Guide to Your MediSave Account in 2022: Its Uses, Contributions, Limits & More

What is MediSave and who has it?

MediSave is a savings account that’s part of a set of CPF accounts. It is compulsory for you and your employer to contribute to your MediSave account. For employees, this money is set aside automatically from your monthly salary. All Singaporeans and PRs residing and working in Singapore are required to make MediSave contributions. Singaporeans residing and working overseas do not have to make compulsory MediSave contributions, but they are free to make voluntary contributions.

What can you use MediSave for?

Money in your MediSave account can be used for your healthcare needs such as medical treatments, dental care, MediShield Life, Integrated Shield Plans and ElderShield or CareShield Life with certain limits.

MediSave can be used to pay for your personal or approved dependents’ healthcare needs. It is meant to help you save for future medical expenses in your later years. It can only be used for certain healthcare and medical expenses like:

- Hospitalisation and surgery (including wisdom tooth surgery)

- Palliative care

- Outpatient treatments

- Chronic disease management

- Health screenings

- Vaccinations

- Having a baby

- Health insurance (MediShield + Integrated Shield) premiums

- Disability insurance (CareShield + ElderShield) premiums

However, there are limits to how much you can withdraw. Here is a quick snapshot of what you can withdraw for different purposes:

- Inpatient care:

- Minimum 8-hour admission - up to $550 for first 2 days, $400 per day from third day onwards

- Psychiatric episodes - up to $150 per day, maximum of $5,000 per year

- Day surgeries - up to $300 per day including surgical limit ($250-$7,550)

- Approved community hospital – up to $250 per day, maximum of $5,000 per year

- MediSave Maternity Package – up to $550 for first 2 days and $400 per day from third day onwards + $900 for pre-delivery medical expenses

- Outpatient care:

- MediSave500/MediSave700 Scheme – simple chronic conditions: up to $500; complex chronic conditions: up to $700 per patient

- Selected childhood and adult vaccinations

- Health screenings – mammograms for women above 50 years old and newborn screening tests in outpatient setting

- Patients above 60 years old + spouse - $300 per patient per year

- Renal dialysis treatment - $450 per month

- Radiotherapy – $80-$2,800 per treatment

- Radiosurgery treatment – Up to $7,500 per course

- Chemotherapy – Up to $1,200 per month with MediShield Life claim limit above $5,400. Up to $600 per month for other treatments

- Anti-retroviral treatment for HIV – up to $550 per month per patient

- Immuno-suppressants after organ transplants - $300 per month per patient

- Autologous bone marrow transplant – up to $2,800 per year per patient

- Long-term care:

- Inpatient hospice palliative care services – up to $250 per day (general palliative care) and up to $350 per day (specialised palliative care)

- Home palliative and day hospice care – combined lifetime withdrawal limit of $2,500 per patient

- MediSave Care – withdraw up to $200 per month for long-term care needs

For more information and up to date limits, please refer to MediSave’s website.

What’s the difference between MediSave and MediShield?

MediSave is a savings account funded by CPF contributions. It helps all Singaporeans and Permanent Residents (PR) save for their and also their dependents’ future healthcare needs.

MediShield Life is a personal health insurance plan that covers all Singaporeans and PRs from birth. It boosts your MediSave account’s coverage and helps you pay less for expensive hospital bills in B2/C class wards (6-8 beds in a room). MediShield Life can also be used to help pay for expensive outpatient treatments like chemotherapy or dialysis.

The savings in your MediSave account can eventually be depleted while MediShield Life covers you for life. There’s also no limit on how much you can claim in your lifetime (with annual limits).

MediShield Life provides coverage for pre-existing medical conditions such as cancer, blood disorders, heart diseases and more. There’s also the potential for coverage to include treatment for attempted suicide, substance abuse and alcoholism in the future - traditional health insurance plans usually exclude these conditions.

You can pay for your MediShield Life premiums with MediSave. MediSave can also be used to pay for a portion of your Integrated Shield Plans, a type of private hospitalisation insurance that helps to reduce your out-of-pocket healthcare expenses.

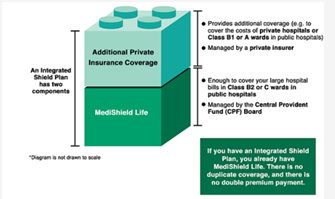

An Integrated Shield Plan has 2 components:

MediShield Life

+

Additional Private Insurance coverage (for example: to cover costs of private hospitals or A/B1-type wards in public hospitals)

The MediShield Life portion of your Integrated Shield Plan is fully payable by MediSave. The additional private insurance portion is also payable by MediSave and any excess is paid in cash.

- $300 per year - aged 40 years and below on their next birthday

- $600 per year – aged 41-70 years on their next birthday

- $900 per year – aged 71 years and above on their next birthday

How much do I need to contribute to my MediSave in 2022?

MediSave account contributions vary depending on your monthly salary, business or work income, and whether you’re an employee or self-employed.

MediSave Account contributions for salaried employee

A percentage of your salary is set aside and deposited into your CPF accounts – employee CPF contribution.

Your employer is also required to contribute to your CPF accounts over and above your salary. This contribution does not affect your take-home pay after CPF contributions. Here are the current rates of CPF contributions for salaried employees:

| CPF Contribution Rates | |||

| Age | By employer (calculated as % of your wage) | By employee (calculated as % of your wage and set aside from your salary) | Total (calculated as % of your wage) |

| 55 and below | 17% | 20% | 37% |

| Above 55-60 | 14% | 14% | 28% |

| Above 60-65 | 10% | 8.5% | 18.5% |

| Above 65-70 | 8% | 6% | 14% |

| Above 70 | 7.5% | 5% | 12.5% |

Provided the employee has a salary over $750 per month, this is how your contributions will be distributed between your CPF accounts by age:

55 years old and below:

- Ordinary Account – Savings can be used for housing and education.

- Special Account – Retirement savings.

- MediSave Account – Savings for healthcare, dental care, MediShield Life Premiums and medical insurance premiums.

When you turn 55, Ordinary Account and Special Account will merge to become your Retirement Account. Singaporeans and PRs aged 55 and above will have:

- Retirement Account – Retirement savings.

- MediSave Account – Savings for healthcare, dental care, MediShield Life Premiums and medical insurance premiums.

Here are the allocation rates according to your age:

| Allocation rates (% of wage) | |||

| Age | Ordinary Account | Special Account | MediSave Account |

| 35 and below | 23 | 6 | 8 |

| 36-45 | 21 | 7 | 9 |

| 46-50 | 19 | 8 | 10 |

| 51-55 | 15 | 11 | 11 |

| 56-60 | 12 | 5 | 11 |

| 61-65 | 3.5 | 5 | 10 |

| 66-70 | 1 | 2 | 11 |

| Above 70 | 1 | 1 | 10 |

To demonstrate this allocation, let’s look at Matthew, a 36-year-old engineer working full-time for a company in Singapore.

Monthly salary = $5,000

Matthew’s CPF contribution = $1,000 (20%) // Take home pay = $4,000

Employer’s CPF contribution = $850 (17%)

Total monthly CPF contribution = $1,850

Matthew’s monthly CPF contribution will be allocated as such:

| Total | $1,850 | |

| Ordinary Account | 21% x 5,000 | $1,050 |

| Special Account | 7% x 5,000 | $350 |

| MediSave Account | 9% x 5,000 | $450 |

MediSave Account contributions for self-employed individual

If you’re self-employed and earning a Net Trade Income of more than $6,000, you are required to make annual MediSave Account contributions. This amount depends on your age and work or business income as declared on your IRAS tax return. Here’s an easy way to calculate your CPF Self-Employed MediSave Contribution.

You are not required to contribute to your CPF Ordinary Account of Special Account but it is highly encouraged. You can also contribute more than required to your MediSave Account.

Here are the compulsory MediSave Account contribution rates for self-employed individuals:

| Age as of 1 January 2021 | ||||

| Annual net trade income | Below 35 years | 35 to below 45 years | 45 to below 50 years | 50 years and above |

| Above $6,000 to $12,000 | 4% | 4.5% | 5% | 5.25% |

| Above $12,000 to $18,000 | 4-8% | 4.5-9% | 5-10% | 5.25-10.5% |

| Above $18,000 | 8% (max $5,760) | 9% (max $6,480) | 10% (max $7,200) | 10.5% (max $7,560) |

To demonstrate this, let’s look at Nadia, a 28-year-old freelance piano teacher.

Annual income: $40,000

Annual MediSave Account contribution: 8% x $40,000 = $3,200

MediSave Account interest

From now till 30 September 2022, the savings in your MediSave Account will earn a base rate of 4% per annum. This is reviewed on a quarterly basis and updated interest rates can be found here.

You receive an additional 1% interest per annum on the first $60,000 of your combined balances in your Retirement Account, Ordinary Account (with a cap of $20,000), Special Account and MediSave Account.

When you reach the age of 55, you will earn an additional 2% interest per annum on the first $30,000 and 1% per annum on the next $30,000 of your combined balances (capped at $20,000 for your Ordinary Account).

You can also do voluntary top ups to your MediSave Account to enjoy tax reliefs. To check on the balance in your MediSave account, login to myCPF Online Services here or download the myCPF mobile application for iOS and Android and log in using your SingPass.

What is the Basic Healthcare Sum and what happens when you reach it?

Basic Healthcare Sum is basically like your MediSave Account limit. It is the maximum amount of money that your MediSave Account can hold. Once the Basic Healthcare Sum is reached, any money that would usually go to your MediSave Account will flow into your Special Account or Retirement Account instead.

The Basic Healthcare Sum is reviewed annually and once you reach 65 years of age, it remains fixed for the rest of your life. Basic Healthcare Sum for 2022 is $66,000. Thus, if you turn 65 in 2022, your MediSave Account limit is $66,000 for the rest of your life.

How to make a MediSave claim

When using your MediSave funds to pay for healthcare or dentalcare costs at a MediSave-accredited medical institution, you will need to submit a Medical Claims Authorisation Form (Single Institution) to the relevant healthcare provider.

This form should be submitted whether or not you are also being covered by an Integrated Shield Plan and/or MediShield Life. The healthcare provider will handle any additional paperwork on their end. You should see your MediSave withdrawals reflected on your final bill.

If you wish to use your own MediSave funds to pay for future healthcare costs at all public healthcare institutions, you can submit a Medical Claims Authorisation Form (Multiple Institutions), or do this electronically through HealthHub. Thereafter, your MediSave funds will be used to pay healthcare costs at all eligible healthcare providers whenever permitted by the system.

When using MediSave to pay for Integrated Shield Plan premiums, the agent or insurer you are purchasing your plan through will handle all the necessary paperwork. The portion of your premiums to be paid through MediSave will thereafter be automatically deducted every year.

Frequently Asked Questions about MediSave Account

How do you check your MediSave Account balance?

Log in to mycpf using your SingPass details. From there, you’ll see the balance of your MediSave Account along with your other CPF accounts. To see how much is available for chronic diseases and outpatient treatment, you can find it under ‘My Statement’ where there’s a MediSave section.

What happens if you’ve not contributed to your MediSave Account?

You may not have enough to pay for your future healthcare needs. It is legally compulsory for self-employed individuals to make MediSave contributions. Those who do not contribute can be fined up to $2,500 for first time offenders and $10,000 for subsequent offences. You may not be able to renew your ACRA (Accounting and Corporate Regulatory Authority) or LTA (Land Transport Authority) licence which prevents you from keeping your bank accounts open. For partnerships, all partners need to contribute to MediSave before you are able to renew your business licence(s).

What happens to unused funds in your MediSave Account?

These funds will stay in your Medisave Account and accumulate interest as mentioned above.

What happens to your MediSave Account after you die?

For those with a valid CPF Nominee, the CPF board will contact them within 15 working days from the date that the board is notified of the death. The CPF monies, including those from the MediSave Account will be distributed to the CPF Nominee.

For those who do not have a CPF Nomination, the CPF monies will be distributed according to the intestacy/inheritance laws of Singapore.

Conclusion

Your MediSave Account can provide a cushion for your and your dependents medical costs. However, as it doesn’t cover all conditions, it may not be enough to rely on your MediSave Savings alone.

Maximise your MediSave funds by getting a comprehensive Integrated Shield Plan from Income. Ensure that you and your loved ones are comprehensively covered to have peace of mind in the event of any healthcare needs.

This article is meant purely for informational purposes and should not be relied upon as financial advice. The precise terms, conditions and exclusions of any Income Insurance products mentioned are specified in their respective policy contracts. For customised advice to suit your specific needs, consult an Income Insurance advisor. This advertisement has not been reviewed by the Monetary Authority of Singapore.

These policies are protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact Income Insurance or visit the GIA/LIA or SDIC websites (www.gia.org.sg or www.lia.org.sg or www.sdic.org. sg).