Frequently Asked Questions

Operations

-

Q:What sets Operations at Income apart from other Insurers?

A:

As Singapore’s leading life, health and general insurance provider, each Operations role is unique as they service different products. Being conceptual, compassionate and inventive are characteristics that Income truly values in the Operations team as we strive to deliver value to our policyholders through our product offerings.

Conceptual

Income’s Operations team has a huge impact on the product development process, the decisions made during policy claims and the overall quality of service provided to policyholders. Hence, having compassion is key in differentiating Income from other insurance providers, especially when products and pricing amongst the industry are virtually homogenous.Compassionate

Income’s Operations team has a huge impact on the product development process, the decisions made during policy claims and the overall quality of service provided to policyholders. Hence, having compassion is key in differentiating Income from other insurance providers, especially when products and pricing amongst the industry are virtually homogenous.Inventive

Income’s Operations team has a huge impact on the product development process, the decisions made during policy claims and the overall quality of service provided to policyholders. Hence, having compassion is key in differentiating Income from other insurance providers, especially when products and pricing amongst the industry are virtually homogenous. -

Q:What jobs are available under Operations?

A:If you’re keen to explore an Operations role, please check out our job portal here.

Actuarial

-

Q:What sets Actuarial at Income apart from other Insurers?

A:

At Income, our Actuarial team works very closely with Product Development and Risk Management in technical pricing, the selection of product features and recommending new product solutions. While this role traditionally finds most of its answers in numerical formulas, Income is doing things differently by leveraging innovation and technology to drive systematic improvements in actuarial methodology, systems and processes. With the adoption of agile methodology, the Actuarial team has evolved greatly in the recent years, producing excellent results. To complement the direction in which our Actuarial team is heading, we value Actuaries who are adaptable, enthusiastic about technology and last but not least, fun seeking!

-

Q:Adaptable

A:Income’s Actuarial team constantly looks for improved ways of working to maximise their output. Switching from a waterfall to agile approach of working, the team is constantly stretched to adapt and improve so as to produce excellent results. As the industry evolves, our Actuarial team needs to be able to respond and adapt to these changes, with the goal of keeping Income at the forefront of the industry.

-

Q:Technology Enthusiast

A:Technology has enabled our Actuarial team to provide fresh business insights and achieve results within a quicker time. Technology-enabled automated reporting workflows has led to a reduction of manual workload. In addition, technology has allowed the team to use the latest machine learning platforms to understand patterns behind insurance data. The Actuarial team are all technology enthusiasts as they have seen the advantages of incorporating technology into their day-to-day work.

-

Q:Fun Seeker

A:Income’s Actuarial team challenges the industry stereotype – They’re not all just about numbers. Our Actuarial team is a fun bunch with a quirky sense of humor, and self-proclaimed to be the noisiest bunch in the office. You can look forward to a great sense of belonging and a team that enjoys after-work activities like badminton or karaoke.

-

Q:What jobs are available under Actuarial?

A:If you’re keen to explore Actuarial roles, please check out our job portal here.

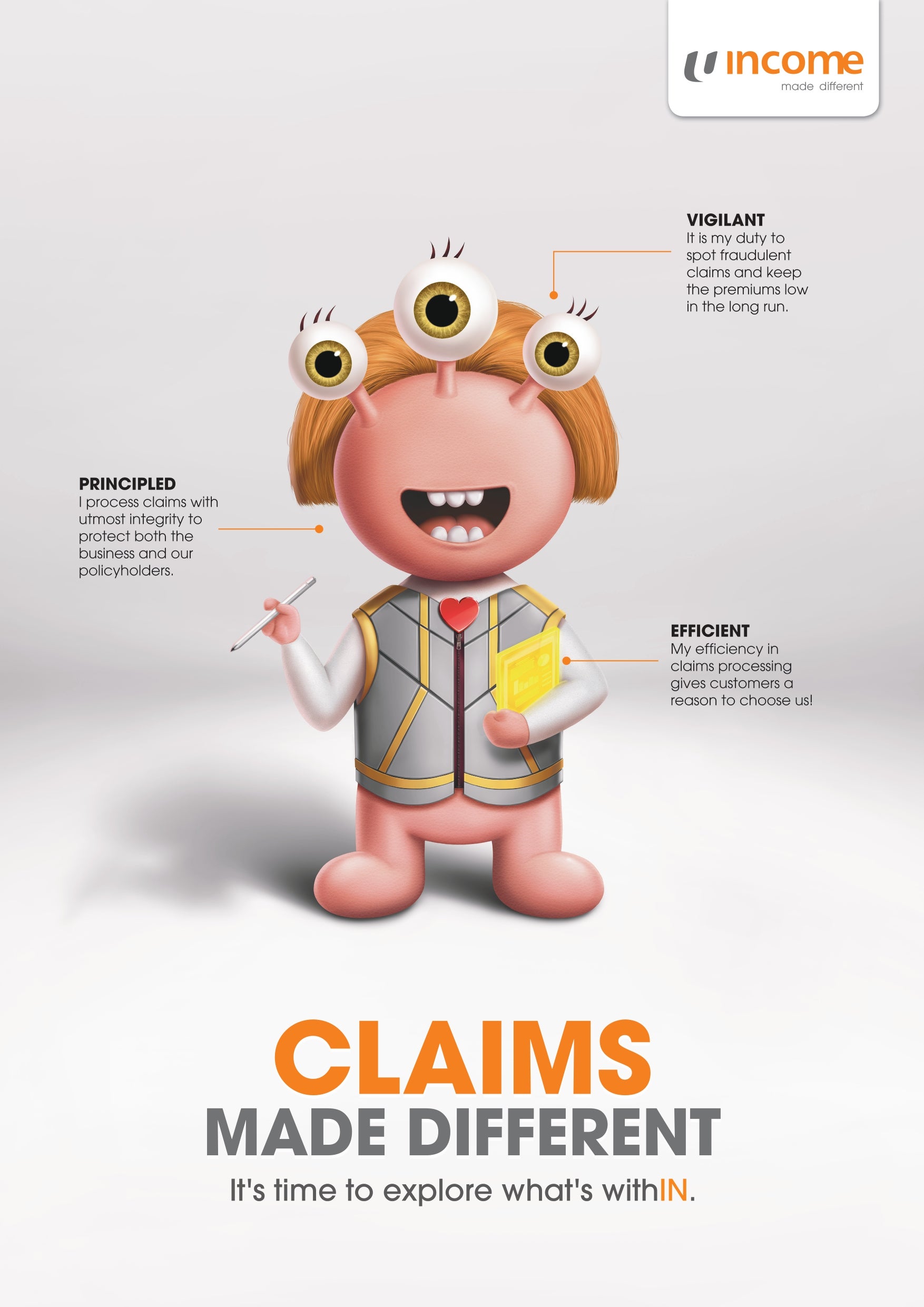

Claims

-

Q:What sets Claims at Income apart from other Insurers?

A:

While other insurers place a large emphasis on the product development phase to deliver new products to bring to market, Income recognises that a high priority must also be placed on our customers’ claims experience. We look for our Claims team to be vigilant, principled and efficient.

-

Q:Vigilant

A:Being vigilant and spotting fraudulent claims not only upholds the integrity of the insurance business, but also allows Income to keep our premiums affordable in the long run for the greater benefit of all Income policyholders. Vigilance on the job allows our Claims team to go beyond just the administrative processing of each claim, to being a vital player in keeping the business sustainable in the long run.

-

Q:Principled

A:Every customer’s case and claim is unique – There is a need to be principled in assessing each of these claims, and to have utmost integrity protecting both the interests of policyholders and the business. We aim to give policyholders the confidence in our decision-making process, how their payouts are derived, and to safeguard their premiums against fraud.

-

Q:Efficient

A:While being efficient is something we desire from all at Income, it is an especially important trait for the Claims department. The two most crucial interactions a customer would have with us is buying a policy, and claiming against that policy, and we want to make both as pleasant as possible. Being efficient allows for claims to be paid out within a quick turnaround time, giving our policyholders the assurance that Income is able to pay out the assured sum when they need it most.

-

Q:What jobs are available under Claims?

A:If you’re keen to explore Claims roles, please check out our job portal here.

Customer Service

-

Q:What sets Customer Service at Income apart from other companies?

A:

At Income, we take pride in giving our customers the best customer experience possible. In addition to the value-added services as part of our policies, we believe that both our branch services and contact centre serve as important touch points for our customers. To ensure we remain accessible to our customers, we have a strong network of main and lite branches across the island for financial planning and servicing needs. Our award-winning contact centre also enables customers to have their queries addressed quickly and competently. We remain committed to providing the best customer service by looking for optimism, creativity in thinking and warmth in our Customer Service team.

-

Q:Optimism

A:At Income, our Customer Service team is Income’s biggest service ambassador. With a passion to constantly provide the best quality customer service to both internal and external customers, optimism is essential. Facing challenging personalities and situations are common within the customer service industry, but a dose of optimism helps to solve problems effectively by looking for the best in people and the bright side of things.

-

Q:Creativity

A:No training manual will ever be comprehensive enough to prepare our Customer Service team for every unique customer situation they will encounter. Hence, it’s essential for our Customer Service team to have the ability to think on their feet and find a unique solution for each case and for each customer.

-

Q:Warm

A:At Income, we strive for customer interactions to feel like genuine conversations rather than transactions. Going beyond resolving each case, we want our customers to feel the warmth and willingness from our staff to address their concerns. This is what makes our Customer Service team the top contributor for compliments within Income, and this is best fuelled by the warmest and friendliest personalities out there.

-

Q:What jobs are available under Customer Service?

A:If you’re keen to explore Customer Service roles, please check out our job portal here.

Digital Transformation

-

Q:What sets the Digital Transformation Office at Income apart from other companies?

A:

Legacy tools and old systems are often associated with the Insurance industry. In our spirit of ‘made different’ and disrupting the industry, Income recognises the benefits of digital adoption and innovation as we consciously work towards being Singapore’s leading digital insurer. Income has digitised its core business by making life insurance available online and introducing a robo advisor, and to continuously look at the white space for product innovation, such as Southeast Asia’s first micro-insurance for critical illness protection. As we continue to innovate and be an industry game-changer, it is important that we have people who are relentless, disruptive and agile in thinking.

-

Q:Relentless

A:To work at the forefront of digital innovation, there is a need to embrace speed over perfection, to work with the unknown and to a willingness to fail fast and learn fast. Digitising the core business, building new digital business models and creating new products and channels through partnerships may not be smooth sailing journey, but only the most relentless people see success and tangible outputs in their pursuit of digital transformation.

-

Q:Disruptive

A:Due to the success of traditional models and the risk-averse outlook the insurance industry is steeped in, it has resisted waves of technological innovation. At Income, we believe there is a need to find legitimate ways to push the boundaries and challenge the status quo so that we can be at the forefront of supporting other businesses and customers, in order to reach a paradigm shift in the insurance sector.

-

Q:Agile Thinker

A:An agile thinker is able to put the customer at the core of all solutions – delivering value, utility and continuous optimisation. As we champion digital disruption within Income, it is important that we keep ahead of technologies and methodologies that enable us to continuously increase profit margins, streamline operations and shorten our time to market.

-

Q:What jobs are available under Digital Transformation?

A:If you’re keen to explore a Digital Transformation role, please check out our job portal here.

Finance

-

Q:What sets Finance at Income apart from other companies?

A:

At Income, we see our Finance team playing a vital strategic role beyond being a support function to being a business partner that helps all departments achieve their corporate goals by providing financial strategic insights and guidance. To fulfil this role, being strategic, business savvy and tenacious is crucial.

-

Q:Strategic

A:Strong analytical skills allow our Finance team to decipher, interpret and evaluate what various sources of data mean for our business each year. They transform these numbers into a meaningful plan, enabling Income to tangibly demonstrate the corporate performance we aim for each year.

-

Q:Business Savvy

A:The Finance team works closely with all departments across Income to ensure they understand how each business function contributes to our organisation’s success. Being a business partner requires one to be business savvy – steering the organisation forward by providing relevant insights and recommendations to each department that go beyond just improving the business bottom line.

-

Q:Tenacious

A:Working with every department across Income requires building multiple relationships with different business functions. Each business unit is unique , and so are their financial challenges. As a member of the Finance team, being patient and tenacious is vital in ensuring that our financial strategy and goals are aligned and exemplified across our organisation.

-

Q:What jobs are available under Finance?

A:If you’re keen to explore a Finance role, please check out our job portal here.

Governance

-

Q:What sets Governance at Income apart from other companies?

A:

At Income, we believe that strong governance is the heart of any successful business. As an insurance cooperative, it is of upmost importance for Income to maintain a legal and ethical standing in the eyes of the public and our policyholders. To honour our promise of providing advice you can trust, we need our Governance team to be farsighted, protective and fair-minded.

-

Q:Far Sighted

A:We believe that identifying and pre-empting potential issues before they occur requires a Governance team that has strong foresight and a thorough overview of the organisation.

-

Q:Protective

A:Protecting the business goes beyond just protecting Income as a company – Being protective includes looking after the interests of our policyholders, employees and our reputation as a trusted insurer. This requires the Governance team to implement and uphold the necessary work processes that safeguard everyone’s interests.

-

Q:Fair-Minded

A:Governance roles require fair-mindedness. This means being rational, objective and free of personal bias in the face of many challenging decisions to make and situations to resolve. This allows the Governance team to make credible decisions that are trusted by all parties in every situation.

-

Q:What jobs are available under Governance?

A:If you’re keen to explore a Governance role, please check out our job portal here.

Human Resources

-

Q:What sets Human Resources at Income apart from other companies?

A:

The Human Resources (HR) team nurtures the organisation’s most important resource – Our people. Being resilient, bold and daring, and innovative, Income's HR is constantly looking to future proof our talent needs to ensure we have the best personalities and skills to realise our organisation's goals.

-

Q:Resilient

A:Change in any organisation is inevitable for it to grow stronger, be it through changes in structure, people or processes. Being the cheerleader and implementer of these changes is never easy and requires the HR team to be resilient in pushing these changes through to adoption.

-

Q:Bold and Daring

A:At Income, we value challenging the status quo. As a catalyst of change, the HR team needs to be bold and daring when developing ideas and solutions that can steer the organisation in the right direction. They also need to be champions and role models in propagating in each new initiative.

-

Q:Innovation Initiators

A:The spirit of innovation and advancement runs through every department in Income, and especially so within our HR team as champions of improving work lives within Income. The team has implemented several innovations such as a recruitment chatbot and a mobile application to access useful HR services on the go, which has overall allowed us to be more efficient and accessible.

-

Q:What jobs are available under Human Resources?

A:If you’re keen to explore a Human Resources role, please check out our job portal here.

Information Technology

-

Q:What sets Information Technology at Income apart from other companies?

A:

Information Technology (IT) plays a crucial role as Income moves towards the goal of being a digital insurer. IT not only allows Income to be effective in business operations, it is also the catalyst for change in how we manage, analyse and utilise our data to provide the best customer experience. To achieve this, our IT team needs to be opportunity seekers, swift responders and visionary individuals.

-

Q:Opportunity Seekers

A:As an organisation looking to digitise its business, IT is constantly on the lookout for new opportunities and technologies to improve the organisation’s IT infrastructure. As a team that works with various departments and each of their unique IT needs, a strong spirit of collaboration and problem-solving is important too.

-

Q:Visionary

A:In a competitive and quickly-evolving landscape, just being up-to-date is not sufficient when it comes to IT. To keep us at the forefront of the industry, there is a need to be forward looking and equipped with new knowledge to successfully implement IT solutions that support Income’s digital transformation roadmap.

-

Q:Swift Responders

A:Technology is integral to every part of business, from the office tools and systems that we use, to the various touchpoints through which our customers interact with us every day. It is important for IT to respond swiftly to so as to ensure Income puts its best foot forward at all times.

-

Q:What jobs are available under IT?

A:If you’re keen to explore an Information Technology role, please check out our job portal here.

Marketing

-

Q:What sets Marketing at Income apart from other companies?

A:

Income has a diverse team of marketers that comprises various roles and skill sets, allowing the team to collectively deliver results amidst an ever-changing landscape. Within the highly regulated space of insurance, our marketing team has continuously managed to surprise audiences and get them talking about financial planning . Our winning formula involves being data driven, having a focused vision, and being fun loving.

-

Q:Data Driven

A:Being data driven allows our marketing campaigns to be effective. It enables the Marketing team to understand what customers want, who they are, how best to speak to them, and what outcomes we want from them. Marrying data with a strong point of view, and bringing it to life through relatable content allows us to leave a strong impression on an audience that is increasingly harder to captivate.

-

Q:Focused Vision

A:Focused vision is all about delivering results against clear outcomes without being distracted. As a marketer, it is easy to get swayed by the latest trends, technologies or creative formats which may not always bring the right results or return on investment. With a clear understanding of business objectives, our Marketing team ensures that our creative work is measureable and effective.

-

Q:Fun-tastic

A:FUN-tastic! At Income, the Marketing team loves having fun and radiating excitement. New tools, new ideas and new breakthroughs keep the team on their toes. Genuine partnerships are key too, as the team always has a ball of a time cracking new ideas with agency partners, supporting other departments on marketing campaigns or just enjoying each others’ company as a team.

-

Q:What jobs are available under Marketing?

A:If you’re keen to explore a Marketing role, please check out our job portal here.

Orange Force

-

Q:What sets the Orange Force at Income apart?

A:

Orange Force is Income’s accident response team that renders onsite assistance to our policyholders who are involved in motor accidents. As the largest motor insurer in Singapore, Orange Force is a value-added service to ensure our customers’ safety, interests and well-being are taken care of in their hour of need. As part of our commitment to providing an unprecedented level of customer service to our policyholders, we have built an Orange Force team that is investigative, composed and empathetic towards our policyholders.

-

Q:Investigative

A:Arriving at accident scenes to assist policyholders often involves ensuring their interests are protected – This sometimes involves the need to accurately report the accident and to aid in negotiating settlement options with the other party. It is important for the Orange Force team to take an investigative approach so that Income is able to fairly assess situations for the benefit of both the company and our policyholders.

-

Q:Composed

A:The site of a motor accident is often accompanied by high levels of stress, anxiety and sometimes even trauma. The Orange Force team is equipped with skills that allow them to maintain their calm and composure amidst this environment, so they can provide clear instructions, sound advice and hands-on assistance to our policyholders when they need us most.

-

Q:Empathetic

A:Income’s Orange Force team displays high level of empathy by constantly putting themselves in customer’s shoes. In these highly emotionally charged situations, being able to understand the customer’s emotions can help greatly in calming them down while providing professional assistance. Showing empathy goes beyond delivering the job scope, it is something Orange Force prides themselves on – Providing quality service for our policyholders.

-

Q:What jobs are available under Orange Force?

A:If you’re keen to explore an Orange Force role, please check out our job portal here.

Sales

-

Q:What sets the Sales team at Income apart from other companies?

A:

Income’s Sales team encompasses various channels that are each structured differently, but they share the same goal and heart in all they do. We look to our Sales team to constantly engage our current and potential customers so as to ensure their financial planning needs are met. As we work towards minimising the protection gap in Singapore, we want a Sales team that is dedicated, driven and vested in building genuine relationships.

-

Q:Dedicated

A:Income values all of our policyholders and the client-advisor relationship that goes beyond signing a policy. Our Sales team honors the trust that clients place in us by exemplifying the actions of a trusted financial planner rather than a salesman – one that cares about their customers’ changing needs over time and shares knowledge that goes beyond the realm of insurance to ensure our customers have a sound financial plan.

-

Q:Driven

A:A driven Sales force provides the best level of financial knowledge and solutions to our customers. This innate desire drives our Sales team to constantly evaluate how Income can make a difference to our customers’ lives through providing tailored financial planning solutions.

-

Q:Relationship-Oriented

A:Our Sales team is one that has a sense of purpose, building genuine and long term relationships with our customers with a key focus on improving their financial health. We focus on nurturing and value-adding to the client-advisor relationship, and building a team that is willing to go above and beyond for their customers, in the same way they would do for their family and friends.

-

Q:What jobs are available under Sales?

A:If you’re keen to explore a Sales role, please check out our job portal here.

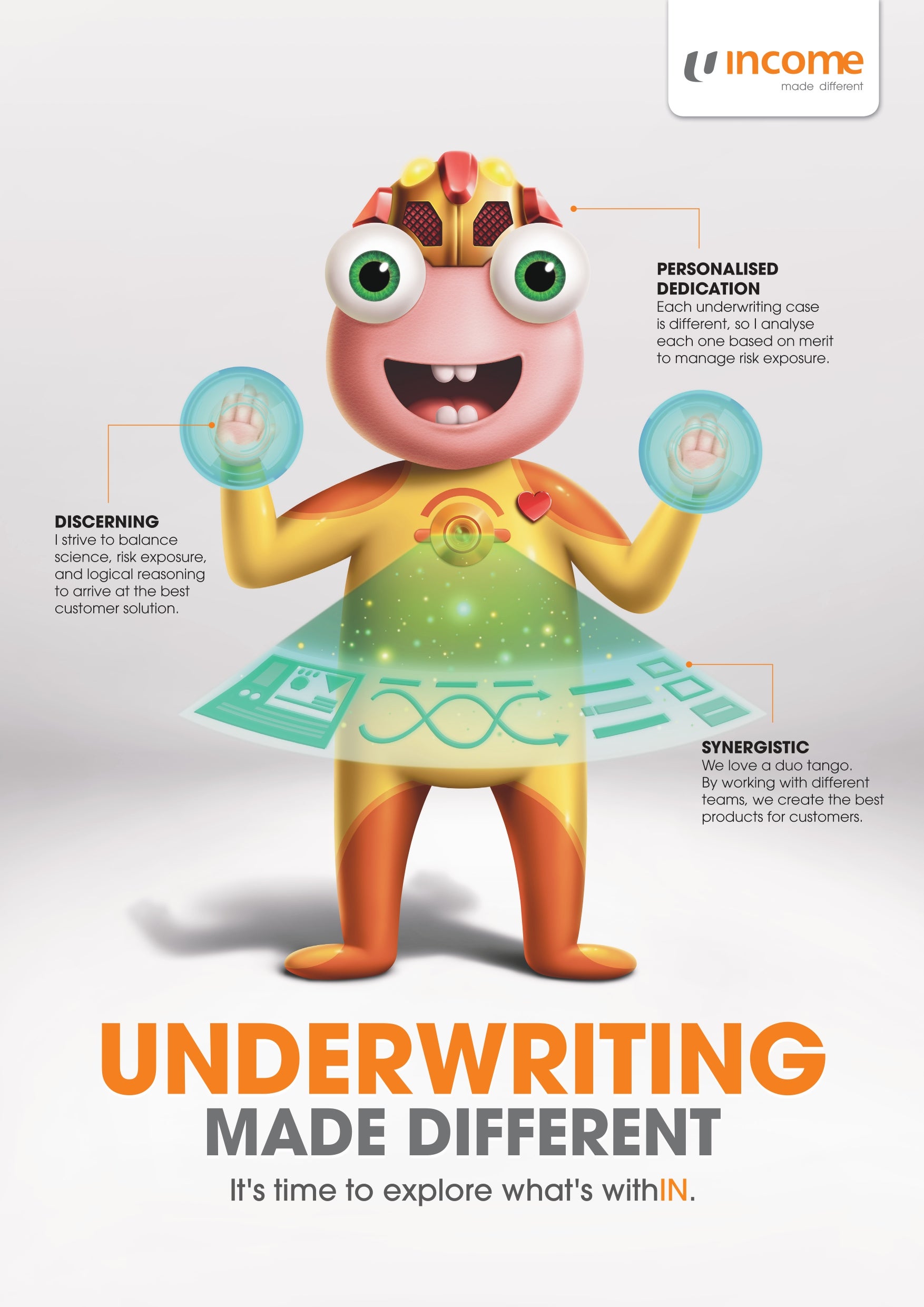

Underwriting

-

Q:What sets the Underwriting team at Income apart from other insurers?

A:

As a social enterprise, Income constantly looks at how to address protection gaps in Singapore. The Underwriting team plays a vital role in enabling this by recalibrating certain underwriting processes to insure a greater segment of our society. For instance, the team introduced a health underwriting questionnaire targeting seniors, specifically to address pain points and barriers that senior citizens face when applying for insurance. This resulted in a shorter and easier process to identify their medical ailments and conditions, leading to more confidence in elderly when applying for insurance. To continue making a social impact, we desire for our Underwriting team to have personalised dedication, to be discerning and synergistic.

-

Q:Personalised Dedication

A:As every prospective customer has a unique background and history, our Underwriters need to take a personalised approach when evaluating each application and recommending policy premiums. It is important for our Underwriters to recognise that each case is different and to spend the time and effort needed to analyse each case as needed.

-

Q:Discerning

A:There is no fixed formula to underwriting. It is a balance of science, assessing risk factors and logical reasoning. Hence, discernment is important in making sound and reliable judgment calls for each case so that we can reach the best outcomes for both the business and our customers.

-

Q:Synergy

A:Underwriters typically work with many stakeholders within Income, such as Operations and Actuarial teams. Externally, the Underwriting team is also required to work closely with professionals such as medical experts. Hence, it’s important for Underwriters to have synergy with other departments and individuals, allowing Income to create products that cater to a wide spectrum of customers’ needs.

-

Q:What jobs are available under Underwriting?

A:If you’re keen to explore an Underwriting role, please check out our job portal here.