How Much Allowance Should I Give My Child For Primary School?

I gave my child her first wallet right before she started Primary 1. It was a tri-fold wallet with a zipped coin and bills compartment. She proudly labelled her name, primary school, and contact details before slipping the card in a transparent ID slot.

She couldn't wait to fill her wallet with money – her mind probably filled with all the yummy snacks, pencils and erasers she could buy.

Oh yes, I thought, it was time to teach her how to save and budget.

Photo: Jenny Tai

A child's allowance teaches money management

“Students without a financial education are more likely to have low credit scores and other financial problems,” this CNBC article reported. In light of that, it is essential for parents to engage in financial conversations with their kids. But don’t just talk – let them practice.

That’s why a great way to instil money management habits early is to give your child an allowance. Instead of simply topping up their money daily or weekly, go one step further: Help to oversee their spending by creating a simple budget and plan for them to save aside some of their allowance.

To sum up: The way to increase your child’s confidence in their money management skills is to give them hands-on experience and oversee their spending. They require practice, but they also require guidance.

When you give your child the responsibility to handle daily expenses (such as food from the school canteen), you are empowering them. They get to practice how to start financial planning – an essential skill that will help them succeed later in life.

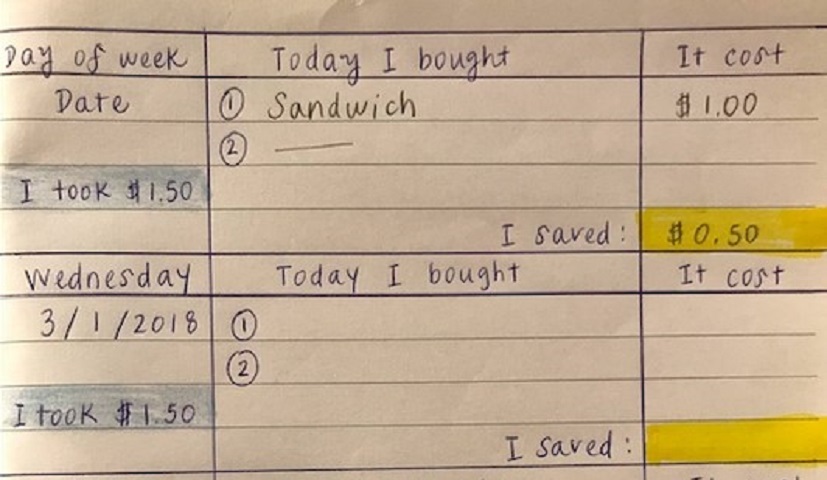

Photo: Jenny Tai

Try this tip: You may get your child in the habit of filling in a budgeting notebook, and writing down how much money they were given that day, what they bought, how much it cost, and how much they saved. Reward their good saving behaviour with incentives such as stickers or additional play-time.

How much allowance to give

Deciding on the right amount depends on several factors, including your family's financial circumstances, your child's age, and what you agree that the allowance should be used for (i.e. canteen food, transportation, books, stationary, etc.).

Based on my informal poll at my child's primary school, the average daily allowance in her P1 class is $2.20. This is not far off from the poll conducted by DollarsAndSense, which found that in Singapore, the average daily allowance for lower primary school children is $2.25 and $3.10 in upper primary school children.

Image: iStock

Daily versus weekly allowance

A daily child's allowance may work best for those in lower primary years. Once they show that they are capable of managing their own money, try transitioning to a weekly allowance. This gives them more independence and practice in deciding how to best allocate their money. In addition, they learn how to make trade-offs (i.e. If they splurge one day, they have to make up for it by being frugal on the other days.)

Try this tip: To prevent over- or under-budgeting, begin by visiting your child's primary school and taking photos of canteen menus and prices. Work out how much they would need for their food. Then, add a bit more to that amount, so that they would be able to save a little on top of that. (If the allowance was only enough to cover their food, then it would be difficult for them to have any left over for their savings.)

Photo: Jenny Tai

Giving an allowance to yourself

As parents, sometimes we become so preoccupied with providing what is best for our children and their future that we may forget to plan for our own future as well.

In the same vein as giving our children allowance and empowering them with financial management skills from young, as adults, we should also set an allowance for ourselves.

When planning for your own allowance, think of the big picture: Best to plan an allowance for our current and future financial commitments (such as future education expenses for our children), as well as for our retirement.

We all want to think that once we retire, we can finally start living the way we want to. But until we take financial planning seriously, how can we be certain that we can afford to ride out our golden years the way we imagine -- whether it's embarking on camping adventures, galavanting off to Paris and Rome, or finally having unlimited "me-time"?

Image: iStock

Try this tip: Financial planning may not be as complicated as you think. In fact, there are several tools to help you decide how much to set aside monthly right now so that you can achieve your desired retirement income. Start by using this handy retirement calculator.

Feel free to have a chat with Income's advisors to get a better grasp of how to plan for that retirement you deserve.

Your golden years start with financial planning

Sure, financial planning may feel overwhelming or confusing to some. I remember how flustered my daughter was when I first started introducing the practice of saving and spending. Suddenly, money wasn't something abstract anymore. It needed to be tracked and set aside.

Eventually though, she got into the habit of saving up bits of her allowance and filling up her piggy bank a coin at a time. Once managing money was no longer a mystery to her, it became less scary – and more like a rewarding challenge. In fact, she puffed up with pride at how heavy her piggy bank was becoming and how loudly it clinked.

If children can get the hang of managing their allowance and benefiting from their savings, you can too. Adults in their 20s to 30s have the advantage of getting a head start in saving for their retirement allowance early. Plus, saving and investing from a young age provides more time for your investments to grow.

Image: Unsplash

Try this tip: Look into how to start saving early, prepare for emergencies, and choose a suitable retirement plan that fits your needs.

After all, with the kids all grown up by then, you deserve to slow down and enjoy all that life has to offer. Start early and take control of the way you spend your golden years now! Do something today that your future self will thank you for.

Important Notes:

This article is meant purely for informational purposes and should not be relied upon as financial advice. The precise terms, conditions and exclusions of any Income products mentioned are specified in their respective policy contracts. For customised advice to suit your specific needs, consult an Income insurance advisor.

This advertisement has not been reviewed by the Monetary Authority of Singapore.