Why You Need Insurance – Even If You’re Young And Healthy

As a young and healthy individual today, you might be feeling that you don’t need insurance. However, health issues can strike anyone, at any time. From minor ailments like appendicitis to life-threatening critical illnesses, you will never know what life may throw at you.

Beyond the physical and psychological impact of such emergencies, you will also have to deal with the financial burden they pose. For example, if you are not able to work during your recovery or if you are left permanently disabled after an illness or accident, your income could just disappear.

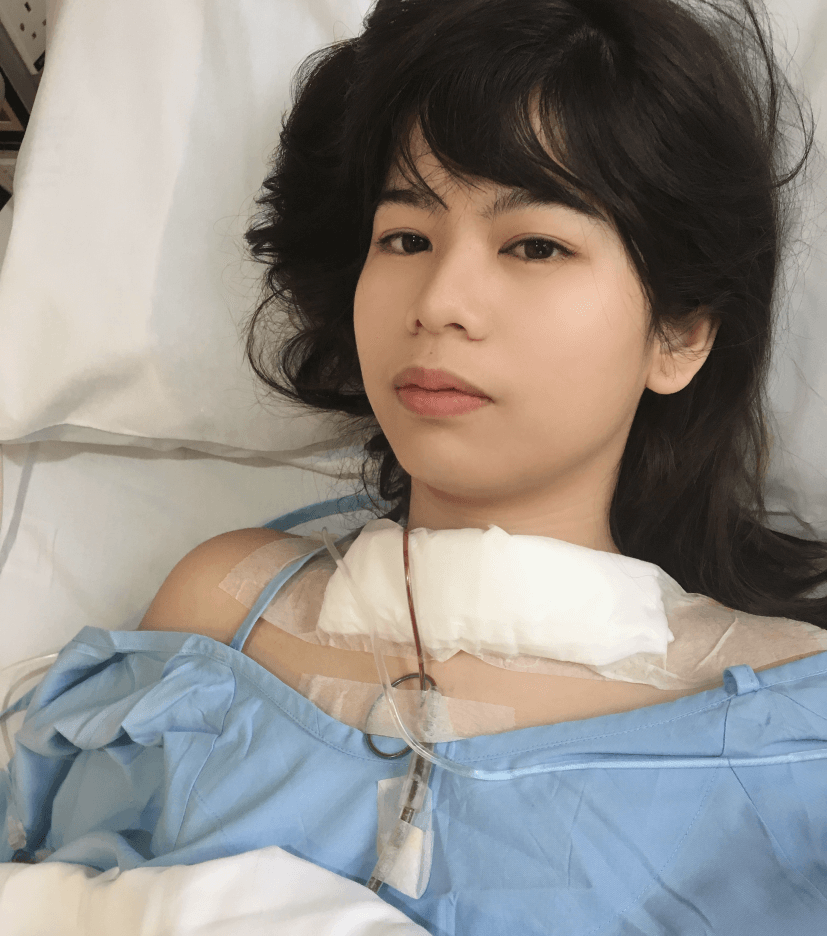

When I was younger, I didn’t realise the importance of insuring myself while I was healthy – and I paid a heavy price. Here is my personal account, which I hope will help you understand why I feel so strongly about helping my clients protect themselves with insurance, from a young age.

I was young & carefree

I first arrived in Singapore from Malaysia in 2011 to pursue university studies. At that time, I knew insurance was important, but I thought it could wait until after I found a job.

After I started working, I decided to wait again, this time for myself to attain Permanent Resident (PR) status, before applying for insurance. Since my company provided some insurance coverage, I figured out that it would be alright to wait that little longer.

And then, the unexpected happened.

In 2017, at 26 years old, as I was in the midst of my wedding preparation, I found out that I had a growth inside my thyroid gland and that there was a possibility of cancer. I was told that the insurance coverage provided by my company would only cover 40% of my medical bills. As I was not a PR yet at that point, my medical bills would not be subsidised (by government schemes).

I underwent surgery that removed half of my thyroid gland and, to my relief, my growth was a benign one. However, that one surgery wiped out almost one and a half years of my saving.

Looking back, I regretted not getting an Integrated Shield Plan (IP) while I had a clean bill of health. When I applied for insurance after my surgery, I was able to get health insurance coverage, but subjected to exclusion – that is, my insurer would not be able to cover certain health incidences, should I encounter them in future.

What surprised me when I signed up was that, contrary to my previous perception, the premium for an IP was actually very affordable. Had I acted earlier to insure myself, my insurer would have taken care of my medical bills, and I would not have lost such a significant amount of my saving.

Don’t forget - accidents happen

In my time as a financial advisor, I have also learnt that we cannot avoid the unexpected. Harsh as it might sound, young people are not immune to accidents. You might just need a few stitches; you might be hospitalised for some time; you might be left permanently disabled; or death might even occur.

As a young person, you are probably not married and do not have children – but remember that you do have dependents. For example, your parents. If they have paid for your education (university fees can be hefty), do you still owe them money? Will they need financial assistance, should you pass on – especially when they are older?

And what if you survive your accident, but are left permanently disabled and/or unable to work. How would your family be impacted financially by the loss of your income and the cost of your care?

So, why buy insurance young?

Because anything can happen, and it is important to do what you can to reduce the impact of unexpected incidences should they happen. Insurance premiums will only get more expensive as we age, so it is best to get your coverage earlier, rather than later. It is also important to buy insurance while you are healthy, so that (unlike me) you can get coverage without exclusion.

I know that budget is the top concern for people who just started work. However, you can always start small and prioritise the type of insurance plans to buy first. One question I always ask my clients to think about is if they do not think they have the money to pay for insurance premiums, will they have the budget to cover hospital bills, should an illness or accident happen?

Protecting yourself financially with insurance is the first step to building a solid financial foundation, after which you can go on to grow your wealth.

What insurance should a fresh graduate buy?

Here are some type of plans that fresh graduates and people in their first jobs can consider purchasing first:

Integrated Shield Plan (IP)

Unexpected medical expenses pose a significant threat to your finances. To mitigate this risk, I would prioritise purchasing an IP, like Income’s Enhanced IncomeShield. I was surprised at how affordable IPs are when I signed up for mine, so do not be worried about the premium. Premiums are also payable with MediSave up to certain withdrawal limits, depending the age band you are in. You can get a quote and make your purchase online here.

Critical Illness (CI) Plan

It is very important to get CI coverage, for both early- and advanced-stage CI, to complement your IP.

Your IP will take care of your hospital bill (subject to the plan’s terms and conditions, of course), but it will not make up for the fact that you may not be able to work while you’re in recovery. You will still need cash to cover your liabilities – loan payments, monthly bills and your daily expenses still need to be paid for.

That is where having an insurance plan that covers critical illness (CI) is important. Critical illness plans, like Income Insurance’s Complete Critical Protect and Complete Cancer Care, provide continuous protection from diagnosis to recovery, offering lump sum payouts. So rather than dipping into your savings (or your parents’ savings) to cover your financial needs, you can use the payout from the plan to support yourself while you focus on your recovery.

It is often more challenging to purchase another life insurance plan after a severe critical illness diagnosis. Income Insurance’s Complete Critical Protect and Complete Cancer Care also provides a guaranteed option to buy another life insurance plan for extra coverage1, which is a first in the market.

Consult a financial advisor to find out more about what plans are available and suitable within your means.

Term Life Insurance Plan

Life insurance provides a payout should death occur or, more importantly, if you become totally and permanently disabled (subject to each specific plan’s terms and conditions). Death is a concern – you may not have dependents and your parents might still be working – but living with a permanent disability is a bigger concern. In that case, having a life insurance plan would mean that you would not have to rely completely on your parents for financial support.

My recommendation would be to start with a term life insurance plan, like Income Insurance’s Star Term Protect, which gives you the flexibility of planning the amount of coverage and duration of coverage to meet your immediate and long-term insurance needs. If you like, you can add the Essential Protect and/or Total Protect riders as well, which provide critical illness coverage.

Take charge of your personal finance

Getting good insurance coverage is one of the basic of personal financial planning. It sets the foundation for your future financial stability by protecting your money from unexpected shocks – shocks that could derail your future.

If you are not sure where to get started or how to fit insurance into your monthly budget, you can always seek help from financial advisors, like myself, by connecting with us. We will work with you to review your current financial situation, understand your priorities and monthly cash flow, and then propose to you options on how to get sufficient coverage, within your means. Reach out to us today.

1 Upon an impairment of a vital function or advanced stage dread disease diagnosis for Complete Critical Protect. Upon an advanced major cancer diagnosis for Complete Cancer Care. Other policy terms and conditions apply.

This article is meant purely for informational purposes and should not be relied upon as financial advice. The precise terms, conditions and exclusions of any Income Insurance products mentioned are specified in their respective policy contracts. For customised advice to suit your specific needs, consult an Income Insurance advisor. This advertisement has not been reviewed by the Monetary Authority of Singapore.

These policies are protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact Income Insurance or visit the GIA/LIA or SDIC websites (www.gia.org.sg or www.lia.org.sg or www.sdic.org. sg).