last birthday, the benefit shown below will be paid less any amount you owe us.

*The Life Insurance Association Singapore (LIA) has standard Definitions for 37 severe-stage Dread Diseases (Version 2019). This Dread Disease falls under Version 2019. You may refer to http://www.lia.org.sg for the standard Definition (Version 2019). For Dread Diseases that do not fall under Version 2019, the definitions are determined by the insurance company.

^You may refer to the policy contract for these conditions and procedures.

For policies we have issued that have special benefit (or equivalent), we will pay no more than the maximum claim limit for the same condition or procedure for each insured (no matter how many policies we have issued to cover each insured).

The special benefit will be paid, subject to the following:

• special benefit has not ceased at the time of any payment of the benefit

• the insured survives at least 7 days from the date of diagnosis or date of surgery performed,

whichever is later;

• a claim for each condition or procedure can only be approved once; and

• maximum of 5 claims may be approved under this benefit.

This policy will continue even if this benefit ends.

Please refer to the policy contract for the list and full definition of special benefits covered under this benefit.

-

Q:What are the exclusion(s) for special benefit?

A:We will not pay this benefit if the insured suffered symptoms of, was investigated for, or was diagnosed with any conditions or conditions which requires a procedure under this benefit (except for angioplasty and other invasive treatment for coronary artery) any time before or within 90 days from the cover start date, whichever is earliest.

For angioplasty and other invasive treatment for coronary artery, we will not pay this benefit if the insured was diagnosed within 90 days from the cover start date. The date of diagnosis will be the date the medical condition that leads to the treatment is diagnosed, and not the date of the treatment.

Juvenile Benefit

-

Q:What is the juvenile benefit payable?

A:If the insured is diagnosed with any of the covered conditions by a specialist, 20% of the sum assured will be paid less any amount you owe us, as long as the diagnosis takes place before the insured reaches age 18 last birthday.

For policies we have issued that have juvenile benefit, we will pay no more than S$30,000 for the same condition for each insured (no matter how many policies we have issued to cover each insured).

The juvenile benefit will be paid, subject to the following:- juvenile benefit has not ceased at the time of any payment of the benefit;

- insured survives at least 7 days from the date of diagnosis or date of surgery performed, whichever is later;

- a claim for each condition can only be approved once; and

- maximum of 5 claims may be admitted under this benefit.

The policy will continue even if this benefit ends.

Please refer to the policy contract for the list and full definitions of conditions covered under this benefit.

-

Q:What are the exclusion(s) for juvenile benefit?

A:We will not pay this benefit if the insured suffered symptoms of, was investigated for, or was diagnosed with any conditions covered under this benefit any time before or within 90 days from the cover start date, whichever is earliest.

Critical Impact Benefit

-

Q:What is the critical impact benefit payable?

A:If the insured undergoes surgery or suffers an infection before reaching age 85 last birthday and requires a stay in an intensive care unit (ICU) for a total of 4 days or more in one hospital admission, 20% of the sum assured will be paid less any amount you owe us.

The critical impact benefit will be paid, subject to the following:

- the insured survives at least 7 days from the first day of admission to ICU; and

- the surgery or infection and the stay in the ICU must be directly due to the same cause and confirmed as necessary medical treatment.

We will not consider a stay in ICU as necessary medical treatment if the insured can be safely and adequately treated in any other facility.

For policies we have issued that have critical impact benefit, we will pay no more than S$50,000 for each insured (no matter how many policies we have issued to cover each insured).

You can only claim the critical impact benefit once.

This policy will continue even if this benefit ends.

-

Q:What are the exclusion(s) for critical impact benefit?

A:We will not pay this benefit if the insured was suffering symptoms of, was investigated for, or was diagnosed with any infection or condition which requires surgery under this benefit any time before or within 90 days from the cover start date, whichever is earliest.

Guaranteed Post-DD Cover Option

-

Q:What is the guaranteed post-DD cover benefit payable?

A:Upon diagnosis of the insured with:

- an advanced stage dread disease covered under dread disease benefit; or

- an impairment covered under vital function benefit,

a new term policy covering the insured may be taken up with only death and terminal illness benefits, without us having to assess the insured’s health. Total and permanent disability will not be covered by the new term policy.

The waiting period of the new term policy is 2 years. If the event giving rise to a claim occurs during the 2 year waiting period, we will refund 100% of the premiums paid for the term policy. The new term policy does not allow any reinstatement.

We will limit the sum assured for the new term policy to

- 100% of the original sum assured for this policy; or

- S$200,000 per life aggregating policies issued under the guaranteed post-DD cover option,

whichever is lower.

We will decide the type of new term policy to be offered and the insured must meet all the following conditions to take up this option:

- this option must be exercised within 6 months from the claim approval date or diagnosis date, whichever is later, of the advanced stage dread disease covered under dread disease benefit or impairment covered under vital function benefit;

- the insured must not have terminal illness at the time of taking up this option;

- the insured must be 60 years old age last birthday or under at the time of taking up this option; and

- the relevant documents must be provided to support the diagnosis of advanced stage dread disease covered under dread disease benefit or impairment covered under vital function benefit.

Please refer to the policy contract for the exact terms and definitions of advanced stage dread disease and terminal illness.

Therapy Support Benefit

-

Q:What is the therapy support benefit payable?

A:If the insured is diagnosed by a specialist to undergo any of the covered therapy during the term of this policy, 20% of the sum assured will be paid less any amount you owe us.

At most, we will pay this benefit two times and only one payout for each therapy. The entire treatment for each therapy must be done in Singapore.

For policies we have issued that have therapy support benefit, we will pay no more than S$50,000 for each therapy listed (no matter how many policies we have issued and paid to cover each insured).

The policy will continue even if this benefit ends.

Please refer to the policy contract for the list and full definitions of therapies covered under this benefit.

-

Q:What are the exclusion(s) for therapy support benefit?

A:We will not pay the benefit if the insured suffered symptoms of, was investigated for, or was diagnosed with any condition which requires therapy under this benefit any time before or within 90 days from the cover start date, whichever is earliest.

Death Benefit

-

Q:What is the death benefit payable?

A:Upon death of the insured during the term of this policy, we will pay S$10,000 less any amount you owe us.

The policy will end when we make this payment. We will not pay any further benefits.

Cash Value and Bonuses

-

Q: Is the policy eligible for any bonus?

A:No, this policy is not eligible for any bonus as this is a non-participating policy.

-

Q:Is there any cash value for the policy?

A:No, there is no cash value for this policy.

Riders and Supplementary Benefits

-

Q:What are riders/ supplementary benefits?

A:Riders, also known as supplementary benefits, can be attached to a basic insurance policy to provide additional protection at lower cost.

-

Q:What are the riders(s) that can be attached to this plan?

A:The following rider(s) can be added to Complete Critical Protect:

List of available rider(s) Enhanced Payor Premium Waiver Payor Premium Waiver Dread Disease Premium Waiver

Eligibility and Premium Payments

-

Q:What are the policy terms and entry ages for insured?

A:There is no minimum entry age for the insured. The maximum entry age for the insured depends on the policy term as shown in the table below.

Policy Term Minimum Entry age (last birthday) Maximum Entry age (last birthday) To age 64 (LB) 0 54 To age 74 (LB) 0 64 To age 84 (LB) 0 64 To age 100 (LB) 0 64 -

Q:What are the minimum and maximum entry ages for the policyholder?

A:Minimum Entry Age (last birthday) Maximum Entry Age (last birthday) 16* N.A * Parents cannot be the policyholder on their child who are 18 years old (age last birthday) and above at the point of application.

-

Q:What is the minimum and maximum sum assured for this policy?

A:Insured Age Minimum Sum Assured Maximum Sum Assured Age 0 - 15 last birthday S$30,000 per policy

- For Protect 100, S$350,000 per life

- For Protect Max, S$70,000 per life

Age 16 last birthday and above S$30,000 per policy

S$350,000 per life The insured may choose any amount in multiples of S$10,000.

-

Q:What are the premium frequencies available?

A:The premiums can be paid monthly, quarterly, half-yearly or yearly.

-

Q:Is the premium payable for this policy guaranteed?

A:Premium rates are not guaranteed. These rates may be adjusted based on future experience. We will give you at least 30 days’ written notice in the event premium rates needs to be revised.

-

Q:Can I use funds in Central Provident Fund (CPF) or Supplementary Retirement Scheme (SRS) to buy this policy?

A:No, you cannot use funds in CPF and SRS to buy this policy.

-

Q:Can I backdate my policy?

A:Backdating is allowed if all of the conditions are met:

- The backdating is for a traditional individual (savings or protection) life policy paying regular premium or single premium. Backdating for investment-linked policy and annuity policy is not allowed;

- The backdating results in a lower premium or higher minimum protection value due to a lower entry age;

- The policy is backdated to a date up to one day before the Insured’s last birthday and it must be within 6 months from date of receipt of application by Income; and

- Backdating of policy to a date before the launch date of the main plan or rider is not allowed.